Wednesday Feb 25, 2026

Wednesday Feb 25, 2026

Wednesday, 8 July 2020 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

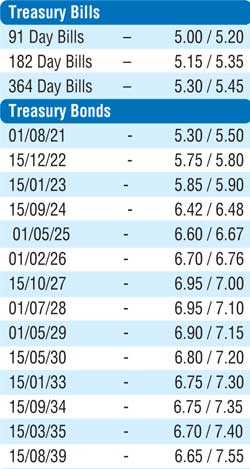

The activity in the secondary bond market remained moderate yesterday with limited trades seen on the liquid maturities of 15.12.22, 15.01.23, 01.05.25, 01.02.26 and 15.10.27 within a narrow range of 5.77% to 5.80%, 5.87% to 5.90%, 6.64% to 6.67%, 6.74% and 6.96% to 6.97% respectively.

A January 2021 maturity was seen changing hands at 5.22% in the secondary bill market. This was ahead of today’s weekly Treasury bill auctions, where a total amount of Rs. 28.5 billion will be on offer, consisting of Rs. 4 billion on the 91 day, Rs. 6 billion on the 182 day and Rs. 18.5 billion on the 364 day maturity. At last week’s auctions, weighted averages dipped to 5.08%, 5.22% and 5.45% on the 91 day, 182 day and 364 day respectively.

The total secondary market Treasury bond/bill transacted volume for 6 July was Rs. 11.15 billion.

The overnight call money and repo rates remained steady to average 5.51% and 5.54% respectively in the money market yesterday while the net liquidity surplus in the system stood at Rs. 164.14 billion.

Rupee dips marginally

In Forex markets, the USD/LKR on spot contracts dipped marginally to close the day at Rs. 185.85/95 yesterday in comparison to its previous day’s closing of Rs. 185.80/90 on the back of buying interest by Banks. The total USD/LKR traded volume for 6 July was $ 108.58 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)