Monday Feb 16, 2026

Monday Feb 16, 2026

Friday, 17 March 2023 00:30 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

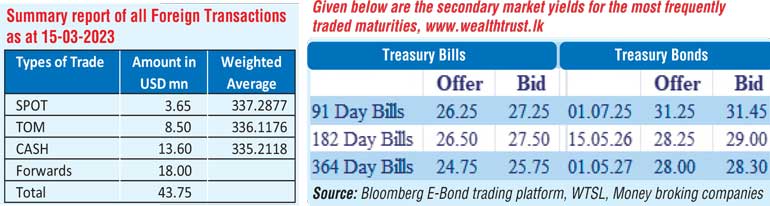

The secondary bond market witnessed moderate activity yesterday as yields were steady. The 01.07.25, two 2027’s (i.e., 01.05.27 & 1509.27) and 15.07.29 maturities changed hands at levels of 31.30% to 31.50%, 28.07% to 28.20%, 28.25% to 28.30% and 26.00% respectively. Meanwhile, bills maturing in June 2023 traded between 25.75% to 26.00%.

The total secondary market Treasury bond/bill transacted volume for 15 March 2023 was Rs. 117.45 billion.

In money markets, the weighted average rates on overnight call money and REPO stood at 16.48% and 16.50% respectively while an amount of Rs. 121.07 billion was withdrawn from Central Banks SLFR (Standard Lending Facility Rate) of 16.50%. The net liquidity deficit stood at Rs. 118.47 billion yesterday as an amount of Rs. 2.60 billion was deposited at Central Banks SDFR (Standard Deposit Facility Rate) of 15.50%.

Forex Market

In the Forex market, the USD/LKR rate spot contracts depreciated marginally to close the day at levels of Rs.337.00/344.00 yesterday subsequent to trading at Rs.340.00.

The total USD/LKR traded volume for 15 March was $ 43.75 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)