Saturday Feb 21, 2026

Saturday Feb 21, 2026

Tuesday, 13 November 2018 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

By Wealth Trust Securities

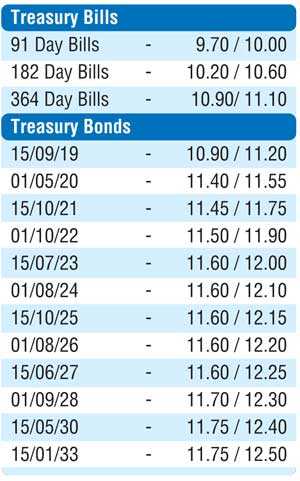

The secondary bond market opened the week by continuing its bearish sentiment witnessed towards the latter part of the previous week with limited trades taking place. Trades on the 01.05.20, 15.12.21, 15.03.23 and 15.07.23 maturities were witnessed at levels of 11.50% to 11.60%, 11.25% to 11.30%, 11.56% to 11.60% and 11.70% respectively. March and August 2019 maturities were seen changing hands at levels of 9.95% to 10.05% and 10.25% respectively in the secondary bill market.

Today’s Treasury bond auctions, in lieu of a Treasury bond maturity of Rs. 102.69 billion, will have an total amount of Rs. 98 billion, consisting of Rs. 50 billion on a 8 year and 7 months maturity of 15.06.27 and Rs. 48 billion on a 10 year and 6 months maturity of 01.05.29. The weighted average yields at the auctions conducted on 11 October for the maturities of 15.07.2023 and 15.01.2033 were recorded at 11.69% and 11.90% respectively.

The total secondary market Treasury bond/bill transacted volumes for 09 November was Rs. 6.66 billion.

In the money market, the overnight call money rate remained steady to average 8.49% in the absence of Repo transactions as the OMO Department of the Central Bank was seen infusing liquidity by way of an overnight and a seven day term repo auction for successful amounts of Rs. 23.00 billion and Rs. 16.30 billion respectively at weighted average yields of 8.44% and 8.49%. The net liquidity shortage in the system stood at a high of Rs. 78.74 billion yesterday.

By Wealth Trust Securities

The secondary bond market opened the week by continuing its bearish sentiment witnessed towards the latter part of the previous week with limited trades taking place. Trades on the 01.05.20, 15.12.21, 15.03.23 and 15.07.23 maturities were witnessed at levels of 11.50% to 11.60%, 11.25% to 11.30%, 11.56% to 11.60% and 11.70% respectively. March and August 2019 maturities were seen changing hands at levels of 9.95% to 10.05% and 10.25% respectively in the secondary bill market.

Today’s Treasury bond auctions, in lieu of a Treasury bond maturity of Rs. 102.69 billion, will have an total amount of Rs. 98 billion, consisting of Rs. 50 billion on a 8 year and 7 months maturity of 15.06.27 and Rs. 48 billion on a 10 year and 6 months maturity of 01.05.29. The weighted average yields at the auctions conducted on 11 October for the maturities of 15.07.2023 and 15.01.2033 were recorded at 11.69% and 11.90% respectively.

The total secondary market Treasury bond/bill transacted volumes for 09 November was Rs. 6.66 billion.

In the money market, the overnight call money rate remained steady to average 8.49% in the absence of Repo transactions as the OMO Department of the Central Bank was seen infusing liquidity by way of an overnight and a seven day term repo auction for successful amounts of Rs. 23.00 billion and Rs. 16.30 billion respectively at weighted average yields of 8.44% and 8.49%. The net liquidity shortage in the system stood at a high of Rs. 78.74 billion yesterday.

Downward trend in rupee continues

Continued buying interest from banks yesterday saw the rupee rate on spot contracts losing further to close at Rs. 175.70/78 against its previous day’s closing level of Rs. 175.10/25.

The total USD/LKR traded volume for 09 November was $ 70.00 million.

Some of the forward USD/LKR rates that prevailed in the market were 1 Month - 176.65/95; 3 Months - 178.70/00 and 6 Months - 181.75/15.

Continued buying interest from banks yesterday saw the rupee rate on spot contracts losing further to close at Rs. 175.70/78 against its previous day’s closing level of Rs. 175.10/25.

The total USD/LKR traded volume for 09 November was $ 70.00 million.

Some of the forward USD/LKR rates that prevailed in the market were 1 Month - 176.65/95; 3 Months - 178.70/00 and 6 Months - 181.75/15.