Thursday Feb 19, 2026

Thursday Feb 19, 2026

Tuesday, 17 August 2021 03:38 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The fresh trading week commenced on a dull note yesterday with trades only witnessed on the 15.03.23 maturity at levels of 5.95% to 6%.

The fresh trading week commenced on a dull note yesterday with trades only witnessed on the 15.03.23 maturity at levels of 5.95% to 6%.

The total secondary market Treasury bond/bill transacted volume for 13 August was Rs. 29.92 billion.

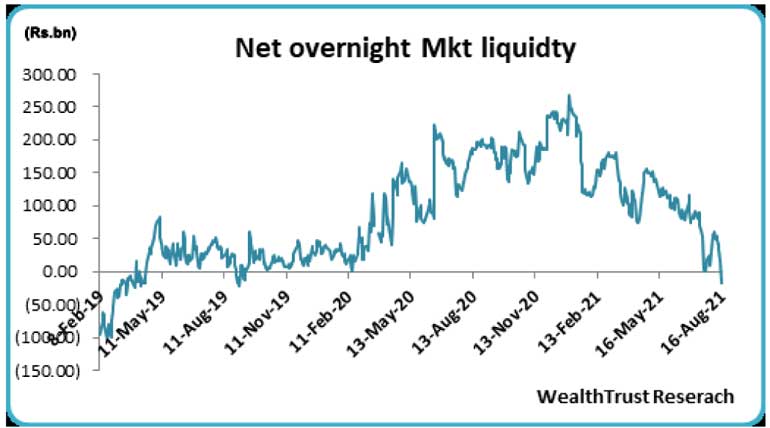

The money market liquidity turned negative for the first time since 10 September 2019 to record a deficit of Rs. 17.45 billion yesterday. Nevertheless, the weighted average rates on overnight call money and repo remained mostly unchanged at 5.05% and 5.07% respectively as an amount of Rs. 85.65 billion was deposited at Central Banks SDFR (Standard Deposit facility Rate) of 4.50%. An amount of Rs. 103.11 billion was withdrawn from Central Banks SLFR (Standard Lending facility Rate) of 5.50%.

USD/LKR

In Forex markets, the overall market continued to remain inactive yesterday. The total USD/LKR traded volume for 13 August was $ 12.12 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)