Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Friday, 31 December 2021 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

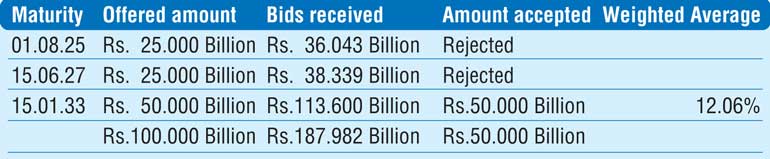

In a surprise move, the Central Bank of Sri Lanka was seen rejecting all bids for the 01.08.2025 and 15.06.2027 maturities while accepting bids only on the 15.01.2033 maturity at its auctions conducted yesterday.

In a surprise move, the Central Bank of Sri Lanka was seen rejecting all bids for the 01.08.2025 and 15.06.2027 maturities while accepting bids only on the 15.01.2033 maturity at its auctions conducted yesterday.

An auctioned Treasury bond maturity was rejected for the first time since 4 April 2017.

The weighted average rate of 12.06% on the 15.01.2033 maturity was the highest rate recorded on any auctioned bond maturity since 13 December 2018. The total accepted volume fell short of the total offered volume for the first time in five auction rounds.

A direct issuance window of 20% of the offered amount on 15.01.33 maturity was opened until close of business of the day prior to settlement (i.e., 4.00 p.m. on 31.12.2021).

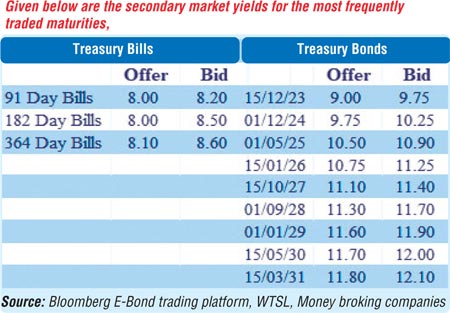

Activity in the secondary bond market was at a standstill yesterday as most market participants were seen on sideline yesterday.

The total secondary market Treasury bond/bill transacted volumes for 29 December was Rs. 24.29 billion.

In money markets, the weighted average rates on call money and repo remained mostly unchanged at 5.94% and 5.99% respectively as an amount of Rs. 458.28 billion was withdrawn from Central Banks SLFR (Standard Lending Facility Rate) of 6%. The net liquidity deficit increased marginally to Rs. 353.19 billion yesterday with an amount of Rs. 105.09 billion been deposited at Central Banks SDFR (Standard Deposit Facility Rate) of 5%.

USD/LKR

In the Forex market, the USD/LKR rate on spot contracts traded at Rs. 202.97 while the overall market remained inactive yesterday.

The total USD/LKR traded volume for 29 December was US $ 25.80 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)