Sunday Feb 08, 2026

Sunday Feb 08, 2026

Monday, 9 January 2023 00:05 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

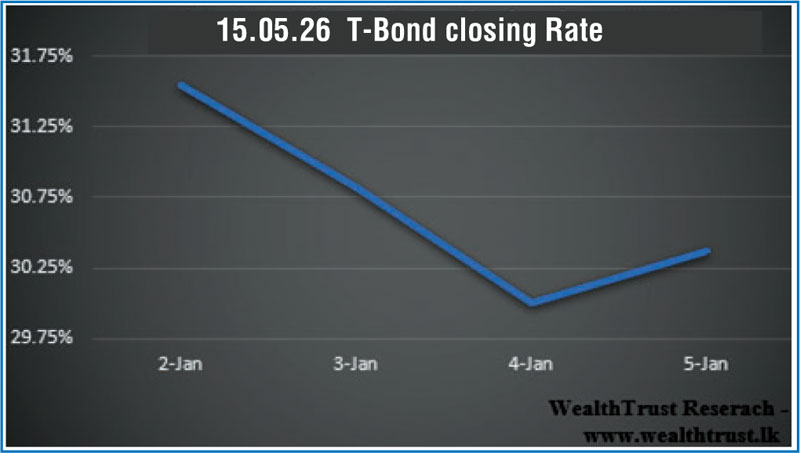

The secondary market bond yields decreased considerably over the shortened trading week ending 5 January 2023 to record a downward shift on the short end of the yield curve. The restrictions imposed on CBSL policy windows of 14.50% and 15.50% with effect from 16 January along with the Domestic Operations Department (DOD) of Central Bank conducting bond buy back auctions, was seen as the reasons behind the dip in yields.

The secondary market bond yields decreased considerably over the shortened trading week ending 5 January 2023 to record a downward shift on the short end of the yield curve. The restrictions imposed on CBSL policy windows of 14.50% and 15.50% with effect from 16 January along with the Domestic Operations Department (DOD) of Central Bank conducting bond buy back auctions, was seen as the reasons behind the dip in yields.

The use of CBSL Standard Deposit Facility Rate (SDFR) of 14.50% by a Licensed Commercial Bank (LCB) will be restricted to a maximum of five times per calendar month while the use of its Standing Lending Facility Rate of 15.50% by a LCB will be restricted to 90% of its Statutory Reserve Requirement (SRR). The DOD of Central Bank was seeing buying back 2025 bond maturities at weighted averages of 30.80% and 29.00%, well below its secondary market rate prior to the auction while Rs. 40 billion was injected by way of a 31-day term reverse repo auction at a weighted average rate of 28.56%.

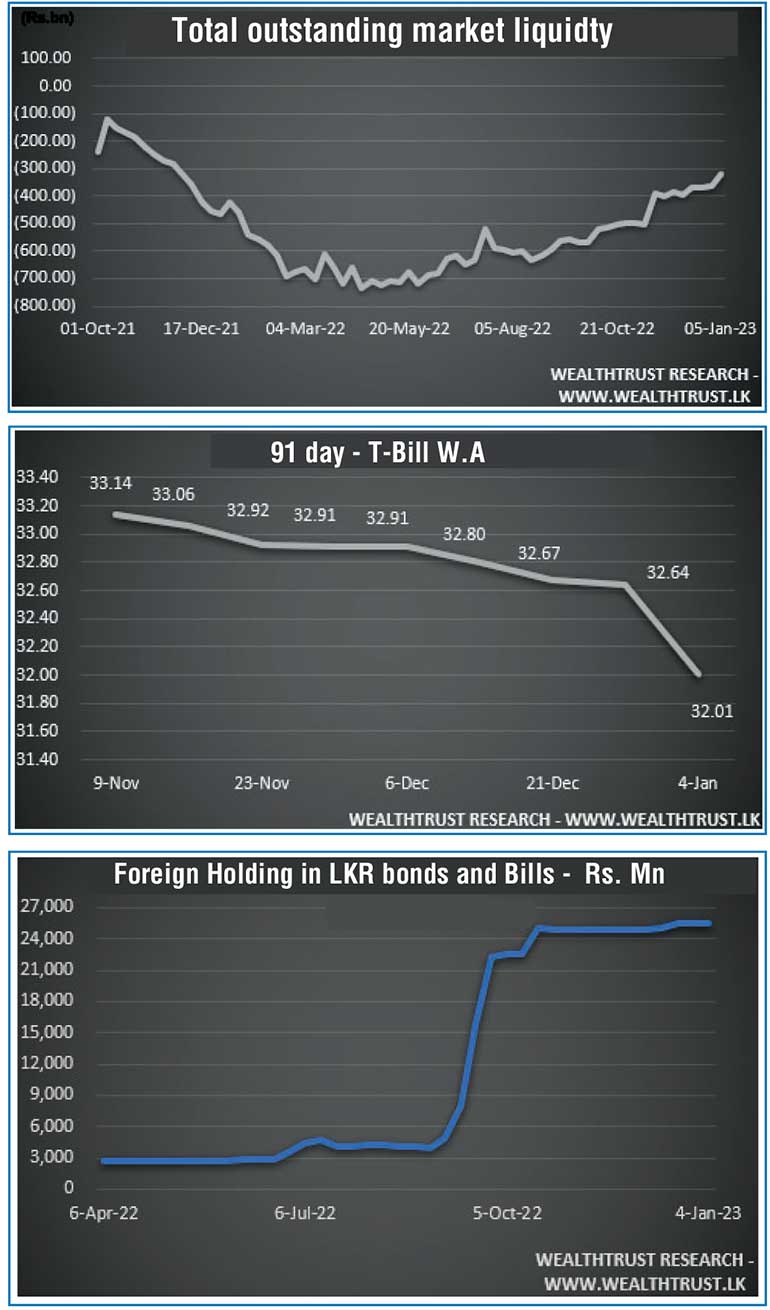

The weekly Treasury bill auction saw demand picking up which led to weighted average rates decreasing by 63, 18 and 11 basis points on the 91-day, 182-day and 364-day maturities respectively to 32.01%, 32.02% and 29.16%.

Buying interest on the liquid maturities of 01.05.24, 15.01.25 and 15.05.26 saw its yields hitting weekly lows of 31.95%, 30.75% and 30.47% respectively against its previous week’s closing levels of 32.20/00, 33.25/50 and 31.45/55. In addition, the 15.01.28 maturity was traded at levels of 27.55% to 28.01% as well.

The foreign holding in rupee bonds remained mostly unchanged at Rs. 25.55 billion for the week ending 4 January while the daily secondary market Treasury bond/bill transacted volumes for the first three trading days of the week averaged Rs. 29.30 billion.

In money markets, the weighted average rates on overnight call money and repo stood at 15.50% each for the week while the total outstanding liquidity deficit was registered at Rs. 321.19 billion by the end of the week against its previous week’s of Rs. 361.25 billion. The CBSL’s holding of Government Securities stood at Rs. 2,602.38 billion against its previous week’s of Rs. 2,598.18 billion.

USD/LKR

In the forex market, the middle rate for USD/LKR spot contracts remained steady throughout the week at Rs. 363.11.

The daily USD/LKR average traded volume for the first three trading days of the week stood at $ 43.57 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)