Monday Feb 16, 2026

Monday Feb 16, 2026

Monday, 3 October 2022 02:05 - - {{hitsCtrl.values.hits}}

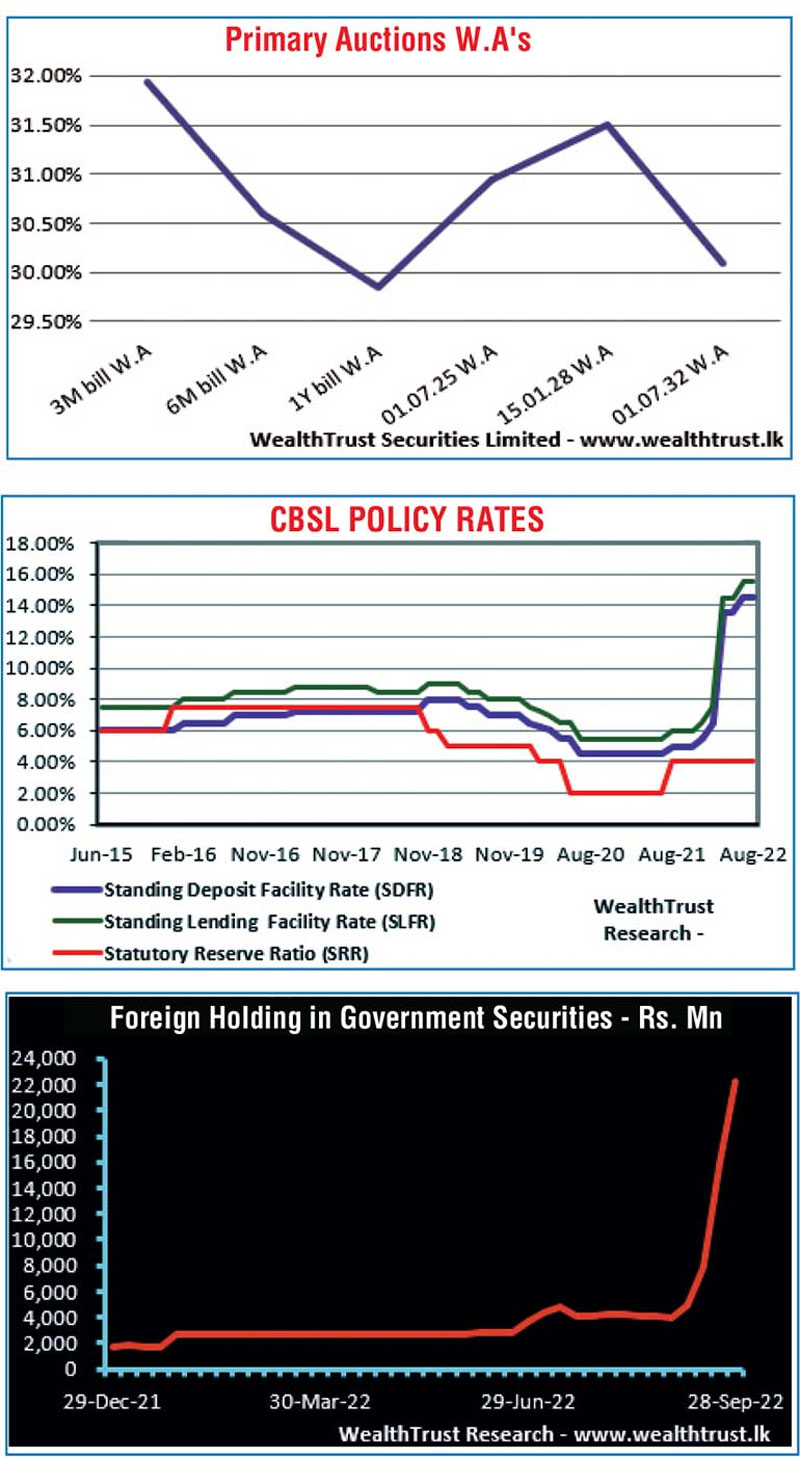

The trading week ending 30 September 2022 saw weighted average rates on all auctioned Treasury bill and bond maturities either holding or crossing the 30.00% psychological level while the accepted amounts fell short of the offered amounts.

The trading week ending 30 September 2022 saw weighted average rates on all auctioned Treasury bill and bond maturities either holding or crossing the 30.00% psychological level while the accepted amounts fell short of the offered amounts.

At the weekly Treasury bill auction conducted on Wednesday, the 91-, 182- and 364-day maturities registered weighted averages of 31.94%, 30.59% and 29.85% respectively while the total accepted amount fell short of the total offered amount for the first time in three weeks. An amount of Rs. 81.68 billion was accepted against an offered amount of Rs. 85 billion.

Furthermore, the weighted average rates on the 3-Y, 5-Y and 10-Y maturities crossed the 30.00% psychological level at its primary auctions conducted on Thursday where only an amount of Rs. 127.31 billion was accepted in total against its total offered amount of Rs. 145 billion. The averages came in at 30.95%, 31.50% and 30.09% respectively.

In the secondary bond market, 3Y and 10Y maturities which were traded at levels of 29.00% and 29.48% to 29.75% respectively prior to the bond auctions were seen changing hands at levels of 30.96% to 31.50% and 30.00% following auction outcomes. The 5-Y maturity traded at levels of 31.20% to 32.00% subsequent to its auction outcome as well.

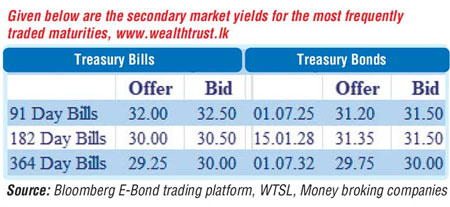

The foreign holding in Rupee bonds continued its increasing trend, recording an inflow of Rs. 6.40 billion for the week ending 28 September 2022 while its overall holding increased to Rs. 22.17 billion. The accumulated inflow for the past four weeks stands at Rs. 18.16 billion. Meanwhile, the Colombo Consumer Price Index (CCPI; Base 2013=100) for the month of September increased further to a high of 69.8% on its point to point against its previous month’s figure of 64.3%. The annual average also increased to 33.4% from 28.00%.

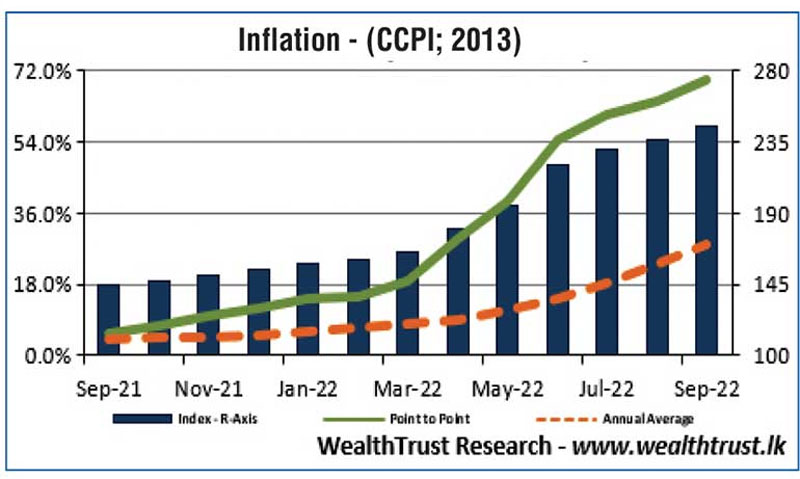

The seventh monetary policy announcement for the year 2022 is due on 6 October at 7:30 a.m. The Central Bank of Sri Lanka kept its policy rates unchanged at 14.50% and 15.50% at its previous announcement on 18 August 2022.

The daily secondary market Treasury bond/bill transacted volumes for the first four trading days of the week averaged Rs. 33.97 billion.

In money markets, the weighted average rate on repo was at 15.50% for the week while the total outstanding liquidity deficit registered at Rs. 568.46 billion by the end of the week against its previous weeks of Rs. 569.85 billion. The CBSL’s holding of Government Securities decreased further to Rs. 2,320.40 billion against its previous weeks of Rs. 2,321.11 billion.

USD/LKR

In the forex market, the middle rate for USD/LKR spot contracts remained steady for a second consecutive week at 362.90 throughout the week.

The daily USD/LKR average traded volume for the first four trading days of the week stood at $ 37.24 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)