Monday Feb 16, 2026

Monday Feb 16, 2026

Friday, 13 March 2020 00:01 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

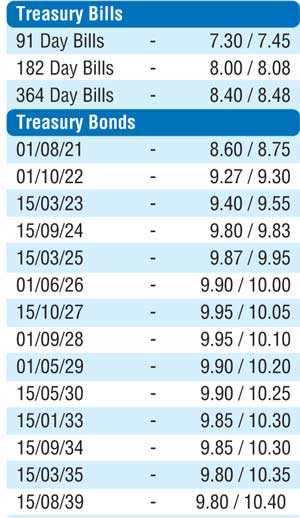

The Rs. 60 billion that was on offer on the three Treasury bond auctions conducted yesterday was successfully taken up at its phase one stage. The 2 years and 07 months maturity of 01.10.2022 recorded a weighted average rate of 9.33%, the 4 years and 06 months maturity of 15.09.2024 a weighted average of 9.81% and the 7 years and 7 months maturity of 15.10.2027 a weighted average of 9.99%. The respective maturities were quoted at levels of 9.10/20, 9.70/75 and 10.00/10, prior to the auctions.

The secondary bond market saw activity picking up gradually following the bond auction outcome, following a dull start, as the maturity of 01.10.22 changed hands within the range of 9.25% to 9.27%. In addition, the 01.05.21 and 15.09.24 maturities changed hands at levels of 8.60% to 8.75% and 9.70%, pre-auction. In secondary bills, May 2020, June 2020, September 2020, February 2020 and March 2021 changed hands at levels of 7.28% to 7.32%, 7.30%, 8.02% to 8.06%, 8.40% and 8.42% to 8.48% respectively.

The total secondary market Treasury bond/bill transacted volume for 11 March was Rs. 17.60 billion. In money markets, weighted average yields on overnight call money and repo rates remained steady at 6.99% and 7.02% respectively as the overnight net liquidity surplus in the system stood at Rs. 30.59 billion yesterday.

Rupee dips below Rs. 183

In the Forex market, renewed pressures from global economic conditions saw the USD/LKR rate on spot contracts dipping considerably yesterday to an intraday low of Rs. 183.30 before closing at levels of Rs. 183.00/40 against its previous day’s closing level of Rs. 182.55/60. The one week forward contracts were quoted at Rs. 183.20/50.

The total USD/LKR traded volume for 11 March was $ 136.66 million.

Some of the forward USD/LKR rates that prevailed in the market were 1 month - 183.40/70; 3 months - 184.25/65 and 6 months - 185.80/20.