Sunday Feb 15, 2026

Sunday Feb 15, 2026

Monday, 21 February 2022 02:40 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

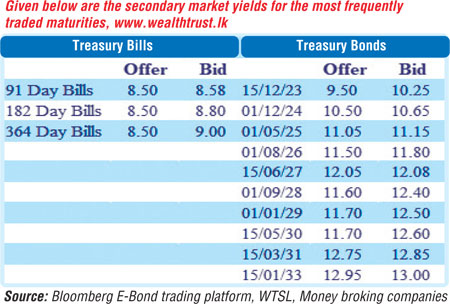

The activity in the secondary bond market slowed down considerably during the shortened trading week ending 18 February. The limited trades witnessed took place on the 2025’s (i.e. 15.03.25 and 01.05.25), 15.06.27 and 15.01.33 maturities within the range of 11.07% to 11.12%, 12.00% to 12.10% and 12.94% to 12.96% respectively.

The activity in the secondary bond market slowed down considerably during the shortened trading week ending 18 February. The limited trades witnessed took place on the 2025’s (i.e. 15.03.25 and 01.05.25), 15.06.27 and 15.01.33 maturities within the range of 11.07% to 11.12%, 12.00% to 12.10% and 12.94% to 12.96% respectively.

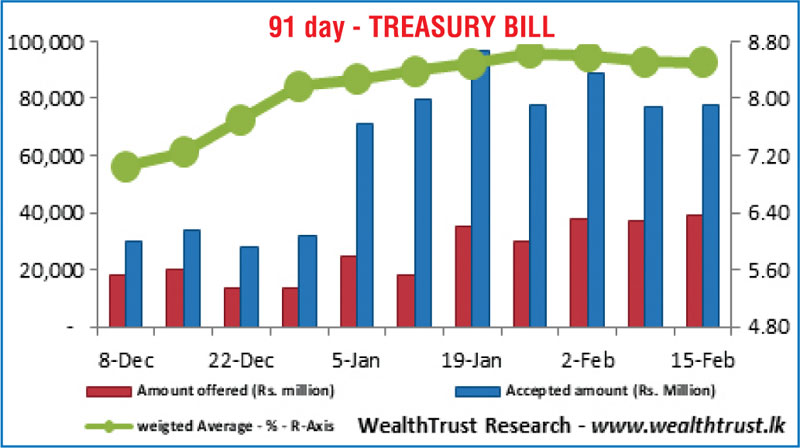

Nevertheless, the primary Treasury bill market continued with its positive sentiment due to persistent buying interest solely on the 91 day bill as its weighted average was seen edging down further during the week. The weighted average rate on the 91 day and 364 day maturities were seen dipping by 02 basis points each to 8.50% and 8.57% respectively while weighted average rate on the 182 day bill remained steady at 8.54%. In the secondary bill market, 8 April, 20 May and 10 June were traded at levels of 8.00%, 8.545% to 8.58% and 8.60% to 8.65%, subsequent to the auction.

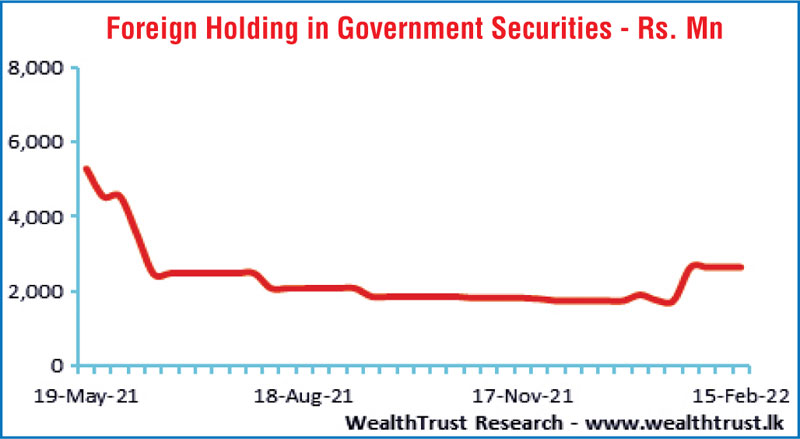

The foreign holding in rupee bonds remained steady at Rs. 2.65 billion for the week ending 15 February while the daily secondary market Treasury bond/bill transacted volumes for the first three trading days of the week averaged Rs. 26.27 billion.

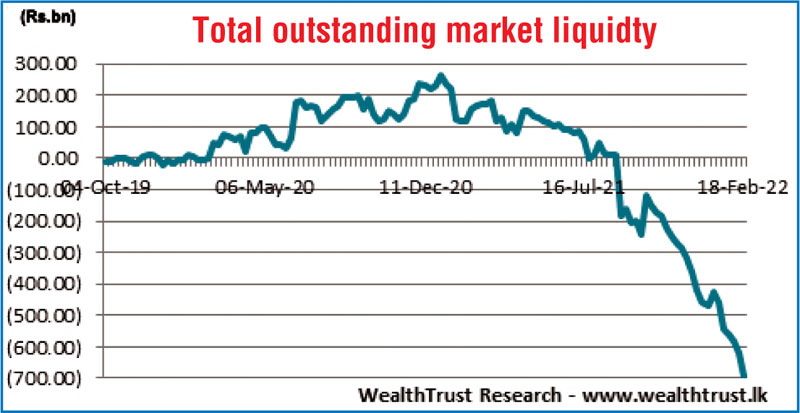

In money markets, the total outstanding liquidity deficit increased further during the week to register Rs. 693.54 billion by the end of the week against its previous weeks Rs. 617.99 billion while CBSL’s holding of Govt. Securities decreased further to Rs. 1,511.20 billion against its previous weeks of Rs. 1541.53 billion. The weighted average rates on overnight call money and repo was 6.48% and 6.50% respectively for the week.

The Domestic Operations Department (DOD) of Central Bank was seen draining out liquidity during the early part of the week by way of overnight repo auctions at a weighted average yield of 6.49%.

Forex market

In Forex markets, the USD/LKR rate on spot contracts continued to trade at Rs. 203.00 during the week while overall activity remained moderate.

The daily USD/LKR average traded volume for the first three trading days of the week stood at $ 56.75 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)