Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Tuesday, 22 August 2023 00:57 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary bond market commenced the week on a sluggish tone yesterday as yields remained broadly the same on the lack of impetus. The limited trades were seen on the maturities of the 15.01.25, 15.05.26, and 15.09.27 at levels of 13.85%, 13.00% and 13.00% respectively.

In secondary bills, September, October and November 2023 maturities traded at 16.25%,17.00% and 17.00% to 17.25 respectively.

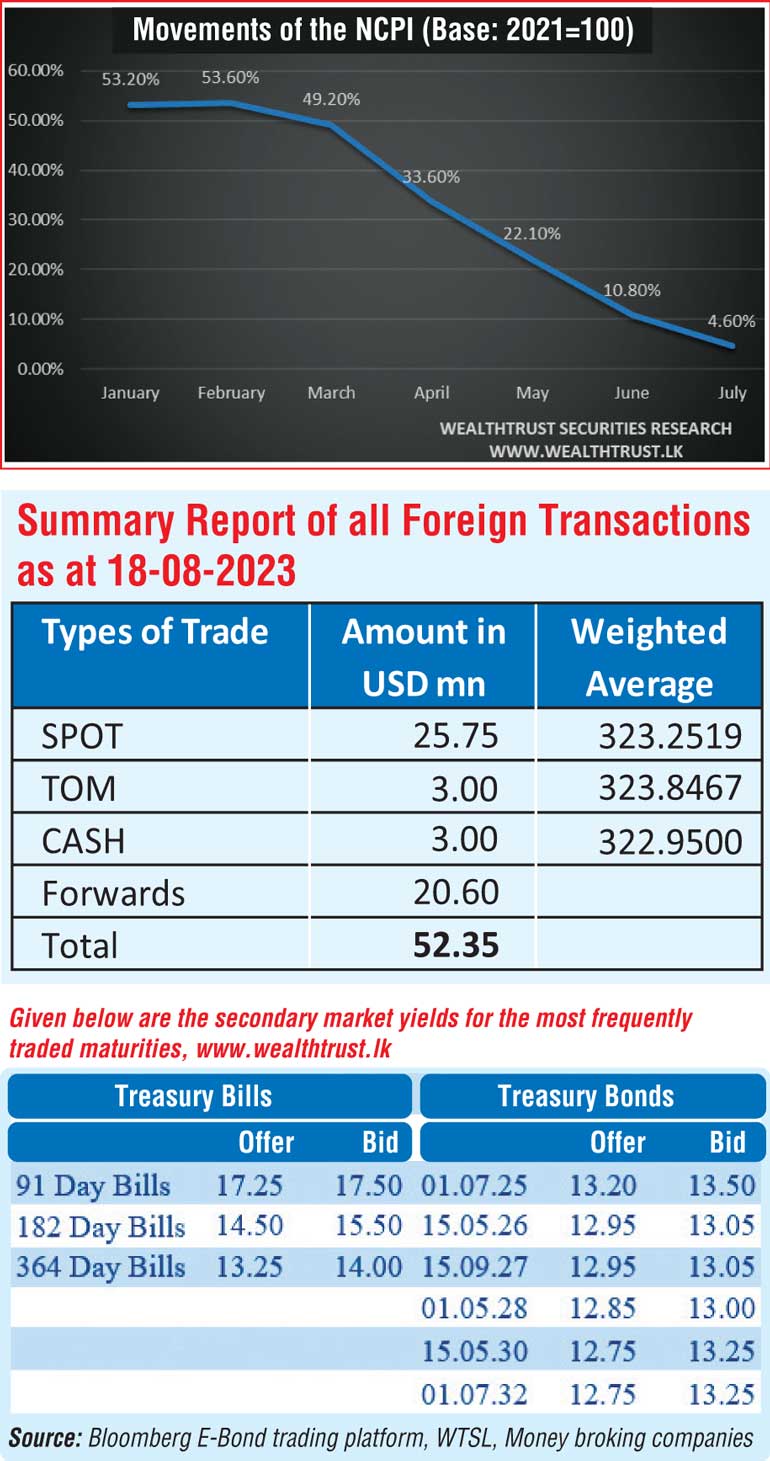

The total secondary market Treasury bond/bill transacted volume for 21 August 2023 was Rs. 10.84 billion. The National Consumer Price Index -NCPI (Base: 2021=100) or National inflation for the month of July decreased sharply to 4.60% on its point to point as against 10.80% recorded in June and a peak of 53.6% in February of 2023. This is the lowest level witnessed in the NCPI since the index was rebased, at the start of the year 2023, so far.

In money markets, the DOD (Domestic Operations Department) of Central Bank injected liquidity by way of overnight and 7-day reverse repo auctions for a total volume of Rs. 95.90 billion at weighted average rates of 11.60% and 12.00% respectively while an amount of Rs.98.77 billion was withdrawn from Central Banks SLFR (Standard Lending Facility Rate) of 12.00%. The net market liquidity deficit stood at Rs.194.60 billion yesterday. The weighted average rates on overnight call money and repo were registered at 11.87% and 11.81% respectively.

Forex Market

In the Forex market, the Rupee or USD/LKR rate on spot contracts depreciated marginally to close trading yesterday at Rs.323.50/324.50 against its previous day’s closing level of Rs.323.00/324.00.

The total USD/LKR traded volume for 18th August 2023 was $ 52.35 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)