Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Tuesday, 21 November 2023 00:01 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary bond market commenced the week with considerable activity with yields initially creeping up and subsequently closing the day down. Trades were seen across the yield curve, with large volume transactions seen on selected maturities.

The secondary bond market commenced the week with considerable activity with yields initially creeping up and subsequently closing the day down. Trades were seen across the yield curve, with large volume transactions seen on selected maturities.

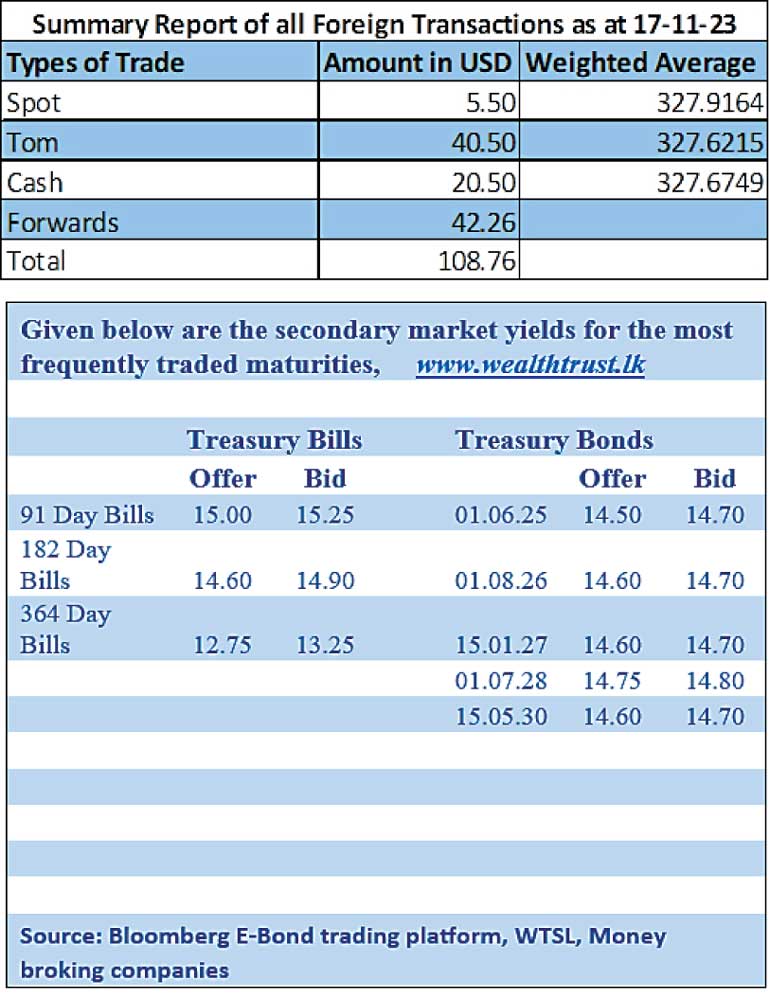

Accordingly, the maturities of 01.08.24, three 26s (15.05.26,01.06.26 and 01.08.26), three 27s (15.01.27,01.05.27 and 15.09.27), two 28’s (01.05.28 and 01.07.28) and 15.05.30 were seen changing hands at levels of 14.25%, 14.90% to 14.60%, 14.93% to 14.65%, 14.93% to 14.75% and 14.60% respectively.

Meanwhile, in secondary market bills, January/February 2024 maturities were seen trading within the range of 15.28% to 15.10%.

The total secondary market Treasury bond/bill transacted volume for 17 November was

Rs. 14.711 billion.

In money markets, the weighted average rates on overnight call money and Repo stood at 10.35% and 10.58% respectively while the net liquidity stood at a deficit of Rs. 84.50 billion yesterday.

The DOD (Domestic Operations Department) of Central Bank injected liquidity by way of an overnight auction for Rs. 46.44 billion at a weighted average rate of 10.38%. An amount of Rs. 38.06 billion was withdrawn from Central Banks SLFR (Standard Lending Facility Rate) of 11.00%.

Forex Market

In the Forex market, the USD/LKR rate on spot contracts closed the day broadly steady at

Rs. 328.00/328.20 yesterday against its previous day’s closing level of Rs. 327.90/328.10.

The total USD/LKR traded volume for 17 November was $ 108.76 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)