Saturday Feb 14, 2026

Saturday Feb 14, 2026

Monday, 16 December 2019 01:11 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

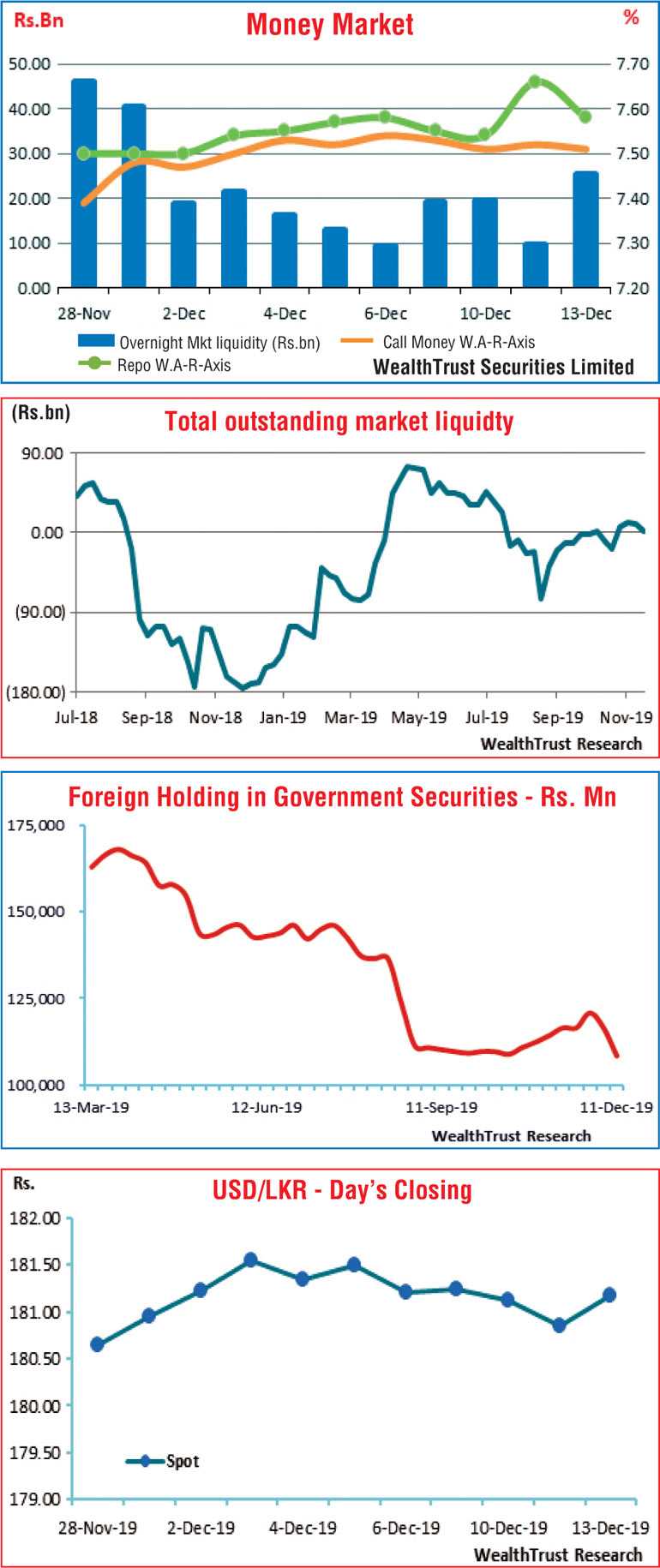

Secondary bond market yields closed on a steady note during the short trading week ending 13th December, as activity across the yield curve moderated.

However, activity slowed down considerably with limited amount of trades taking place consisting of the 01.05.20, 15.03.23, 01.01.24, two liquid 2024’s (i.e. 15.06.24 & 15.09.24), 15.03.25 and 15.09.34 maturities at levels of 7.85%, 9.40%, 9.95% to 10.05%, 9.80% to 9.85%, 10.08% to 10.15% and 10.30%, respectively.

At the weekly Treasury bill auction, the weighted average yield of the 182-day and 364-day maturities increased by 5 and 1 basis point(s), respectively while the weighted average yield on the 91-day maturity remained steady.

However, the outcome of the Treasury bond auction conducted during the week was an impressive one with the four-year and nine-month maturity of 15.09.24 recording a weighted average yield of 9.87% and the 10-year five-month maturity of 15.05.30 recording a weighted average yield of 10.23%.

Nevertheless, the foreign component in rupee bonds decreased for a second consecutive week to record an outflow of Rs. 8.18 billion during the week ending 10 December.

The daily secondary market Treasury bond/bills transacted volume for the first three days of the week averaged Rs. 9.47 billion.

In money markets, the Open Market Operations (OMO) Department of the Central Bank injected liquidity during the week on an overnight basis and term basis (i.e. seven and 14 Days) at weighted average yields ranging from 7.53% to 7.63% as the overall liquidity in the system decreased further to Rs. 0.82 billion, when compared against the previous weeks level of Rs. 9.52 billion. Call money and repo rates averaged at 7.52% and 7.58%, respectively.

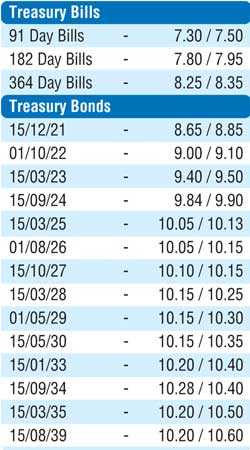

Rupee closes mostly unchanged

The USD/LKR rate on spot contracts was seen closing the week mostly unchanged at Rs. 181.10/25 subsequent to trading within the range of Rs. 180.70 to Rs. 181.35.

The daily USD/LKR average traded volume for the first three days of the week stood at $ 69.17 million.

Some of the forward dollar rates that prevailed in the market were 1 month - 181.45/65; 3 months - 182.30/60 and 6 months - 184.10/40.