Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Friday, 1 December 2023 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary bond market saw activity moderating with yields stabilising and holding broadly steady.

The secondary bond market saw activity moderating with yields stabilising and holding broadly steady.

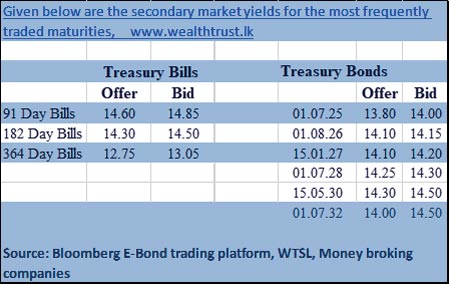

Accordingly, the maturities of 01.05.24, 15.05.26, 15.01.27, 01.07.28, 15.07.29, 15.05.30 and 01.07.32 were seen changing hands at levels of 14.50%, 14.30%, 14.20% to 14.10%, 14.35% to 14.30%, 14.25% and 14.30% each respectively.

In secondary market bills, May 2024 maturities were seen trading at 14.45%.

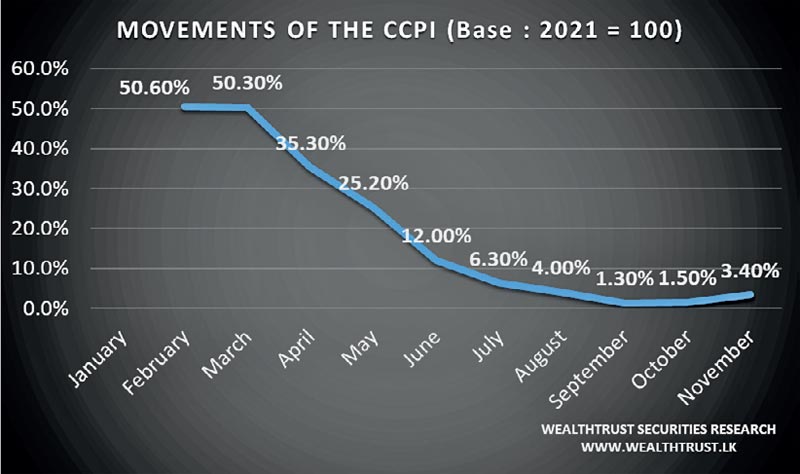

On the inflation front, the Colombo Consumer Price Index – CCPI (Base: 2021=100) or inflation for the month of November was recorded at 3.40% on its point to point as against 1.50% recorded in October. This is the second straight month that inflation has accelerated, albeit marginally. Since peaking in February 2023 at 50.60%, inflation was seen on steady and rapid disinflation path, reaching the current significantly moderated levels compared to a year ago.

This is in line with Central Bank of Sri Lanka’s projections. The Central Bank had earlier expressed the view that the disinflation trend might reverse due to increased energy tariffs and higher taxes, but it anticipates price increases stabilising at a 5% target in the medium term.

The total secondary market Treasury bond/bill transacted volume for 29 November was Rs. 46.29 billion.

In money markets, the weighted average rates on overnight call money and Repo stood at 9.10% and 9.94% respectively while the net liquidity stood at a surplus of Rs. 7.01 billion yesterday.

The DOD (Domestic Operations Department) of Central Bank injected liquidity by way of an overnight Repo auction for Rs. 16.23 billion at a weighted average rate of 9.22%. An amount of Rs. 66.08 billion was withdrawn from Central Bank’s SLFR (Standard Lending Facility Rate) of 10.00% while an amount of Rs. 42.84 billion was deposited at the Central Bank’s SDFR (Standard Deposit Facility Rate) of 09.00%.

Forex market

Forex market

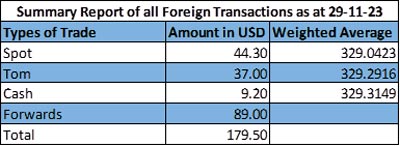

In the forex market, the USD/LKR rate on spot contracts closed the day marginally stronger at Rs. 328.00/328.15 yesterday against its previous day’s closing level of Rs. 328.25/328.50.

The total USD/LKR traded volume for 29 November was $ 179.50 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)