Saturday Feb 14, 2026

Saturday Feb 14, 2026

Monday, 24 January 2022 02:08 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

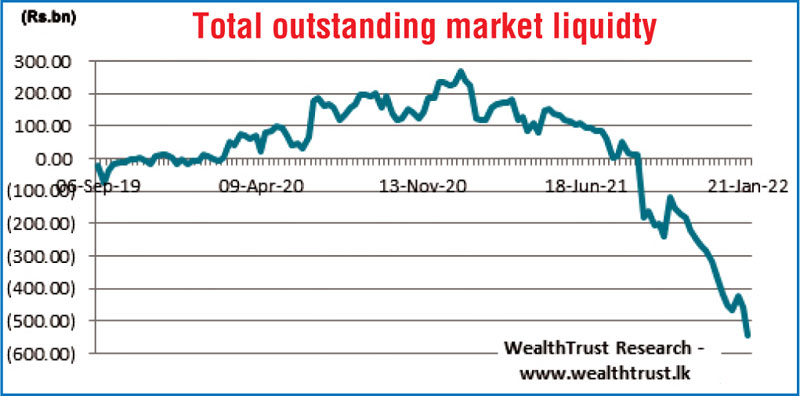

The secondary bond market continued to remain inactive during the shortened trading week ending 21 January as most market participants persisted on the side lines. The first monetary policy announcement during the week for the year saw the Central Bank of Sri Lanka increase its policy rates by 50 basis points each to 5.50% and 6.50% on its Standing Deposit Facility Rate (SDFR) and Standing Lending Facility Rate (SLFR) respectively.

The secondary bond market continued to remain inactive during the shortened trading week ending 21 January as most market participants persisted on the side lines. The first monetary policy announcement during the week for the year saw the Central Bank of Sri Lanka increase its policy rates by 50 basis points each to 5.50% and 6.50% on its Standing Deposit Facility Rate (SDFR) and Standing Lending Facility Rate (SLFR) respectively.

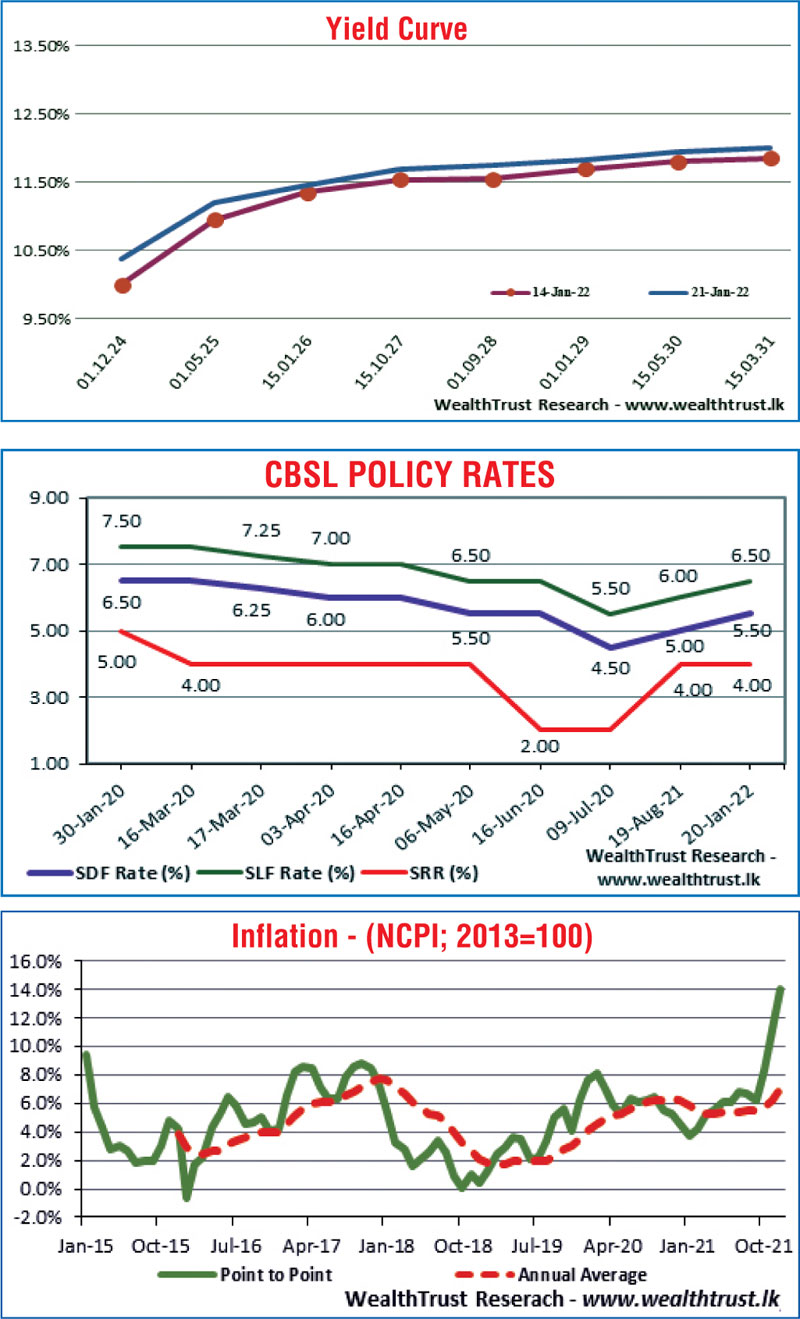

The limited trades witnessed prior to the policy adjustment were on the maturities of 15.12.22 15.05.23, 15.03.25 and 01.12.31 at levels of 8.80%, 9.50%, 11.05% and 11.92% to 12.04% respectively, while 15.12.22 and 15.09.24 maturities were traded at levels of 9.20% to 9.29% and 10.25% respectively, following the policy adjustment.

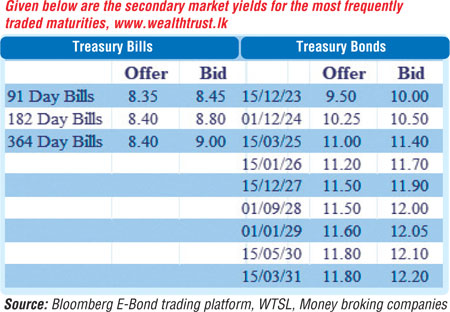

Nevertheless, an all-time high offered volume of Rs. 97 billion at a weekly Treasury bill auction was fully subscribed during the week, which was conducted prior to the policy adjustment while weighted average rates increased by 11 and four basis points each to 8.49%, 8.44% and 8.48% respectively on the 91-day, 182-day and 364-day maturities.

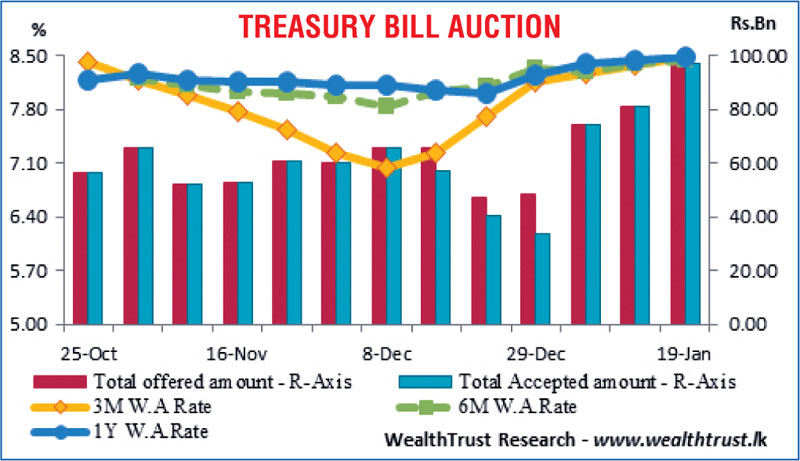

The National Consumer Price Index (NCPI; Base 2013=100) for the month of December increased steeply to a high of 14% on its point-to-point against its previous month’s figure of 11.1% along with the annual average increasing as well to 7% from 6.2%.

The foreign holding in rupee bonds remained mostly unchanged at Rs. 1.76 billion for the week ending 19 January while the daily secondary market Treasury bond/bill transacted volumes for the first three trading days of the week averaged Rs. 30.65 billion.

In money markets, the base rate increase resulted in weighted average rates on overnight call money and repo increasing during the last two trading days of the week to average 6.45% and 6.50% respectively, as against its first two days of 5.95% and 6%. The total outstanding liquidity deficit increased during the week to register Rs. 543.37 billion by the end of the week against its previous weeks Rs. 459.93 billion while CBSL’s holding of Gov. Securities increased to Rs. 1,547.82 billion against its previous weeks Rs. 1,416.39 billion.

The Domestic Operations Department (DOD) of the Central Bank was seen draining out liquidity during the week by way of overnight to seven-day repo auctions at weighted average yields ranging from 5.97% to 6.49%.

USD/LKR

In Forex markets, overall activity continued to remain moderate during the week while limited trades were witnessed on the USD/LKR spot contracts at a level of Rs. 203.

The daily USD/LKR average traded volume for the first three trading days of the week stood at $ 47.90 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)