Saturday Feb 21, 2026

Saturday Feb 21, 2026

Monday, 20 May 2024 02:53 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

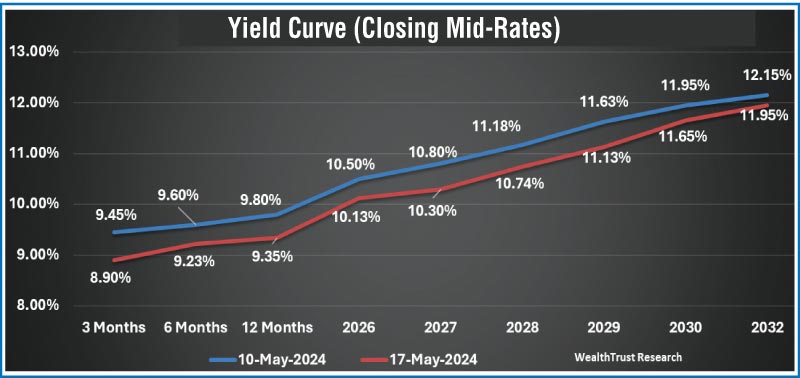

The secondary bond market commenced the trading week ending 17 May 2024 on an upbeat note, with the bullish momentum from the previous week carrying over. The market continued to rally up until midweek, with yields seen declining considerably on the back of aggressive buying interest and healthy transaction volumes, reflecting the strong demand witnessed at the primary auctions. However, the tail-end of the week saw intermittent bouts of profit-taking selling pressure that caused a slight reversal in gains. Nevertheless, renewed buying interest at the elevated levels kept a cap on rates and brought yields back down to close the trading week significantly lower, on a week-on-week basis. As such the yield curve was seen recording a parallel shift downwards.

The secondary bond market commenced the trading week ending 17 May 2024 on an upbeat note, with the bullish momentum from the previous week carrying over. The market continued to rally up until midweek, with yields seen declining considerably on the back of aggressive buying interest and healthy transaction volumes, reflecting the strong demand witnessed at the primary auctions. However, the tail-end of the week saw intermittent bouts of profit-taking selling pressure that caused a slight reversal in gains. Nevertheless, renewed buying interest at the elevated levels kept a cap on rates and brought yields back down to close the trading week significantly lower, on a week-on-week basis. As such the yield curve was seen recording a parallel shift downwards.

Trading was primarily on 2026 to 2032 durations, with a particular emphasis on 2028 tenors. Accordingly, the yield on the liquid 2026 tenor of 15.12.26 was seen nosediving to an intraweek low of 9.93%, from its intraweek high of 10.45%. Likewise, the liquid 2027 tenors of 01.05.27 and 15.09.27 were seen declining to intraweek lows of 10.25% from intraweek highs 10.50%. The popular 2028 tenors (15.03.28, 01.05.28, 01.07.28 and 15.12.28) saw heavy trading in particular, which led it to its yield dropping to an intraweek low of 10.50%, as against highs of 10.90%. Additionally, demand was observed on the medium tenor 15.05.30 and 01.10.32 maturities, as it traded within weekly highs of 11.90% each to lows of 11.40% and 11.90% respectively as well.

The primary auction influence to the secondary market commenced with the round of Treasury bond auctions conducted last Monday (13 May), which recorded a bullish outcome with yields declining sharply and the entire offered amount of Rs. 70 billion being snapped up at the 1st phase. The total bids received exceeded the total offered amount by a staggering 3.63 times. All three maturities saw strong demand which led to weighted averages of 11.01%, 11.85% and 12.17% on the 01.05.28, 15.10.30 and 01.10.32 maturities respectively. A further Rs. 7.00 billion was raised at the direct issuance window.

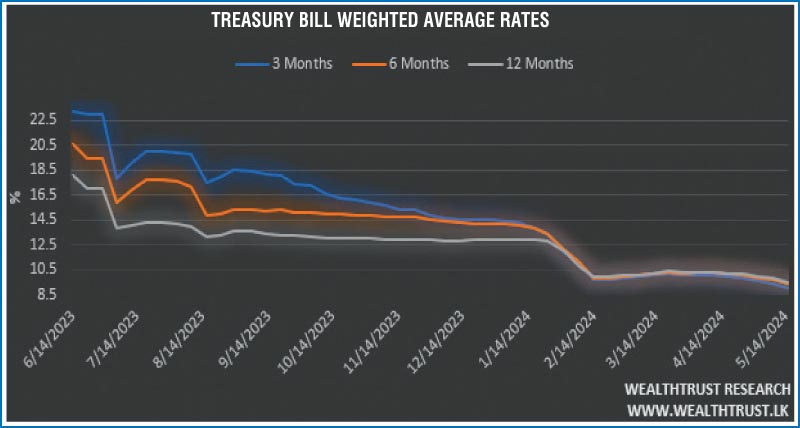

Similarly, the weekly Treasury bill auction (conducted on 15 May 2024) recorded a bullish outcome, with yields declining across all tenors for the sixth consecutive week. The 91-day bill dropped by 39 basis points to 9.04%, the 182-day bill by 33 basis points to 9.43%, and the 364-day bill by 33 basis points to 9.57%. The auction was fully subscribed, with the entire Rs. 177.50 billion offered amount been accepted in the first phase, and total bids exceeded the offered amount by 2.24 times. A further 17.75 billion was raised at the 2 phase, being the maximum offered, at the weighted averages determined at the 1 phase.

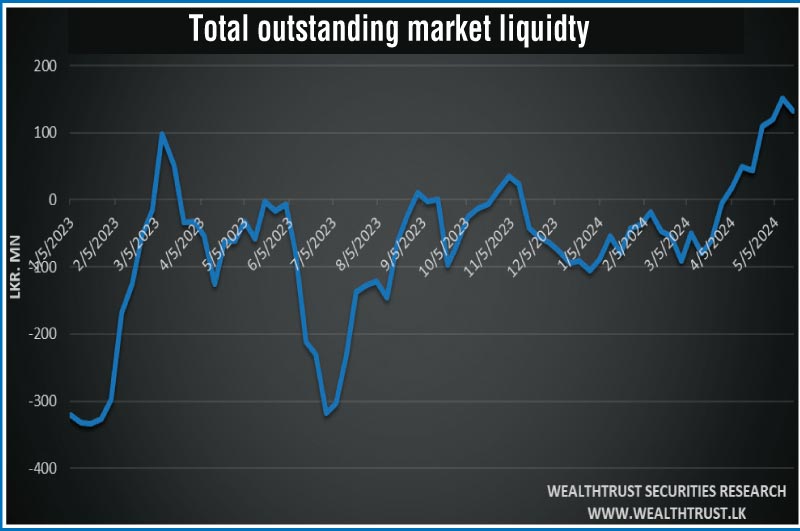

In money markets, the total outstanding liquidity surplus reduced to Rs. 132.86 billion by the week ending 17 May from its previous week’s surplus of Rs. 151.90 billion. The Domestic Operations Department (DOD) of Central Bank abstained from injecting liquidity during the week by way of overnight reverse repo auctions, however it conducted one instance of 7-day term reverse repo at the rate of 8.72%. The weighted average interest rate on call market and repo ranged between 8.63% to 8.65% and 8.69% to 8.76% respectively.

The Central Bank of Sri Lankas (CBSL) holding of Government Securities was registered at Rs. 2,655.62 billion as at 17 May 2024, unchanged from its previous week’s level.

The daily secondary market Treasury bond/bill transacted volumes for the first four days of the week averaged at Rs. 42.92 billion.

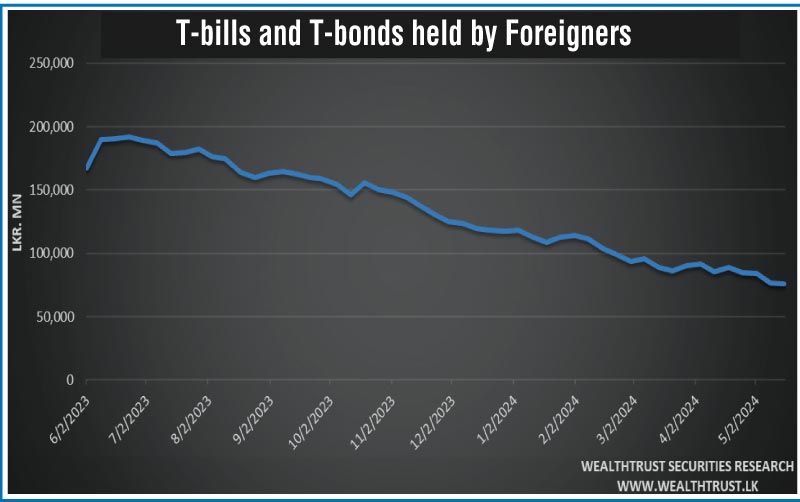

Meanwhile, the foreign holding in rupee Treasuries decreased for a fourth consecutive week, by Rs. 1.15 billion for the week ending 16 May 2024. Accordingly, the overall holding stood at Rs. 75.85 billion.

Forex Market

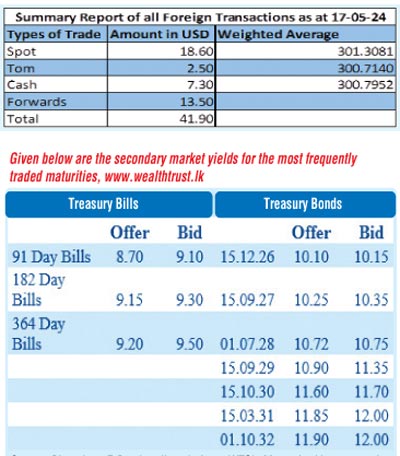

In the Forex market, the USD/LKR rate on spot contracts was seen depreciating during the week to close at Rs. 299.60/299.70. This is as against its previous week’s closing level of Rs. 299.00/299.30 and subsequent to trading at a high of Rs. 298.85 and a low of Rs. 302.25.

The daily USD/LKR average traded volume for the first four trading days of the week stood at $ 32.75 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)