Monday Feb 16, 2026

Monday Feb 16, 2026

Tuesday, 14 July 2020 00:06 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The two Treasury bond auctions conducted yesterday recorded impressive outcomes, as the total offered amount of Rs. 40 billion was successfully accepted at its first phase of the auction.

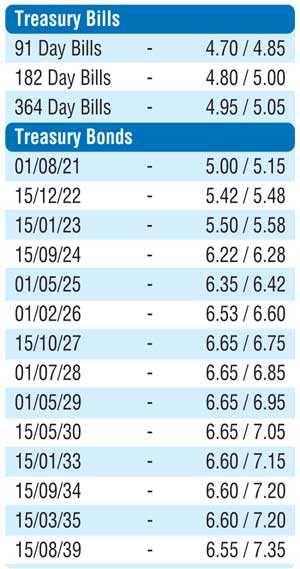

The 2 year and 05 months maturity of 15.12.2022 recorded a weighted average of 5.47%, equal to its pre-auction rate of 5.42/47, but well below its stipulated cut off rate of 5.85%. The 05 year and 7 month maturity of 02.02.2026 fetched a weighted average of 6.57%, marginally above its pre-auction rate of 6.50/55, but below its stipulated cut off rate of 6.60%. The bids to offer ratio stood at 2.80:1.

In the secondary bond market yesterday, liquid maturities of 15.12.22, 15.01.23, 15.09.24, 01.05.25 and 01.02.26 changed hands within a narrow range of 5.43% to 5.45%, 5.50% to 5.52%, 6.23% to 6.25%, 6.36% to 6.38% and 6.53% respectively. In addition, the maturities of 01.10.22, 01.09.23 and 15.10.27 traded at levels of 5.40%, 5.70% to 5.75% and 6.68% to 6.70% respectively as well.

The total secondary market Treasury bond/bill transacted volume for 10 July was Rs. 11.76 billion. In money markets, the high liquidity surplus of Rs.169.02 saw the overnight call money and repo rates remaining steady to average 4.53% and 4.55% respectively yesterday.

USD/LKR

In the Forex market, the USD/LKR rate on spot contracts traded within the range of Rs.185.88 to Rs.185.95 yesterday before closing the day mostly unchanged at levels of Rs.185.85/90. The total USD/LKR traded volume for 10 July was $ 74.96 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, money broking companies)