Sunday Feb 22, 2026

Sunday Feb 22, 2026

Monday, 3 April 2023 00:08 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary bond market was seen closing the week ending 31 March 2023 on a bullish note following a bearish sentiment at the start of the week on the back of clarity provided by CBSL and the Finance Ministry on Domestic Debt Restructuring (DDR) at its investor presentation on Thursday, 30 March.

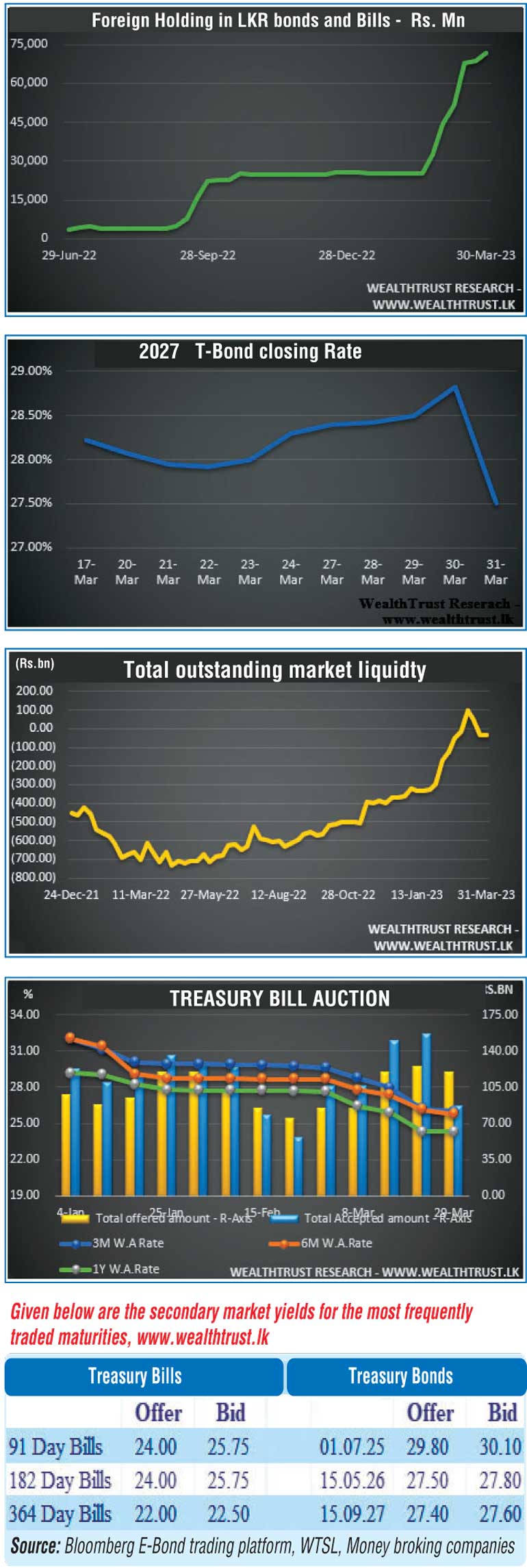

The secondary market bond yields seesawed mainly on the liquid maturities of 01.07.25, 15.05.26 and 15.09.27 as selling interest led to yields increasing during the first four days of the week to weekly highs of 32.00%, 28.30% and 29.00% respectively. However, renewed buying interest on Friday saw it dip once again to weekly lows of 30.00%, 27.65% and 27.50% respectively. The secondary bill market too witnessed the same trend as March 2024 bill maturities changed hands at a low of 21.00%.

At the weekly Treasury bill auction, weighted average rates continued its decreasing trend reflecting dips of 24, 33 and 01 basis points on 91-day, 182-day 364-day maturities respectively. However, the auction went undersubscribed for the first time in five weeks, as only Rs. 92.53 billion was accepted in total against its total offered volume of Rs. 120.00 billion.

Meanwhile, the Colombo Consumer Price Index -CCPI (Base; 2021=100) or inflation for the month of March decreased marginally to 50.3% on its point to point as against 5.06% recorded in February.

The foreign holding in rupee bonds increased further by Rs. 2.74 for the week ending 30 March while the daily secondary market Treasury bond/bill transacted volumes for the first four trading days of the week averaged Rs. 18.16 billion. In money markets, the total outstanding liquidity deficit decreased marginally to Rs. 32.15 billion by the end of the week against its previous week’s deficit of Rs. 34.53 billion while CBSL’s holding of Gov. Security’s increased to Rs. 2,675.23 billion against its previous weeks of Rs. 2,658.21 billion.

In the Forex market, the USD/LKR rate on spot contacts was seen depreciating during the week to close the week at Rs. 328.00/329.00 against its previous weeks closing levels of Rs. 320.00/325.00 subsequent to fluctuating within a high of Rs. 327.00 and a low of Rs. 328.00 for the week. The daily USD/LKR average traded volume for the first four days of the week stood at $ 49.04 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)