Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Friday, 9 February 2024 00:02 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary bond market yesterday continued to rally, with aggressive buying interest driving yields down further while robust volumes were transacted. Trading continued to be predominantly on 2026-2028 durations.

This was against the backdrop of the outcome of the Special Monetary Policy Board Meeting held on 7 February. Effective from 16 February, the Central Bank of Sri Lanka has decided to relax restrictions on Licensed Commercial Banks’ access to its Standing Facilities under Open Market Operations (OMOs). The existing Standing Lending Facility (SLF) restriction, which is capped at 90% of the Statutory Reserve Requirement (SRR), will be lifted, while access to the Standing Deposit Facility (SDF) will increase from 5 to 10 times per month. This move is aligned with the Central Bank’s broader monetary policy direction, aiming to accelerate downward adjustments in market interest rates. Initially implemented in January 2023, these restrictions were aimed to curb overreliance on overnight facilities and stimulate the domestic money market.

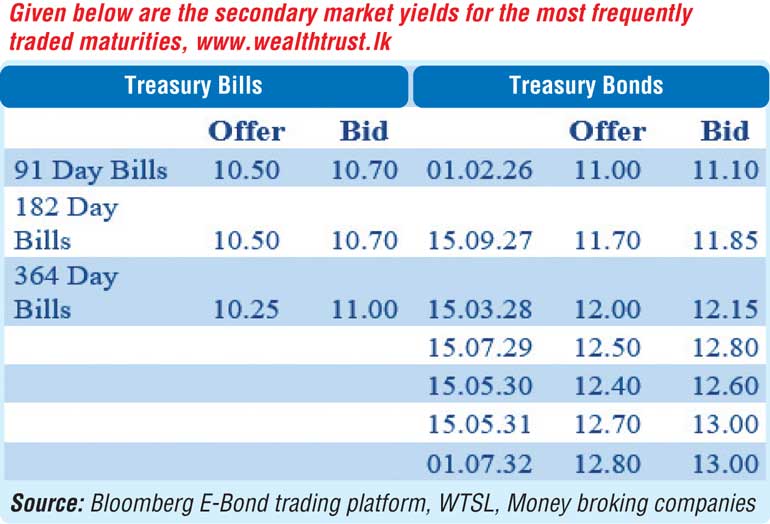

The popular liquid 2028 tenors (15.03.28, 01.05.28, 01.07.28, and 15.12.28) were seen hitting intraday lows of 12.00% against opening highs of 12.20%, while 2026 tenors (01.02.26, 01.06.26, 01.08.26 and 15.12.26) were seen dropping to intraday lows of 10.90% as against intraday highs of 11.20%. Additionally, trades were also seen on the maturities of 15.01.25, the two 27’s (01.05.27 and 15.09.27) and 15.05.30 at levels of 10.70%, 11.85% to 11.70%, 12.55% to 12.50% respectively.

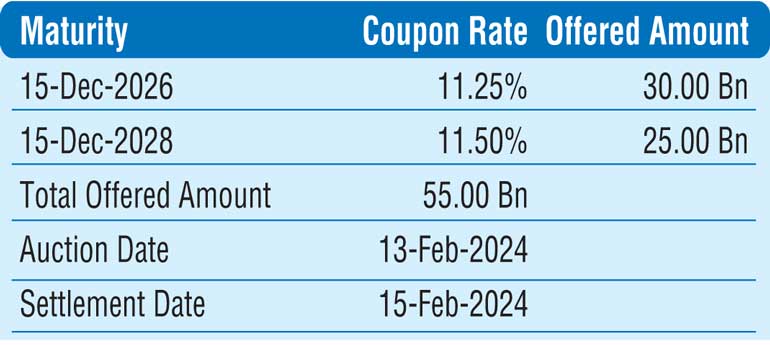

However, market activity began to taper off at the latter part of the day after the announcement of the upcoming Treasury bond auctions, with some slight profit taking pressure also being observed. Despite this, closing two-way quotes were considerably lower than the previous day. The round of Treasury bond auctions for a total of Rs. 55 billion is due to be held on 13 February. The auctions will have an offer of Rs. 30 billion from a maturity of 15 December 2026 with a coupon rate of 11.25%, and Rs. 25 billion from a maturity of 15 December 2028 with a coupon of 11.50%.

Secondary market bills with June 2024 maturities were seen changing hands at 10.75%.

The total secondary market Treasury bond/bill transacted volume for 7 February was

Rs. 115.25 billion.

In money markets, the weighted average rates on overnight call money and Repo stood at 9.11% and 9.26% respectively while the net liquidity stood at a surplus of Rs. 75.76 billion yesterday.

The DOD (Domestic Operations Department) of the Central Bank injected liquidity by way of an overnight reverse repo auction for Rs. 10.86 billion at the weighted average rate of 9.12%. An amount of Rs. 12.93 billion was withdrawn from Central Banks SLFR (Standing Lending Facility Rate) of 10.00 while an amount of Rs. 99.56 billion was deposited at the SDFR (Standing Deposit Facility Rate) of 9.00%.

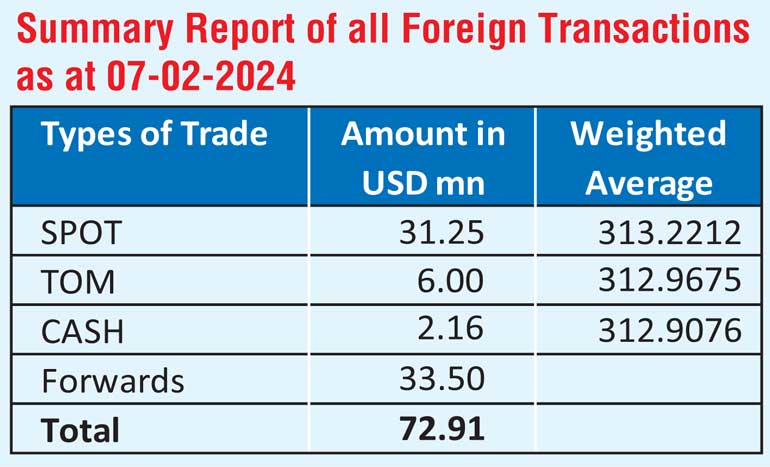

Forex Market

In the Forex market, the USD/LKR rate on spot contracts closed the day broadly steady at

Rs. 313.20/313.50 yesterday against its previous day’s closing level of Rs. 313.00/313.50.

The total USD/LKR traded volume for 7 February was

$ 72.91 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)