Monday Feb 23, 2026

Monday Feb 23, 2026

Monday, 10 April 2023 02:31 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

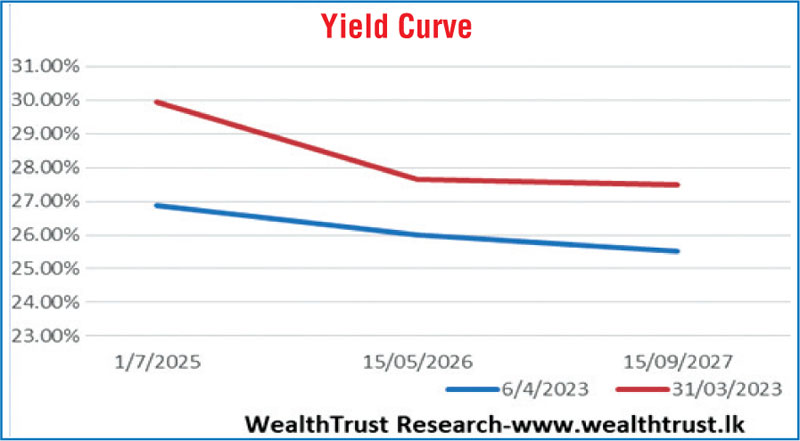

The secondary bond market rallied during the shortened trading week ending 6 April on the back of the positive sentiments prevailing in markets. Buying interest across the yield curve led to yields dipping significantly to six-month lows as traded volumes increased drastically among market participants.

The secondary bond market rallied during the shortened trading week ending 6 April on the back of the positive sentiments prevailing in markets. Buying interest across the yield curve led to yields dipping significantly to six-month lows as traded volumes increased drastically among market participants.

Activity centered on the liquid maturities of two 2025’s (i.e., 01.06.25 & 01.07.25), 15.05.26 and two 2027’s (i.e., 01.05.27 & 15.09.27) as its yields dipped to lows of 26.15% each, 25.10%, 25.00% and 24.90% respectively against its previous weeks closing levels of 29.80/10 each, 27.50/80 and 27.40/60, leading to a steep parallel shift down of the yield curve. In addition, the 01.07.32 maturity was seen changing hands from a weekly high of 22.23% to a low of 21.60% as well. However, profit taking late on Thursday saw yields close marginally higher than its weekly lows.

The outcome of the weekly Treasury bill auction complimented the downward movement in bond yields as its weighted averages plunged to 40-week lows of 24.12%, 24.10% and 22.37% on the 91-day, 182 day and 364-day maturities respectively. A total amount of Rs. 128.37 billion was raised from its two phases of the auctions against a total offered amount of Rs. 110 billion.

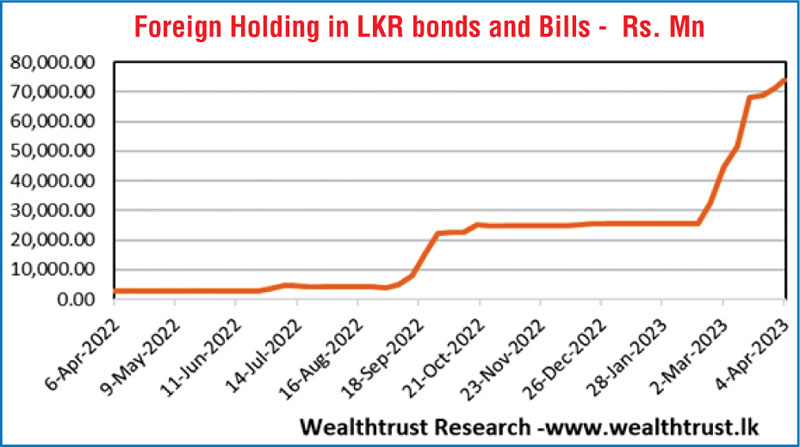

An inflow of Rs. 2.35 billion into rupee securities was witnessed by foreign investors for the week ending 4 April 2023, recording its fifth consecutive week of inflows, accumulating Rs. 29.44 billion.

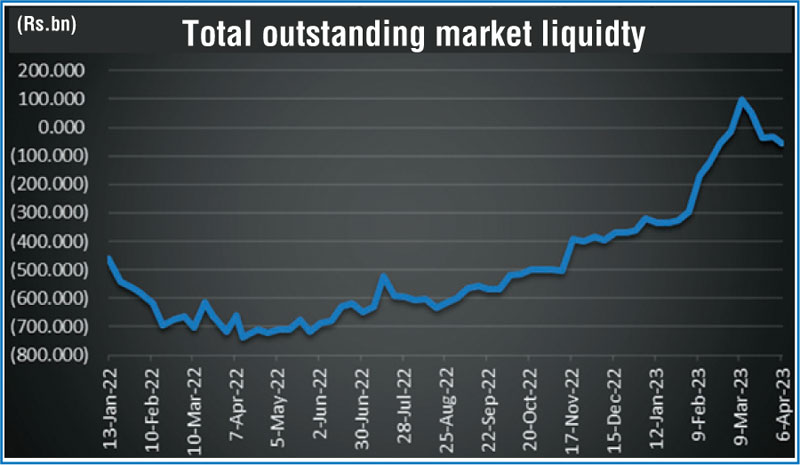

In money markets, the total outstanding liquidity deficit stood at Rs. 53.89 billion by the end of the week against its previous week’s deficit of Rs. 32.65 billion while CBSL’s holding of Gov. Security’s increased marginally to Rs. 2,688.71 billion against its previous weeks of Rs. 2,675.23 billion.

The USD/LKR rate in the interbank forex market appreciated to Rs. 320.00/321.00 on its spot contracts during the week against its previous weeks closing of Rs. 328.00/329.00.

The daily USD/LKR average traded volume for the first two days of the week stood at $ 93.38 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)