Thursday Feb 12, 2026

Thursday Feb 12, 2026

Wednesday, 28 November 2018 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

Activity in the secondary bond market picked up yesterday as yields were seen decreasing marginally on the back of renewed buying interest.

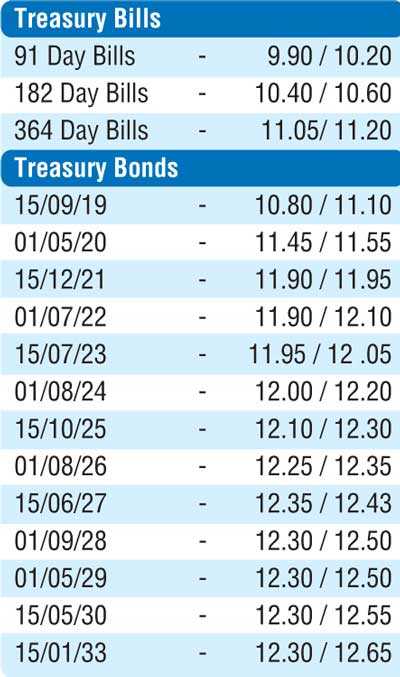

The yields of the 2021 maturities (i.e. 01.03.21 and 15.12.21), 15.07.23 and 15.06.27 were seen decreasing to intraday lows of 11.75%, 11.90%, 12.00% and 12.40% respectively against its previous day’s closing levels of 11.80/95, 11.85/00, 12.05/25 and 12.45/50.

Furthermore, a limited amount of activity was witnessed on the 01.05.20 and 01.08.26 maturities at levels of 11.50% and 12.34% to 12.40% respectively. In the secondary bill market, July and October 2019 maturities changed hands at levels of 10.65% and 11.03% to 11.05% respectively as well.

At today’s weekly bill auction, a total amount of Rs.18 billion will be on offer consisting of Rs.8 billion of the 182 day and Rs.10 billion of the 364 day maturities. At last week’s auction, the weighted average yields on the 91 day and 364 day maturities decreased by six and four basis points respectively to 10.01% and 11.21%. All the bids received for the 182 day bill were rejected.

In the money market, overnight call money and repo rates averaged 8.95% and 8.92% respectively as the OMO Department of Central Bank infused liquidity for durations of overnight, seven days and 14 days for a successful amount of Rs. 15 billion, Rs. 2.75 billion and Rs. 10 billion at weighted averages of 8.49%, 8.65% and 8.75% respectively. The net liquidity shortfall decreased to Rs. 36.71 billion yesterday.

Rupee dips further

The USD/LKR rate on spot contracts was seen depreciating further yesterday to close the day at Rs. 180.50/90 against its previous day’s closing of Rs. 180.10/30 on the back of continued importer demand.

The total USD/LKR traded volume for 26 November 2018 was $ 79.84 million.

Some of the forward USD/LKR rates that prevailed in the market were one month - 181.50/00; three months - 183.50/00 and six months - 186.50/00.