Tuesday Feb 24, 2026

Tuesday Feb 24, 2026

Wednesday, 16 August 2023 03:03 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary bond market was at a standstill yesterday ahead of the weekly Treasury bills auction due today.

The secondary bond market was at a standstill yesterday ahead of the weekly Treasury bills auction due today.

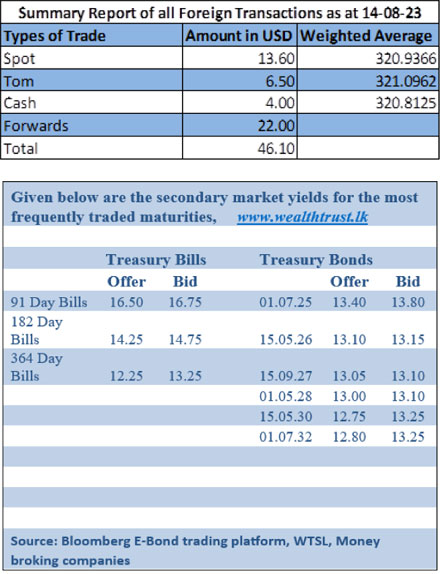

A trade was seen on the 15.09.27 maturity at 13.10% while in secondary bills market, November 2023 and January to March 2024 maturities traded at levels of 16.70% to 16.85% and 14.50% respectively.

Today’s weekly Treasury bill auction will have in total an amount of Rs. 180 billion on offer which will consist of Rs. 90 billion on the 91-day maturity, Rs. 50 billion on the 182-day maturity and a further Rs. 40 billion on the 364-day maturity.

At last week’s auction, the weighted averages decreased across the board to 19.78%, 17.11% and 13.94% on the 91-day, 182-day and 364-day maturities respectively. An amount of Rs. 180.00 billion was accepted at the 1st phase of the auction while a further amount of Rs. 45.00 billion was raised at its phase II.

The total secondary market Treasury bond/bill transacted volume for 14 August was Rs. 7.37 billion.

In money markets, the DOD (Domestic Operations Department) of Central Bank injected liquidity by way of overnight auction and seven-day term reverse repo for a volume of Rs. 174.00 billion at the weighted average rate of 11.48% and 12.00% respectively as net liquidity deficit stood at Rs. 248.95 billion yesterday.

Further an amount of Rs. 90.94 billion was withdrawn from Central Bank’s SLFR (Standard Lending Facility Rate) of 12.00% while the weighted average rates on overnight call money and repo were registered at 11.50% and 12.00% respectively.

Forex market

In the forex market, the USD/LKR rate on spot contracts closed at Rs. 321.00/321.50 yesterday against its previous day’s closing level of Rs. 321.00/322.00.

The total USD/LKR traded volume for 14 August was $ 46.10 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)