Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Tuesday, 26 May 2020 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The downward momentum in the secondary market bond yields witnessed during the previous week continued during the week ending 22 May as well.

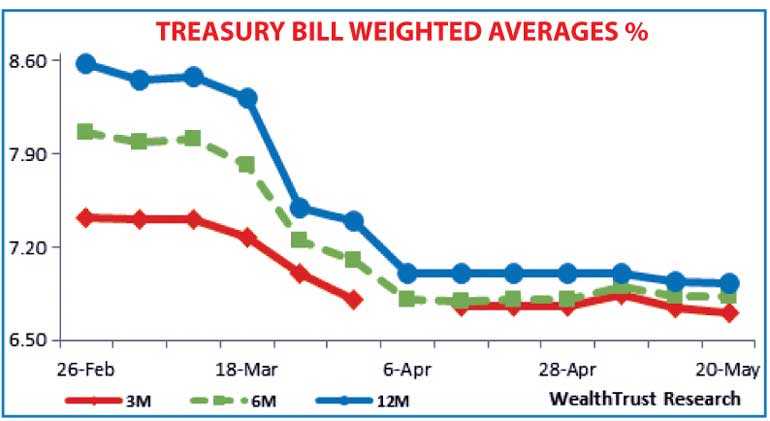

The conduct of bond buyback auctions by the DOD (Domestic Operations Department) of Central Bank was seen as the main reasons behind the downward momentum along with the outcome of the weekly Treasury bill auctions, where the accepted amount on the 364 day maturity was seen exceeding its offered amount for the first time eleven weeks while its weighted average dipped by one basis point.

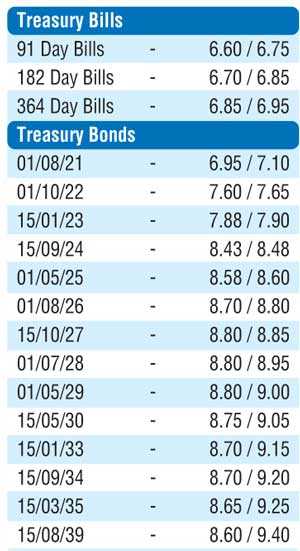

Buying interest on the liquid maturities of 01.10.22, 15.01.23, three 2024’s (i.e.15.03.24, 15.06.24 and 15.09.24), 01.05.25 and 15.10.27 saw its yields dip to intraweek lows of 7.60%, 7.89%, 8.45% each, 8.43%, 8.55% and 8.82% respectively against its previous weeks closing levels of 7.80/90, 8.04/10, 8.52/57, 8.53/60 each, 8.65/70 and 8.85/90, reflecting a parallel shift downwards of the yield curve, week on week.

In the bill market, June 2020 maturities were seen changing hands at levels of 6.50% to 6.55% while July to August 2020, October to December 2020 and April 2021 maturities changed hands at levels of 6.63% to 6.71%, 6.72% to 6.90% and 6.89% to 6.92% respectively.

The foreign component in Rupee bonds remained unchanged at Rs. 23.21 billion for the week ending 20 May.

The daily secondary market Treasury bond/bill transacted volumes for the first four days of the week averaged Rs. 12.45 billion.

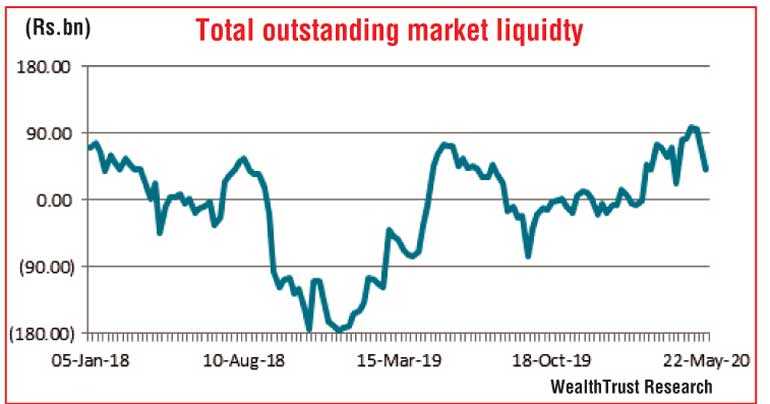

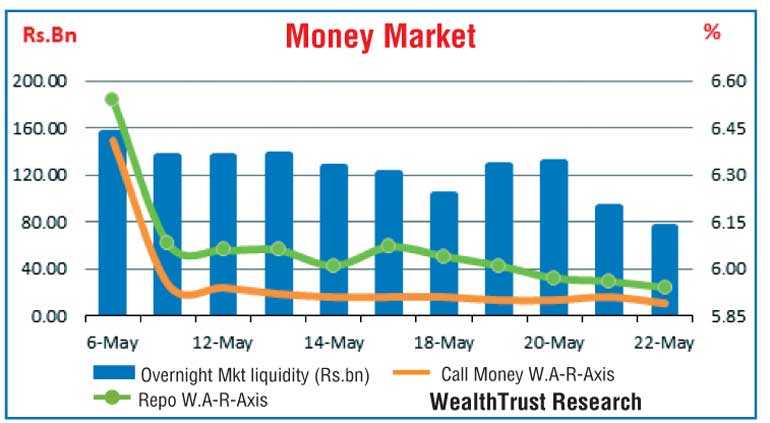

In money markets, the overnight call money and repo rates averaged 5.90% and 5.98% respectively for the week as the Domestic Operations Department (DOD) of the Central Bank of Sri Lanka injected liquidity at weighted averages ranging from 5.99% to 6.46% by way of 4 to 14 day reverse repo auctions.

The overall money market liquidity decreased for a third consecutive week to record a surplus of Rs. 40.93 billion against its previous week’s surplus of Rs.67.64 billion as the OMO department of Central Bank injected a total of Rs. 12.75 billion by way of outright purchases of Treasury bonds on the maturities of 15.03.24, 15.06.24, 15.09.24 & 01.05.25 at weighted averages of 8.42% to 8.66% respectively during the week.

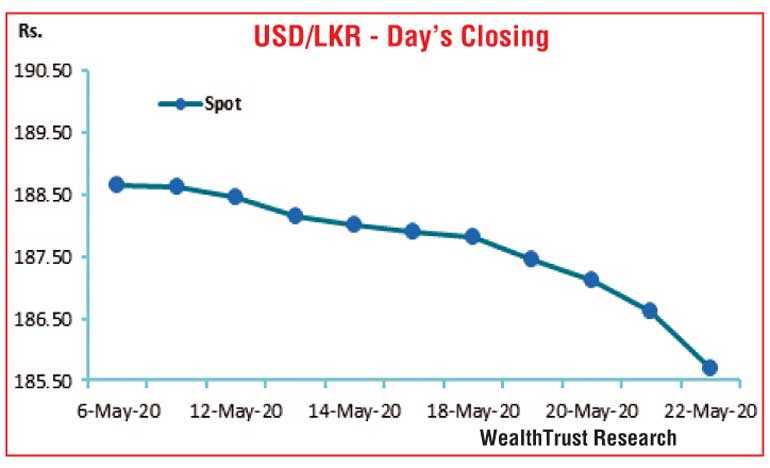

Rupee appreciates considerably

In the Forex market, the USD/LKR rate on spot contracts appreciated considerably to close the week at Rs. 185.60/80 against its previous day’s closing levels of Rs. 187.80/00 subsequent to trading at a high of Rs. 185.50 and low of Rs. 187.80. Selling interest by banks along with forward conversions was seen as the reasons behind the gain.

The daily USD/LKR average traded volume for the first four days of the week stood at $ 49.11 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, money broking companies)