Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Tuesday, 18 January 2022 01:16 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

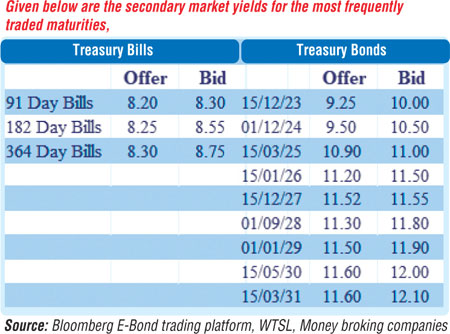

The bearish sentiment prevailing in the secondary bond market continued during the shortened trading week ending 13 January as well, while yields were seen closing marginally higher in comparison to its previous week’s closing. The limited trades that took place were following the primary auctions and on the maturities of 15.03.25 and 15.12.27 at levels of 11% and 11.75% to 11.55% respectively. In addition, 01.05.25 and 15.10.27 maturities traded at levels of 11% to 11.05% and 11.65% as well.

The bearish sentiment prevailing in the secondary bond market continued during the shortened trading week ending 13 January as well, while yields were seen closing marginally higher in comparison to its previous week’s closing. The limited trades that took place were following the primary auctions and on the maturities of 15.03.25 and 15.12.27 at levels of 11% and 11.75% to 11.55% respectively. In addition, 01.05.25 and 15.10.27 maturities traded at levels of 11% to 11.05% and 11.65% as well.

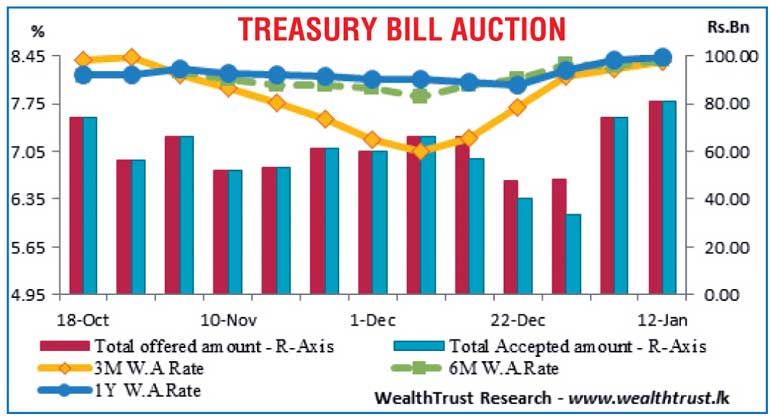

At the primary auctions, the total accepted amount at the T-bond auctions were seen increasing to 80.46% of its total offered volume in comparison to 52% at its previous round of auctions while the weekly T-Bill auction was fully subscribed for a second consecutive week.

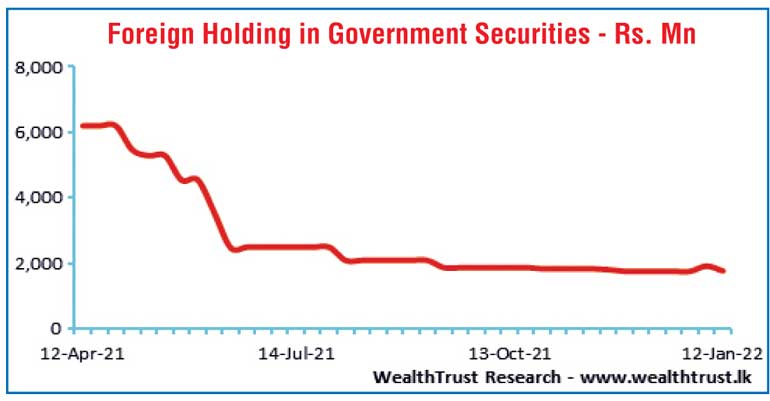

The foreign holding in rupee bonds was seen decreasing during the week to record an outflow of Rs. 150 million for the week ending 12 January while the daily secondary market Treasury bond/bill transacted volumes for the first three trading days of the week averaged Rs. 20.65 billion.

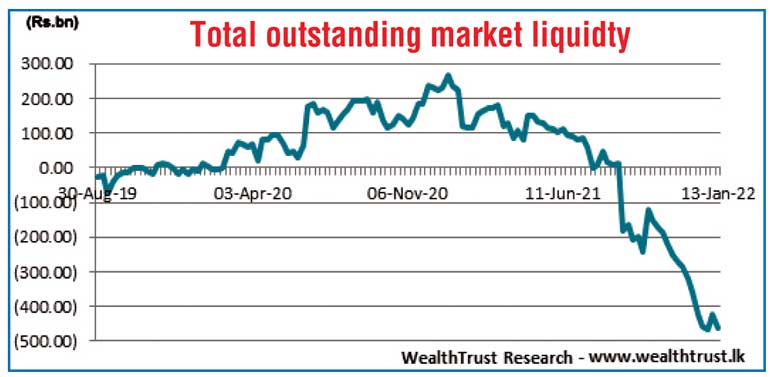

In money markets, the total outstanding liquidity deficit increased during the week to register Rs. 459.93 billion by the end of the week against its previous weeks Rs. 424.45 billion while CBSL’s holding of Gov. Securities remained steady at Rs. 1,416.39 billion. The weighted average rates on overnight call money and repo were 5.94% and 5.99% respectively for the week.

The Domestic Operations Department (DOD) of the Central Bank was seen draining out liquidity during the week by way of overnight to seven-day repo auctions at weighted average yields ranging from 5.95% to 5.98%.

USD/LKR

In the Forex market, the USD/LKR rate on spot contracts traded at a level of Rs. 203 during the week while overall activity remained moderate.

The daily USD/LKR average traded volume for the first three trading days of the week stood at $ 63.18 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)