Thursday Feb 19, 2026

Thursday Feb 19, 2026

Tuesday, 10 October 2023 01:14 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The Central Bank of Sri Lanka (CBSL) announced a round of Treasury Bond auctions due on Thursday, 12 October. The total offered amount of Rs. 25 billion is the lowest offered amount since a round of auctions conducted on 27 February 2023, totalling Rs. 35 billion. This is the first auction since 13 July 2023 to offer a tenor greater than 5 years as well. The details of the upcoming auction are given below,

For context, at the previous bond auctions conducted on 25 September 23, an amount of Rs. 236.70 billion was taken up in total against a total offered amount of Rs. 220 billion which included an additional 20% offered through the direct issuance window on the 01.07.2028 maturity. The weighted average rates were recorded at 15.64% and 14.52% on the 01.06.2026 and 01.07.2028 maturities respectively.

The secondary bond market commenced the week with significant buying interest focused on the 2026 maturities (i.e., 01.06.26 and 01.08.26), which traded at levels of 15.15% to 15.25%. In secondary market bills, January 2024 durations were seen traded within the range of 16.22% to 16.75%.

The total secondary market Treasury bond/bill transacted volume for 06 October 2023 was Rs. 7.39 billion.

In money markets, the weighted average rates on overnight call money and Repo stood at 10.45% and 10.74% respectively while the net liquidity deficit stood at Rs. 73.04 billion yesterday.

The DOD (Domestic Operations Department) of the Central Bank injected liquidity by way of an overnight auction for Rs. 17.45 billion at a weighted average rate of 10.08%. An amount of Rs. 55.98 billion was withdrawn from Central Banks SLFR (Standard Lending Facility Rate) of 11.00% while an amount of Rs. 0.39 billion was deposited at Central Banks SDFR (Standard Deposit Facility Rate) of 10.00%.

Forex Market

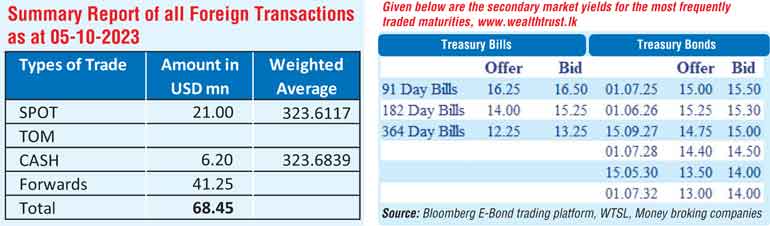

In the Forex market, the USD/LKR rate on spot contracts was traded within the range of Rs. 323.50 to Rs. 323.75 yesterday before closing the day at Rs. 323.40/323.60 against its previous week’s closing level of Rs. 323.85/323.95.

The total USD/LKR traded volume for 06 October was $ 68.45 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)