Monday Feb 23, 2026

Monday Feb 23, 2026

Monday, 29 August 2022 02:42 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary bond market activity picked up towards the latter part of the week ending 26 August 2022 on the back of selective buying interest across the yield curve.

The secondary bond market activity picked up towards the latter part of the week ending 26 August 2022 on the back of selective buying interest across the yield curve.

Activity remained rather dull during the early part of the week as most market participants continued to be on side line which was complimented further by the increase in the weekly Treasury bill weighted average rates.

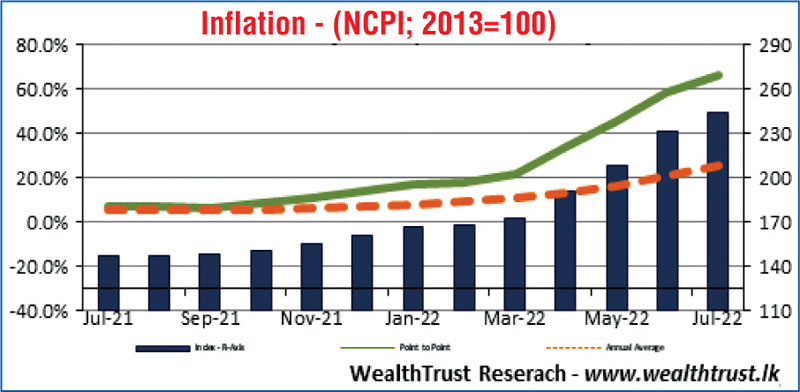

The increase was led by the 91 day bill as it recorded a jump of 107 basis points (1.07%) to 30.51% followed by the 182 day and 364 day bills by 55 and 69 basis points respectively to 29.51% and 29.83%. Furthermore, National Consumer Price Index (NCPI) for the month of July increased for a 10th consecutive month to 66.7% in comparison to its previous month of 58.9%.

However, buying interest on Friday on the 15.01.26, 01.07.28 and 01.01.29 maturities saw it change hands at levels of 22.75%, 23.05% to 23.08% and 24.80% respectively in addition to the 01.06.25 maturity at 28.00%. The 91 day or 3 month bill was seeing changing hands from a high of 31.55% to a low of 30.00%, as well.

The foreign holding in rupee bonds remained mostly unchanged at Rs. 4.11 billion for the week ending 24 August 2022 while the daily secondary market Treasury bond/bill transacted volumes for the first four trading days of the week averaged Rs. 9.01 billion.

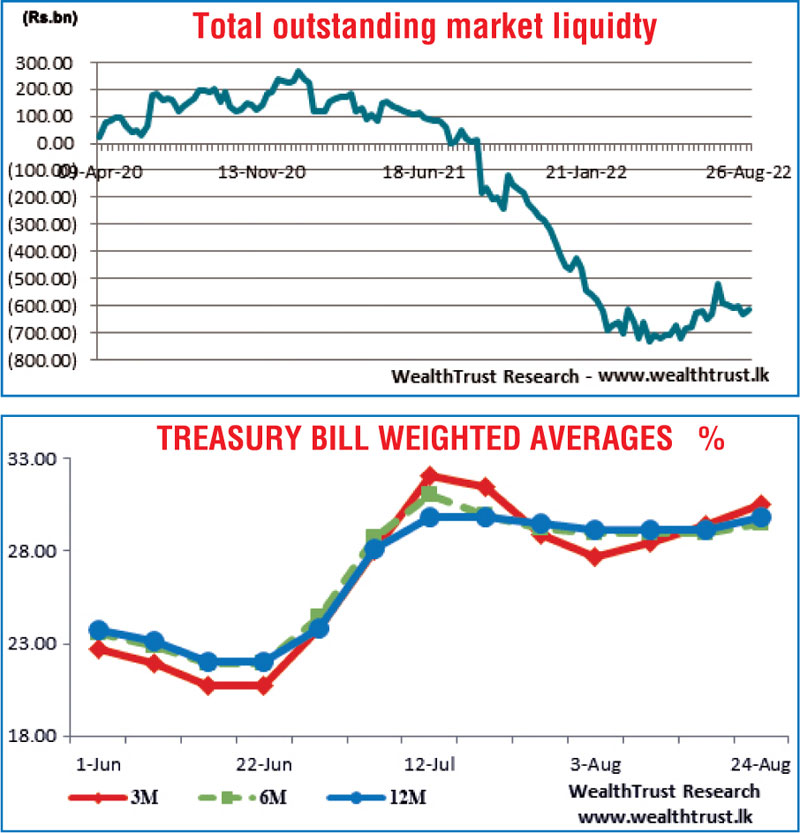

In money markets, the total outstanding liquidity deficit decreased marginally to Rs. 614.94 billion by the end of the week against its previous weeks of Rs. 634.38 billion while the CBSL’s holding of Government Securities was registered at Rs. 2,258.11 billion against its previous weeks of Rs. 2,230.02 billion. The weighted average rate on repo stood at 15.50% for the week while No Call money transactions were reported during the week.

Furthermore, the Domestic Operations Department (DOD) of the Central Bank of Sri Lanka injected an amount of Rs. 60 billion by way of a 60 day Reverse Repo auction at a weighted average rate of 28.01%.

USD/LKR

In the forex market, the middle rate for USD/LKR spot contracts closed the week at Rs. 361.40 against its previous weeks closing of Rs. 361.00.

The daily USD/LKR average traded volume for the first four trading days of the week stood at $ 53.00 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)