Monday Feb 16, 2026

Monday Feb 16, 2026

Monday, 14 December 2020 02:53 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The activity in the secondary bond market moderated during the week ending Friday (11 December) while the Treasury bond auctions conducted on 11 December went undersubscribed.

The activity in the secondary bond market moderated during the week ending Friday (11 December) while the Treasury bond auctions conducted on 11 December went undersubscribed.

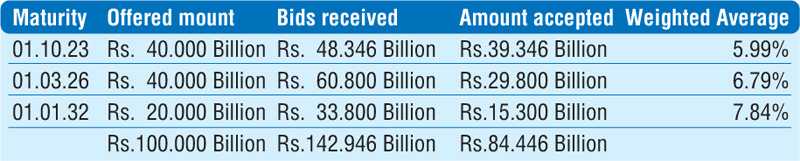

At the bond auctions, the second phase of the auction was opened on all three maturities at their respective weighted average rates due to its offered amounts not being fully subscribed at its first phase. Nevertheless, a total amount of Rs. 84.45 billion was accepted against a total offered amount of Rs. 100 billion. The weighted average rates were recorded at 5.99%, 6.79% and 7.84%, respectively, on the 01.10.23, 01.03.26 and 01.01.32 maturities in comparison to their stipulated cut off rates of 6.01%, 6.80% and 7.85%.

Furthermore, the total accepted amount at the weekly Treasury bill auction decreased as well to Rs. 25.89 billion in comparison to Rs. 34.32 billion accepted the previous week with Rs. 40 billion offered in each instance.

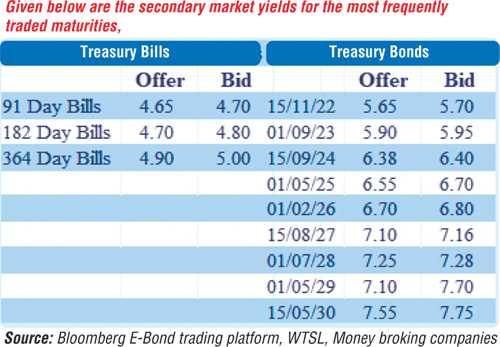

In limited secondary market trades, the liquid maturities of 15.12.22, 15.01.23, 15.07.23, two 2024’s (i.e. 15.06.24, 15.09.24 and 01.12.24), two 2027’s (i.e. 15.08.27 and 15.10.27) and 01.07.28, were seen changing hands at level of 5.62% to 5.72%, 5.74% to 5.76%, 6% to 6.05%, 6.38% to 6.47%, 7.15% to 7.18% and 7.25%, respectively. In addition, short-dated maturity of 15.12.21 and March, July and October bills changed hands at levels of 5%, 4.60% to 4.67%, 4.80% and 4.95%, respectively, as well.

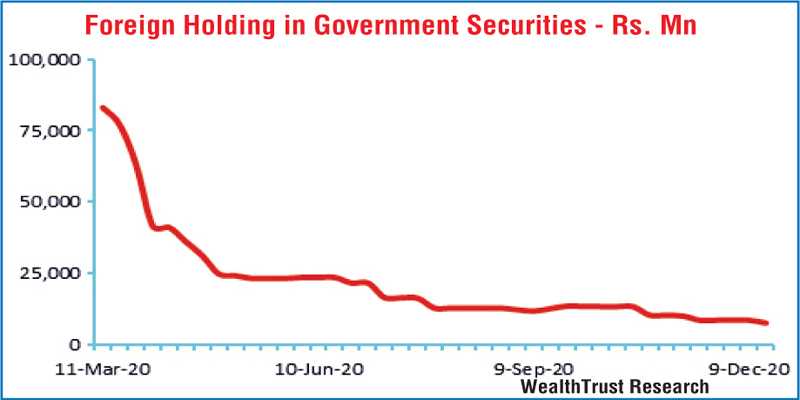

Meanwhile, the foreign component in rupee bonds was seen declining for a second consecutive week to record an outflow of Rs. 0.99 billion for the week ending 9 December.

The daily secondary market Treasury bond/bill transacted volumes for the first four trading days of the week averaged Rs. 8.94 billion.

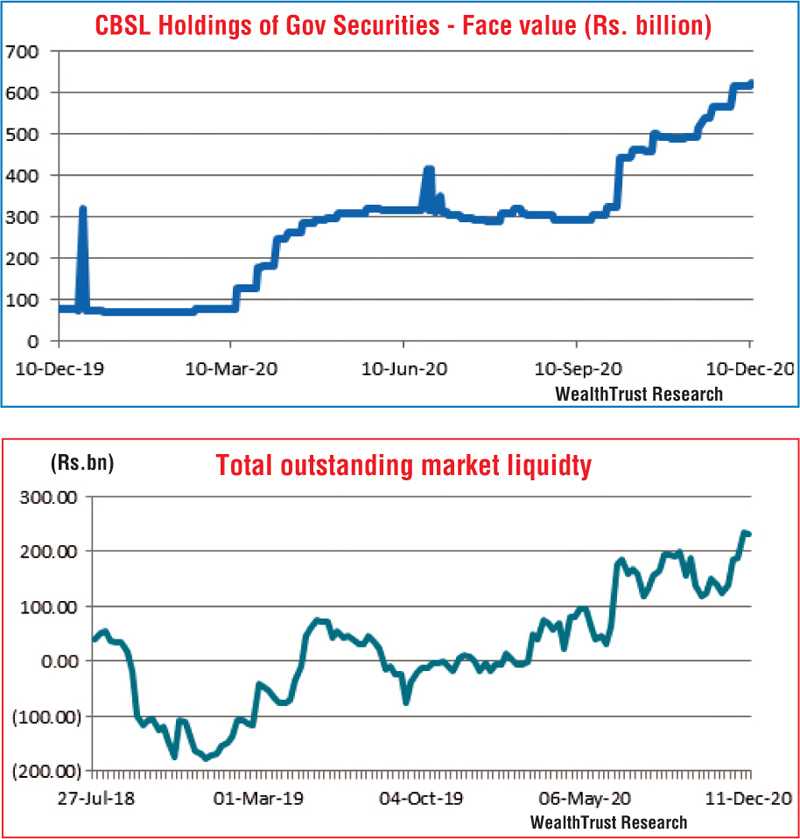

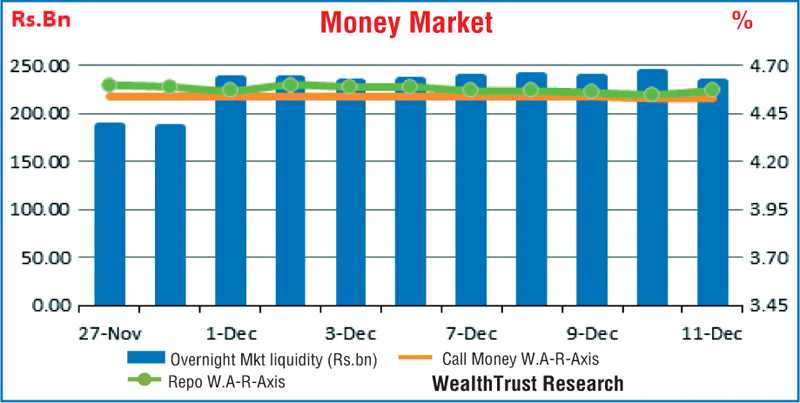

In money markets, the weighted average rates on overnight call money and repo remained mostly unchanged at 4.53% and 4.55%, respectively, for the week as the total outstanding market liquidity stood at Rs. 232.77 billion. The CBSL’s holding of government securities increased to Rs. 625.91 billion.

Rupee depreciates

In forex markets, in the absence of spot contracts being quoted, spot-next contracts were seen depreciating to close the week at Rs. 186.70/20 in comparison to its previous weeks closing of Rs. 185.80.

The daily USD/LKR average traded volume for the first four days of the week stood at $ 43.77 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, money broking companies.)