Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Friday, 20 November 2020 02:45 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

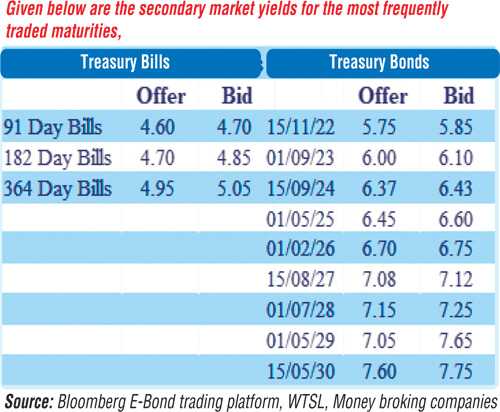

The activity in the secondary bond market continued to remain moderate yesterday with limited trades seen on the maturities of 15.12.21, 15.12.22, 2024s (i.e. 15.09.24 and 01.12.24) and 15.08.27 at levels of 5.04% to 5.05%, 5.85%, 6.37% to 6.42% and 7.10% to 7.12% respectively. In secondary bills, 26 February 2021 maturity traded at level of 4.73%.

The activity in the secondary bond market continued to remain moderate yesterday with limited trades seen on the maturities of 15.12.21, 15.12.22, 2024s (i.e. 15.09.24 and 01.12.24) and 15.08.27 at levels of 5.04% to 5.05%, 5.85%, 6.37% to 6.42% and 7.10% to 7.12% respectively. In secondary bills, 26 February 2021 maturity traded at level of 4.73%.

The total secondary market Treasury bond/bill transacted volumes for 18 November 2020 was Rs. 10.6 billion.

In the money market, the overnight surplus liquidity and weighted average rates on overnight call money and repo was registered at 172.62 billion, 4.54% and 4.61% respectively.

Rupee depreciates once again

In Forex markets, the rupee on the sport contracts depreciated once again yesterday to hit a low of Rs.184.95 against its previous day’s closing level of Rs. 184.60/70, while spot next contacts were seen activity quoted at level of Rs. 185.10/30.

The total USD/LKR traded volume for 18 November was $ 108.44 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, money broking companies)