Thursday Feb 19, 2026

Thursday Feb 19, 2026

Friday, 12 July 2024 02:40 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

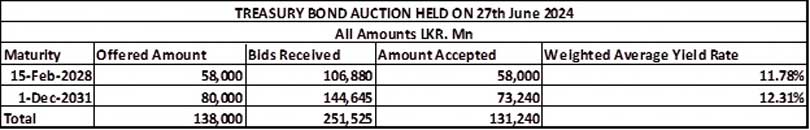

The total accepted amount at yesterday’s round of Treasury bond auctions decreased to a low of 95.10% of its total offered amount against 100.00% recorded at its previous round of auctions conducted on 27 June 2024. Only Rs. 131.24 billion was accepted in total against a total offered amount of Rs. 138 billion, leading to phase 2 of the auctions being opened for the 01.12.31 maturity as it was not fully taken up. However, the offered amount of Rs. 58 billion on the 15.12.2027 maturity was fully subscribed leading to an additional 10% being offered through its direct issuance window until close of business of the day prior to settlement (i.e., 4.00 p.m. on 12.07.2024).

The total accepted amount at yesterday’s round of Treasury bond auctions decreased to a low of 95.10% of its total offered amount against 100.00% recorded at its previous round of auctions conducted on 27 June 2024. Only Rs. 131.24 billion was accepted in total against a total offered amount of Rs. 138 billion, leading to phase 2 of the auctions being opened for the 01.12.31 maturity as it was not fully taken up. However, the offered amount of Rs. 58 billion on the 15.12.2027 maturity was fully subscribed leading to an additional 10% being offered through its direct issuance window until close of business of the day prior to settlement (i.e., 4.00 p.m. on 12.07.2024).

The 15.12.27 maturity recorded a weighted average yield of 11.78% while the 01.12.31 maturity recorded a weighted average yield of 12.31%.

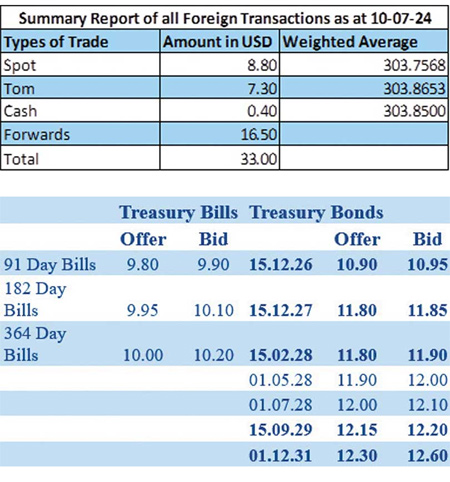

The secondary bond market experienced moderate activity. In the early hours, prior to the release of the auction announcement the 01.08.26,15.02.28 and 15.05.30 maturities were seen trading at the rates of 10.72%, 11.80% and 12.15% respectively. However, following the announcement of the auction results the yield curve was seen adjusting. Accordingly, the 15.12.27 auction bond was seen trading down to a low of 11.80% and a high of 11.85% while the yield on the 2026 tenors were seen edging up with the 15.12.26 maturity trading up from 11.80% to 11.90%. Similarly, the 01.07.28 maturity was seen trading at the elevated level of 12.05%. Overall, at the conclusion of the day market two-way quotes were seen increasing across the yield curve following the auction outcome.

The total secondary market Treasury bond/bill transacted volume for 10th July was Rs. 73.89 billion.

In money markets, the weighted average rates on overnight call money and Repo stood at 8.70% and 9.06% respectively. The DOD (Domestic Operations Department) of the Central Bank injected liquidity by way of an overnight reverse repo auction for Rs 15.00 billion at a weighted average rate of 8.66%.

The net liquidity surplus stood at Rs. 122.26 billion yesterday as an amount of Rs. 137.26 billion being deposited at Central Banks SDFR (Standard Deposit Facility Rate) of 8.50%.

Forex Market

In the Forex market, the USD/LKR rate on spot contracts closed the day appreciating further to Rs. 302.80/303.00 as against its previous day’s closing level of Rs. 303.63/303.72.

The total USD/LKR traded volume for 10 July was $ 33.00 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)