Sunday Feb 22, 2026

Sunday Feb 22, 2026

Monday, 23 September 2024 03:51 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

In a shortened trading week ending 20 September 2024, at where Treasury bill rates were seen increasing sharply, the activity in the secondary bond market slowed down as the week progressed, with most market participants seen on the sidelines ahead of the presidential election.

In a shortened trading week ending 20 September 2024, at where Treasury bill rates were seen increasing sharply, the activity in the secondary bond market slowed down as the week progressed, with most market participants seen on the sidelines ahead of the presidential election.

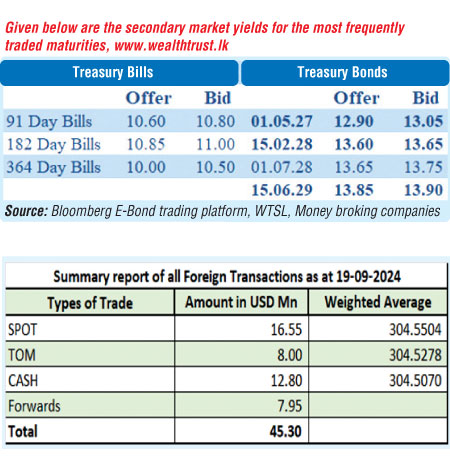

At the weekly Treasury bill auction, weighted average rates increased by 50 and 52 basis points on the 91-day and 182-day maturities respectively to 10.49% and 10.76% while the 364-day average remained steady at 10.07%. All three weighted averages were recorded above the 10.00% psychological level for first time since April 2024.

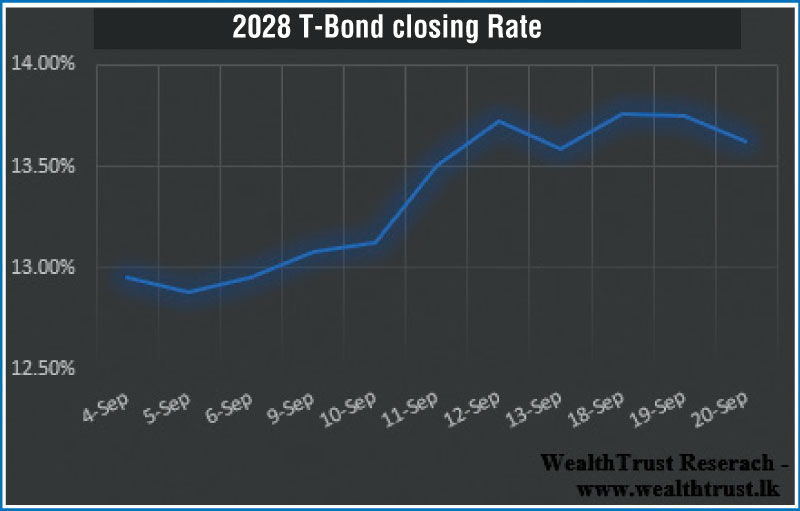

The limited activity in the secondary bond market was witnessed on the liquid maturities of 2027’s (01.05.27 & 15.09.27), 15.02.28 and 15.06.29 within the levels of 13.00% to 13.10%, 13.60% to 13.80% and 13.85% to 13.90% respectively against its previous weeks closing levels of 12.95/05, 13.57/60 and 13.70/80. This was following the announcement that Sri Lanka has reached an agreement in principle on the restructuring of approximately $ 17.5 billion of sovereign debt with external commercial creditors.

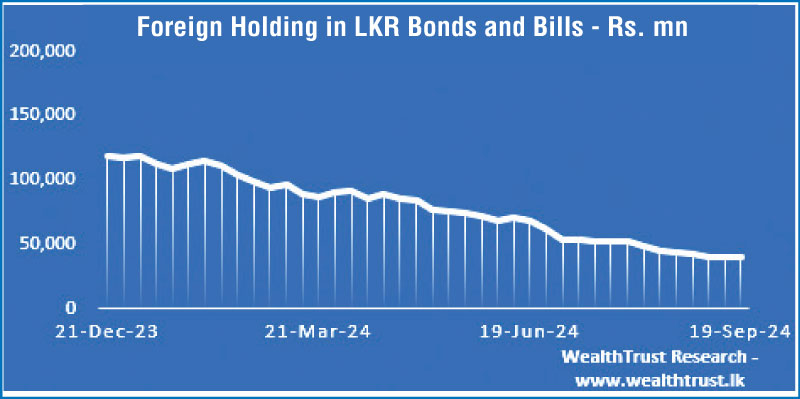

The foreign holding in rupee bonds remained mostly unchanged at Rs. 39.39 billion for the week ending 19 September while the daily secondary market Treasury bond/bill transacted volumes for the first two days of the week averaged at Rs. 43.01 billion.

In money markets, total outstanding liquidity was seen turning negative during the week to a shortfall of Rs. 23.84 billion by the end of the week against its previous week’s surplus of Rs. 38.58 billion.

The Domestic Operations Department (DOD) of Central Bank continued to inject liquidity during the week by way of overnight to 7-day Reverse Repo auctions at weighted average yields ranging from 8.56% to 8.96% while the weighted average rates on overnight call money and repo was at 8.62% and 8.86% respectively for the week.

The CBSL’s holding of Gov. Security’s was registered at Rs.2,515.62 billion against its previous weeks of Rs. 2,523.92 billion.

Forex Market

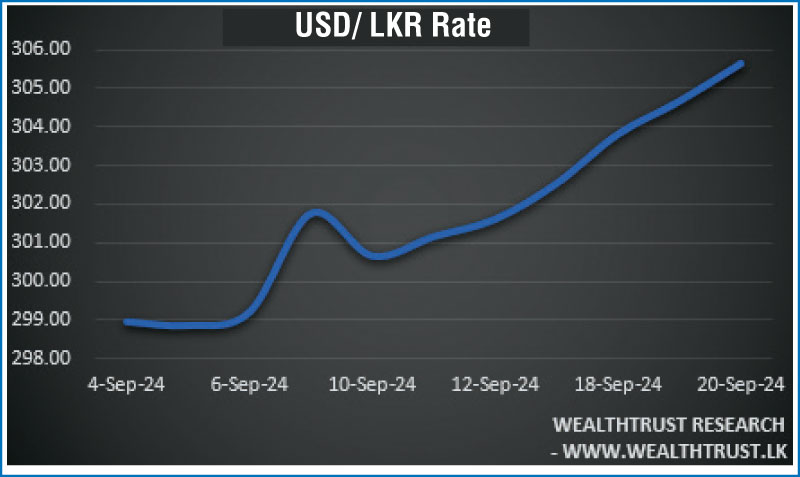

In the Forex market, the USD/LKR rate on spot contacts was seen depreciating during the week to close the week at Rs. 305.25/306.00 against its previous weeks closing levels of Rs. 302.25/302.80 subsequent to trading within a high of Rs. 303.65 to a low of Rs. 305.20 for the week.

The daily USD/LKR average traded volume for the first two trading days of the week stood at $ 48.45 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)