Friday Feb 20, 2026

Friday Feb 20, 2026

Friday, 14 October 2022 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The weighted average rates at yesterday’s Treasury bond auctions reflected an upward movement as the 3-year maturity of 01.07.2025 recorded a jump of 98 basis points to 31.93% in comparison to its previous average while only Rs. 6.79 billion was accepted against an offered amount of Rs. 12.5 billion. The seven-year maturity of 15.07.2029 registered a weighted average rate of 30.85% while its total offered amount of Rs. 17.5 billion was fully accepted.

The weighted average rates at yesterday’s Treasury bond auctions reflected an upward movement as the 3-year maturity of 01.07.2025 recorded a jump of 98 basis points to 31.93% in comparison to its previous average while only Rs. 6.79 billion was accepted against an offered amount of Rs. 12.5 billion. The seven-year maturity of 15.07.2029 registered a weighted average rate of 30.85% while its total offered amount of Rs. 17.5 billion was fully accepted.

The phase two of the auction was opened for the 2025 maturity while the direct issuance window of 20% will be on offer on the 2029 maturity until close of business of the day prior to settlement (i.e., 4 p.m. on 14.10.2022). Given below are the details of the auction,

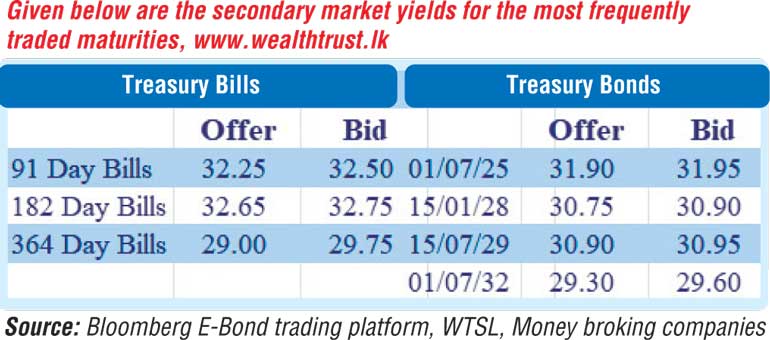

Meanwhile, activity in the secondary bond market remained dull during the early part of the day. However, following the auction outcome activity picked up as the 01.07.2025 and 15.07.2029 maturities changed hands at levels of 31.93% to 31.95% and 30.90% to 30.91% respectively. In secondary bills, January, April and June 2023 maturities changed hands at levels of 30.00% to 32.50%, 32.80% and 29.50% to 29.55% respectively.

The total secondary market Treasury bond/bill transacted volume for 12 October was Rs. 29.74 billion.

In money markets, the weighted average rate on overnight Call money stood at 15.50% while an amount Rs. 723.69 billion was withdrawn from Central Banks SLFR (Standard Deposit Facility Rate) of 15.50%. The net liquidity deficit stood at Rs. 392.77 billion yesterday as an amount of Rs. 330.92 billion was deposited at Central Banks SDFR (Standard Deposit Facility Rate) of 14.50%.

Forex Market

In the Forex market, the middle rate for USD/LKR spot contracts remained steady at Rs. 362.90. The total USD/LKR traded volume for 12 October was $ 21.05 million

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)