Thursday Feb 12, 2026

Thursday Feb 12, 2026

Monday, 11 January 2021 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

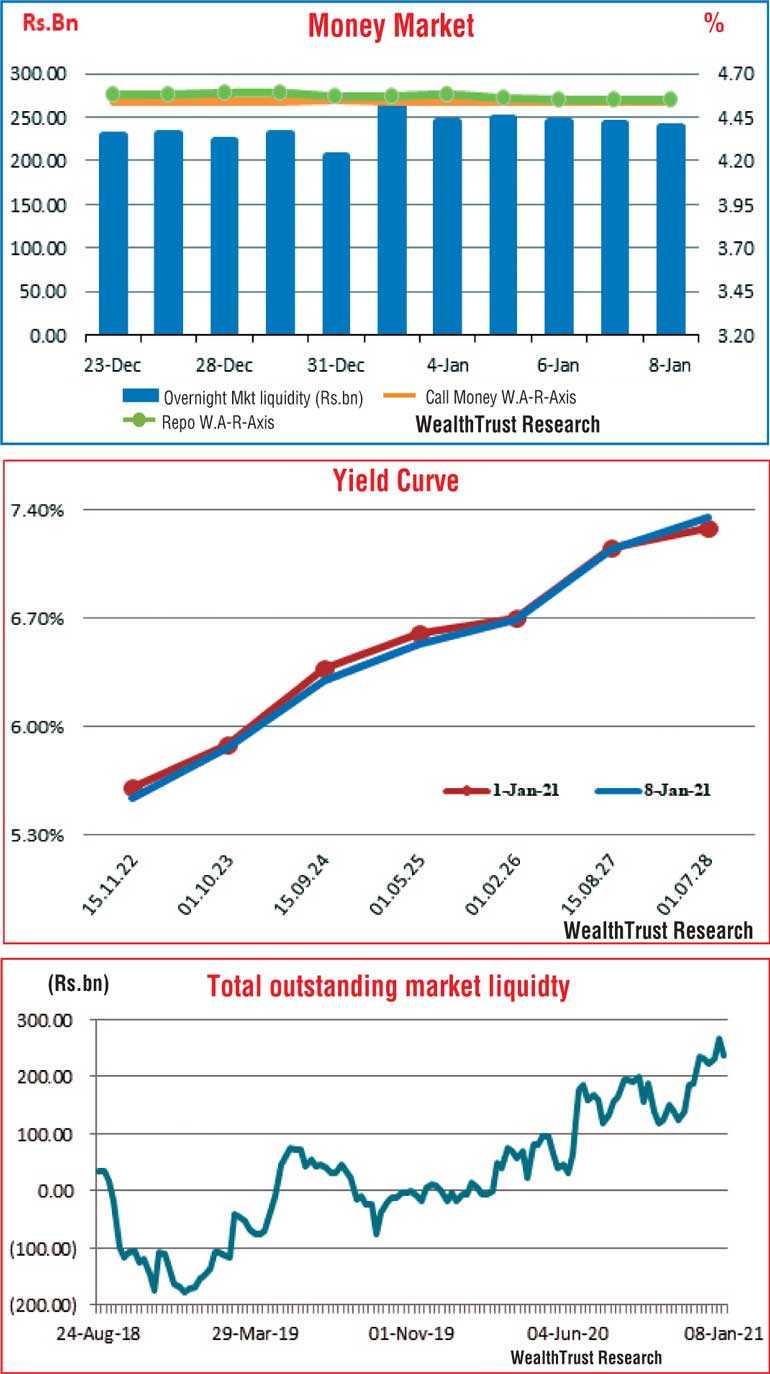

The secondary bond market gained a bullish momentum during the week ending 8 January as yields were seen decreasing further with sizeable volumes changing hands and activity increasing.

The secondary bond market gained a bullish momentum during the week ending 8 January as yields were seen decreasing further with sizeable volumes changing hands and activity increasing.

The yields of the more liquid maturities of 2022’s (i.e. 15.11.22 and 15.12.22), 2023’s (i.e. 15.01.23 and 01.10.23), 15.09.24, 01.05.25, 01.02.26 and 15.08.27 were seen decreasing to weekly lows of 5.52%, 5.53% each, 5.86%, 6.30%, 6.53%, 6.69% and 7.15%, respectively, against its previous weeks closing level of 5.58/63, 5.60/65, 5.65/70, 5.90/95, 6.35/40, 6.50/70, 6.65/75 and 7.10/20. In addition maturities of 01.10.22, 15.12.24 and 15.12.23 changed hands at levels of 5.50% to 5.60%, 6.38% to 6.39% and 5.90% to 6.03% as well.

This downward trend was well supported by the outcome of the weekly T-Bills action where the total offered amount was fully subscribed for the first time in 11 weeks. On the short-dated bonds and bills, 01.05.21, 01.08.21, 15.12.21, February, April, June, July, August, September and October 2021 changed hands at levels 4.70%, 4.69%, 4.75% to 4.80%, 5.00%, 4.53% to 4.68%, 4.74%, 4.75%, 4.80%, 4.75% and 4.89%, respectively.

The first Treasury bond auctions for the year 2021 due today will have in total an amount of Rs. 100 billion on offer, consisting of Rs. 40 billion each of a 01.12.2024 maturity and a new 15.01.2026 maturity and a further Rs. 20 billion of a 01.05.2028 maturity. Stipulated cut off rates were published as 6.39%, 6.73% and 7.44%, respectively. The weighted average yields at the bond auctions conducted on 11th December 2020 for the maturities of 01.10.2023, 01.03.2026 and 01.01.2032 were recorded at 5.99%, 6.79% and 7.84%, respectively.

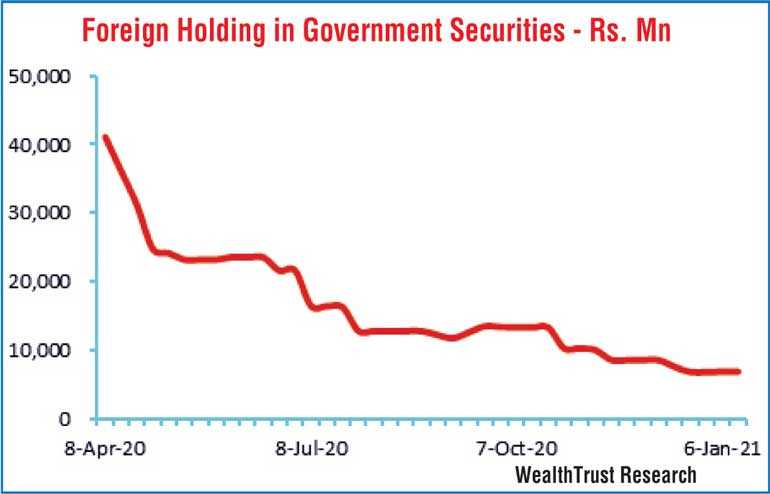

Foreign holding in Rupee bonds remained mostly unchanged recording a meagre outflow of Rs. 0.75 million for the week ending 6 January.

The daily secondary market Treasury bond/bill transacted volumes for the first four trading days of the week averaged Rs. 11.18 billion.

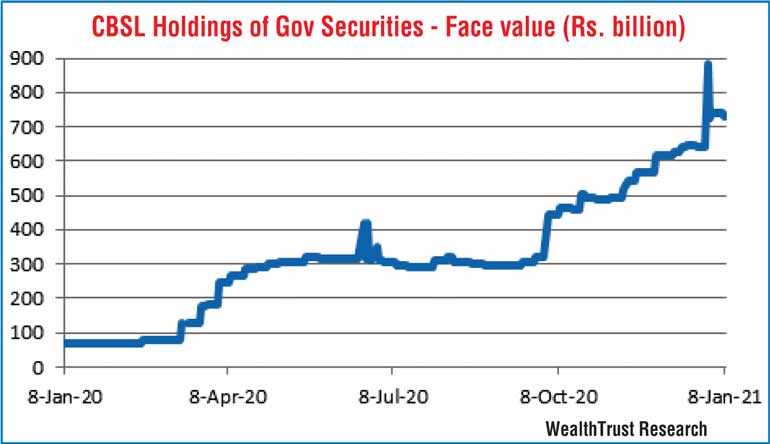

In the money market, weighted average rates on overnight call money and repos remained mostly unchanged to average 4.54% and 4.56%, respectively, for the week as the total outstanding market liquidity stood at a surplus of Rs. 238.35 billion. The CBSL’s holding of government securities was registered at Rs. 731.25 billion.

Rupee closes stronger

In the Forex market, USD/LKR closing rates on the more active one month forward contracts were seen depreciating during the early part of the week to 191.50/192.50 against its previous weeks closing level of Rs. 188.50/189.50 before bouncing back to close the week at Rs. 190.50/192.00 on spot next contacts. The more demanded spot contracts traded at levels of Rs. 188.25 to Rs. 189.00 during the week.

The daily USD/LKR average traded volume for the first four days of the week stood at $ 61.90 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, money broking companies)