Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Friday, 1 September 2023 00:15 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

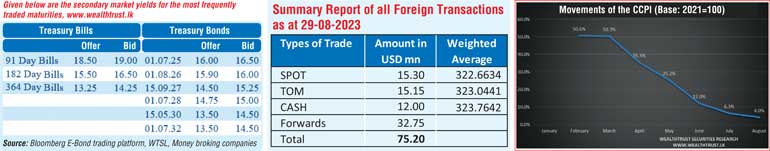

The secondary bond market activity remained dull yesterday. Limited trades were seen on the maturities of the 01.08.26 and 01.07.28 at levels of 15.95% and 15.00% respectively.

In secondary bills, October and November 2023 maturities traded at 17.70% to 17.90% and 18.48% to 19.25% respectively.

The total secondary market Treasury bond/bill transacted volume for 21st August 2023 was Rs. 39.62 billion.

Meanwhile, the Colombo Consumer Price Index -CCPI (Base: 2021=100) for the month of August decreased sharply to 4.00% on its point to point as against 6.30% recorded in July and a peak of 50.6% in February of 2023. This is the lowest level witnessed in the CCPI since the index was rebased, at the start of the year 2023. The figure also beats a Bloomberg consensus estimate of 4.5%.

In money markets, the DOD (Domestic Operations Department) of Central Bank injected liquidity by way of an overnight and 31-day reverse repo auctions for a volume of 67.75 billion and 27.5 billion at weighted average rates of 11.62% and 14.33% respectively. While an amount of Rs. 60.70 billion was withdrawn from Central Banks SLFR (Standard Lending Facility Rate) of 12.00%. The net market liquidity deficit stood at Rs.101.11 billion yesterday.

The weighted average rates on overnight call money and repo were registered at 11.50% and 12.00% respectively.

Forex Market

In the Forex market, the Rupee or USD/LKR rate on spot contracts appreciated marginally to close trading yesterday at Rs.319.50/320.50 against its previous day’s closing level of Rs.320.75/321.75.

The total USD/LKR traded volume for 29 August 2023 was $ 75.20 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)