Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Monday, 27 December 2021 02:20 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

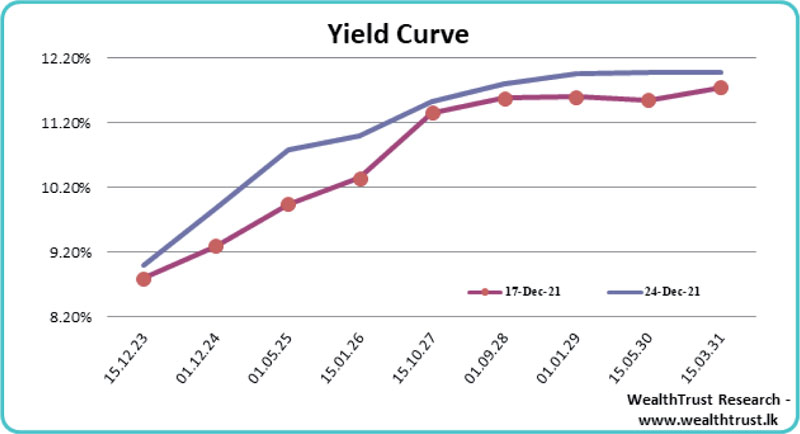

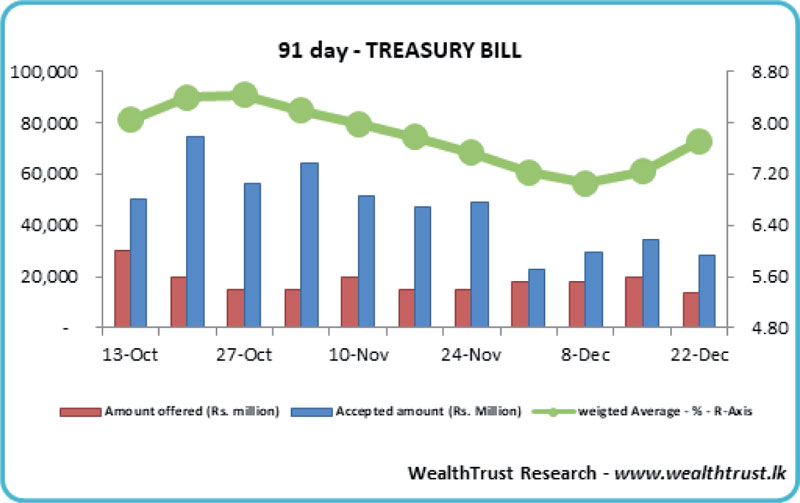

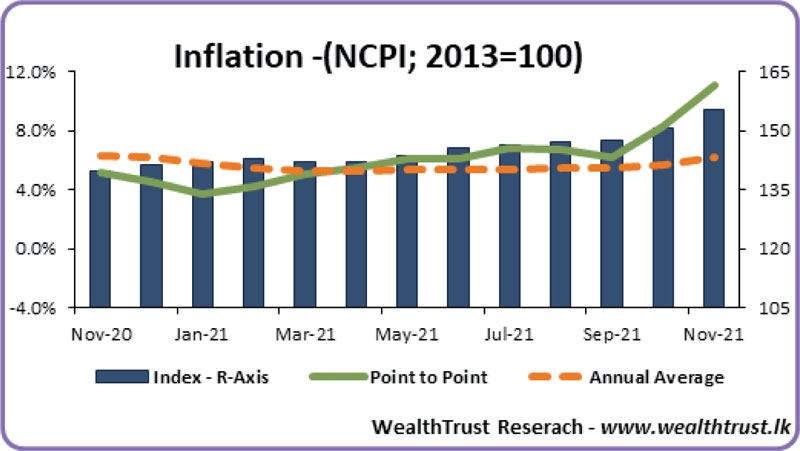

The secondary market bond yields increased during the week ending 24 December to record an upward shift of the yield curve for a second consecutive week. Aggressive selling interest was fuelled by the outcome of the weekly Treasury bill auction and the announcement of the National Consumer Price Index (NCPI; Base 2013=100) for the month of November.

The secondary market bond yields increased during the week ending 24 December to record an upward shift of the yield curve for a second consecutive week. Aggressive selling interest was fuelled by the outcome of the weekly Treasury bill auction and the announcement of the National Consumer Price Index (NCPI; Base 2013=100) for the month of November.

At the weekly Treasury bill auction, the weighted average yield of the market favourite 91-day maturity increased by 47 basis points to 7.71% while the auction went undersubscribed for a second consecutive week. Meanwhile, the NCPI for the month of November increased sharply to 11.1% on its point to point against its previous month of 8.30%.

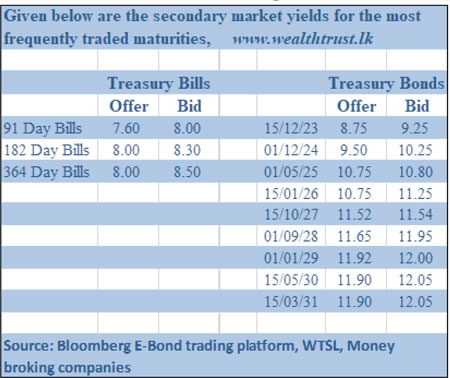

The secondary bond market yields on the liquid maturities of 01.05.25, 15.10.27, 01.01.29 and 15.03.31 were seen hitting weekly highs of 10.77%, 11.60%, 12.02% and 12.00% respectively against its previous weeks closing levels of 9.80/10, 11.32/38, 11.40/80 and 11.70/80. In secondary bills, January and February 2022 maturities were seen hitting highs of 7.60% and 7.70% respectively from its week’s lows of 7.18% and 7.50%.

The foreign holding in rupee bonds remained mostly unchanged at Rs. 1.75 billion for the week ending 22 December while the daily secondary market Treasury bond/bill transacted volumes for the first four trading days of the week averaged Rs. 12.95 billion.

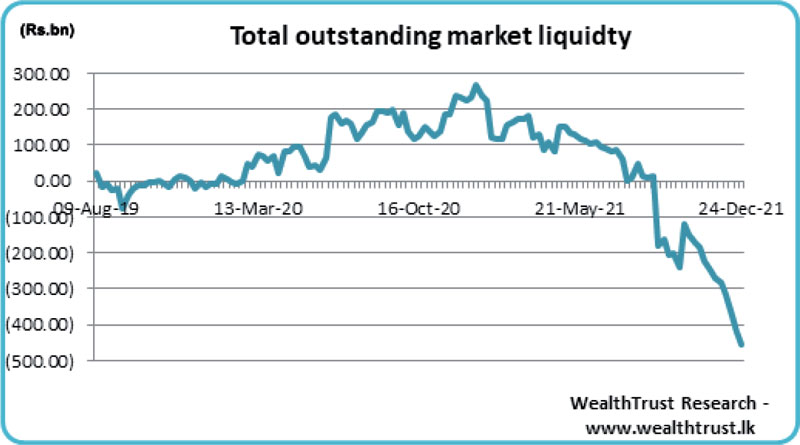

In money markets, the weighted average rates on call money and repo remained mostly unchanged at 5.93% and 5.99% respectively for the week as a staggering volume exceeding Rs. 438 billion was withdrawn on a daily basis during the week from the Central Bank’s SLFR (Standard Lending Facility Rate) of 6%. A historically high volume of Rs.534.64 billion was accessed from Central Banks SLFR on 23 December.

The total outstanding liquidity deficit continued to increase during the week to Rs. 455.55 billion by the end of the week against its previous weeks of Rs. 421.67 billion.

The Domestic Operations Department (DOD) of Central Bank was seen injecting liquidity by way of a 60-day reverse repo auction at a weighted average rate of 7.20% during the latter part of the week while it drained out liquidity during the early part of the week by way of overnight to three day repo auctions at a weighted average rate of 5.99%.

The CBSL’s holding of Government Securities was registered at Rs. 1,362.76 billion against its previous weeks of Rs. 1,372.55 billion.

USD/LKR

In the Forex market, the USD/LKR rate on spot contracts traded at levels of Rs. 202.97 to Rs. 203 during the week while overall activity remained moderate.

The daily USD/LKR average traded volume for the first four trading days of the week stood at $ 52.25 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, money broking companies)