Monday Feb 16, 2026

Monday Feb 16, 2026

Tuesday, 9 January 2024 01:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary bond market saw the week commence on a comparatively subdued note with yields edging up marginally on moderate activity. Accordingly, the maturities of the two 25’s (01.06.25 and 01.07.25), 15.05.26, two 27’s (01.05.27 and 15.09.27), 01.07.28 and 01.07.32 were seen changing hands at the rates of 13.50%, 13.95%, 14.15% and 14.25% each respectively.

The secondary bond market saw the week commence on a comparatively subdued note with yields edging up marginally on moderate activity. Accordingly, the maturities of the two 25’s (01.06.25 and 01.07.25), 15.05.26, two 27’s (01.05.27 and 15.09.27), 01.07.28 and 01.07.32 were seen changing hands at the rates of 13.50%, 13.95%, 14.15% and 14.25% each respectively.

This week will see Rs. 120.00 billion in Treasury Bonds on offer. The CBSL is due to conduct the round of auctions on 11 January (this Thursday). The available maturities are comprised of Rs. 45.00 billion of a 1 February 2026 maturing bearing a coupon of 09.00%, Rs. 45.00 billion of a 15 March 2028 maturing bond bearing a coupon of 10.75% and a 15 May 2030 maturing bond with a coupon rate of 11.00%.

For context the last Treasury Bond auction held on 28 December 2023, recorded positive responses, mainly on the short tenures at its 1st phase. With the entire offered amount on the 2026 and 2028 durations being fully taken up. The 01.02.2026 maturity recorded a weighted average rate of 13.87% while the 15.03.2028 recorded a weighted average rate of 14.21% while the medium tenor 15.05.30 maturity recorded a weighted average of 14.22%. An amount of Rs. 150.43 billion was accepted in total against a total offered amount of Rs. 155 billion, leading to the phase 2 of the auction being opened for the 15.05.30 maturity as it was not fully taken up.

For context the last Treasury Bond auction held on 28 December 2023, recorded positive responses, mainly on the short tenures at its 1st phase. With the entire offered amount on the 2026 and 2028 durations being fully taken up. The 01.02.2026 maturity recorded a weighted average rate of 13.87% while the 15.03.2028 recorded a weighted average rate of 14.21% while the medium tenor 15.05.30 maturity recorded a weighted average of 14.22%. An amount of Rs. 150.43 billion was accepted in total against a total offered amount of Rs. 155 billion, leading to the phase 2 of the auction being opened for the 15.05.30 maturity as it was not fully taken up.

The total secondary market Treasury bond/bill transacted volume for 5 January was Rs. 19.16 billion.

In money markets, the weighted average rates on overnight call money and Repo stood at 9.09% and 9.69% respectively while the net liquidity stood at a deficit of Rs. 48.07 billion yesterday.

The DOD (Domestic Operations Department) of Central Bank injected liquidity by way of an overnight Repo auction for Rs. 23.25 billion at a weighted average rate of 9.07%. An amount of Rs. 28.37 billion was withdrawn from Central Banks SLFR (Standard Lending Facility Rate) of 10.00% while an amount of Rs. 3.55 billion was deposited at its SDFR (Standard Deposit Facility Rate) of 9.00%.

The DOD (Domestic Operations Department) of Central Bank injected liquidity by way of an overnight Repo auction for Rs. 23.25 billion at a weighted average rate of 9.07%. An amount of Rs. 28.37 billion was withdrawn from Central Banks SLFR (Standard Lending Facility Rate) of 10.00% while an amount of Rs. 3.55 billion was deposited at its SDFR (Standard Deposit Facility Rate) of 9.00%.

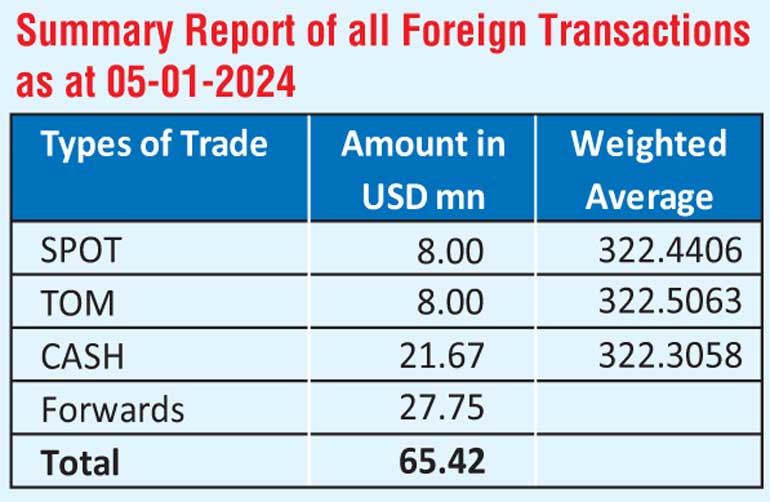

Forex Market

In the Forex market, the USD/LKR rate on spot contracts closed the day broadly steady at

Rs. 322.40/322.50 yesterday against its previous day’s closing level of Rs. 322.45/322.65.

The total USD/LKR traded volume for 5 January was $ 65.42 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)