Saturday Feb 21, 2026

Saturday Feb 21, 2026

Tuesday, 16 November 2021 01:19 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

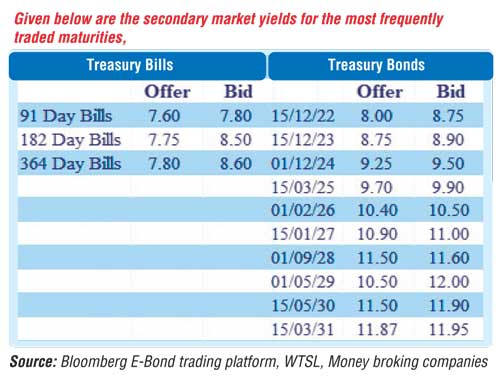

The fresh trading week commenced on a dull note yesterday with trades only witnessed on the 15.01.27 and 15.03.31 maturities at levels of 10.80% and 11.90% to 11.91% respectively.

Today’s Treasury bill auction, conducted a day prior due to a shortened trading week, will have on offer a total amount of Rs. 53 billion, Rs. 1 billion above its previous weeks’ total offered volume. This will consist of Rs. 15 billion on the 91-day maturity, Rs. 18 billion on the 182-day maturity and Rs. 20 billion on the 364-day maturity. At last week’s auction, the total offered amount was fully accepted for a fourth consecutive week with the weighted average rates deceasing across the board by 20, nine and seven basis points on the 91-day, 182-day and 364-day maturities respectively to 7.98%, 8.12% and 8.19%.

The total secondary market Treasury bond/bill transacted volume for 12 November was Rs. 9.88 billion.

In money markets, the net liquidity deficit increased to Rs. 211.03 billion yesterday as an amount of Rs. 90.14 billion was deposited at Central Banks SDFR (Standard Deposit Facility Rate) of 5% against an amount of Rs. 321.38 billion withdrawn from Central Banks SLFR (Standard Deposit Facility Rate) of 6%. The Domestic Operations Department (DOD) of the Central Bank of Sri Lanka was seen draining out amounts of Rs. 10.20 billion and Rs. 10 billion by way of overnight and seven-day repo auctions at weighted average rates of 5.98% and 5.97% respectively. The weighted average rates on overnight call money and repo remained mostly unchanged at 5.92% and 5.96% respectively.

USD/LKR

The overall market continued to remain inactive yesterday. The total USD/LKR traded volume for 12 November was $ 51.20 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)