Sunday Mar 01, 2026

Sunday Mar 01, 2026

Monday, 10 June 2024 00:13 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

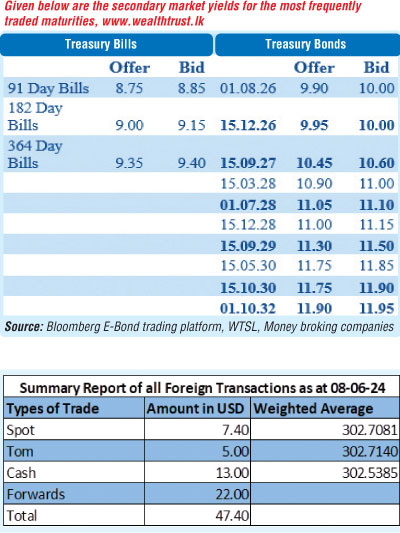

At the weekly Treasury bill auction conducted last Wednesday (05) the entire offered amount of Rs. 235 billion was snapped up at the 1st phase, incidentally the largest Treasury bill auction in Sri Lanka’s history. The total bids received exceeded the offered amount by 1.54 times, an impressive outcome given the scale of the auction. However, weighted average yields were seen edging up on the 91-day maturity by 08 basis points to 8.70% and the 364-day maturity by 09 basis points to 9.27%, while the rate on the 182-day maturity remained stable at 9.04%. This was a deviation from the downward trend prior, which saw 8 consecutive weeks of declines in rates across all three maturities.

At the weekly Treasury bill auction conducted last Wednesday (05) the entire offered amount of Rs. 235 billion was snapped up at the 1st phase, incidentally the largest Treasury bill auction in Sri Lanka’s history. The total bids received exceeded the offered amount by 1.54 times, an impressive outcome given the scale of the auction. However, weighted average yields were seen edging up on the 91-day maturity by 08 basis points to 8.70% and the 364-day maturity by 09 basis points to 9.27%, while the rate on the 182-day maturity remained stable at 9.04%. This was a deviation from the downward trend prior, which saw 8 consecutive weeks of declines in rates across all three maturities.

This week will also see a similarly large Treasury bill auction due to be held on Wednesday (12/06/24), with a total offered amount of Rs. 215 billion. Furthermore, this will be followed by the biggest Treasury bond auction in Sri Lanka’s history, due to be held on Thursday (13) with a total offered amount of Rs. 295 billion across 3-, 5- and 8-year tenors.

The secondary bond market started off the week ending 7 June 2024 with yields overall initially trading sideways on slim volumes. However, the reversal in the downward trend at the Treasury bill auction midweek sparked a sell-off, which saw yields move up considerably. Trading as usual centred on the short to medium end of the yield curve spanning 2026 to 2032 durations.

Noteworthy activity was observed on 2026 tenors, with yields initially dropping at the outset of the week. Accordingly, the popular 15.12.26 maturity was seen hitting an intraweek low of 9.75% before moving up to an intraweek high of 10.05% at the tail end of the week. The other liquid 2026 maturities of 01.06.26 and 01.08.26 also followed suit, moving up to intraweek highs of 10.00% as against lows of 9.65% at the start of the week.

The upwards momentum was witnessed across the yield curve. As such, the yield on the 15.09.27 maturity was seen edging up to 10.55% from 10.40%. The 2028 tenors of 01.07.28 and 15.12.28 were seen moving up to hit intraweek highs of 11.00% and 11.05% respectively as against intraweek lows of 10.90% and 10.91%. In addition, the 01.10.32 was seen trading up from an intraweek low of 10.85% to 10.90%.

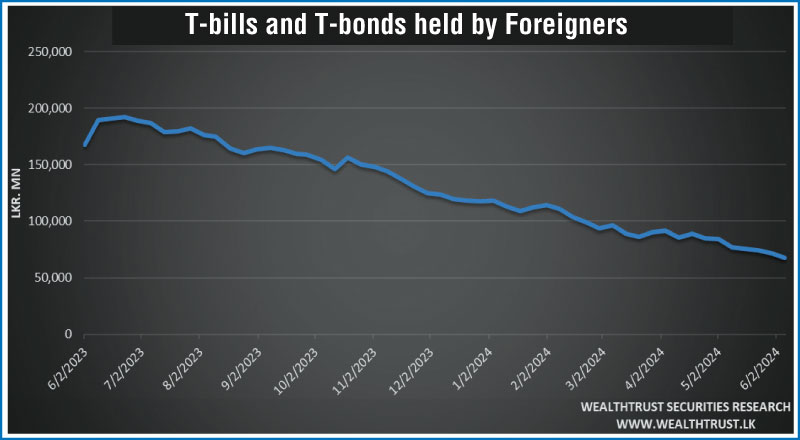

Meanwhile, the foreign holding in rupee Treasuries decreased for the seventh consecutive week, by Rs. 3.65 billion for the week ending 6 June 2024. Accordingly, the overall holding stood at Rs. 67.83 billion. The holdings have dropped a cumulative Rs. 21.44 billion over the past seven weeks, dropping to the lowest levels since the 16 March 2023.

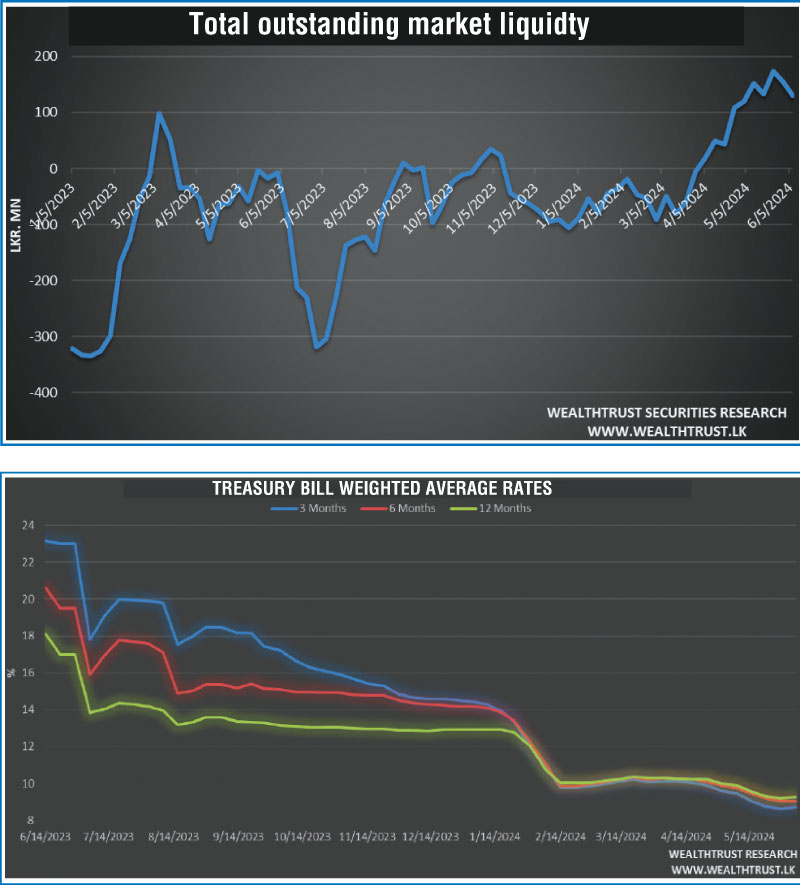

In money markets, the total outstanding liquidity surplus reduced to Rs. 130.55 billion by the week ending 7 June from its previous week’s surplus of Rs. 155.63 billion. The Domestic Operations Department (DOD) of Central Bank injected liquidity during the week by way of overnight reverse repo auctions and 7-day term reverse repo at the rate of 8.66% to 8.98%. The weighted average interest rate on call market and repo ranged between 8.65% to 8.68% and 8.69% to 8.76% respectively.

The Central Bank of Sri Lankas (CBSL) holding of Government Securities was registered at Rs. 2,615.62 billion as at 7 June 2024, down from its previous week’s level of Rs. 2,635.62 billion.

The daily secondary market Treasury bond/bill transacted volumes for the first four days of the week averaged at Rs. 163.01 billion.

Forex Market

In the Forex market, the USD/LKR rate on spot contracts was seen depreciating during the week to close at Rs. 302.70/302.80. This is as against its previous week’s closing level of Rs. 301.90/302.00 and subsequent to trading at a high of Rs. 301.90 and a low of Rs. 302.90.

The daily USD/LKR average traded volume for the first four trading days of the week stood at $ 52.92 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)