Friday Feb 20, 2026

Friday Feb 20, 2026

Monday, 14 September 2020 01:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

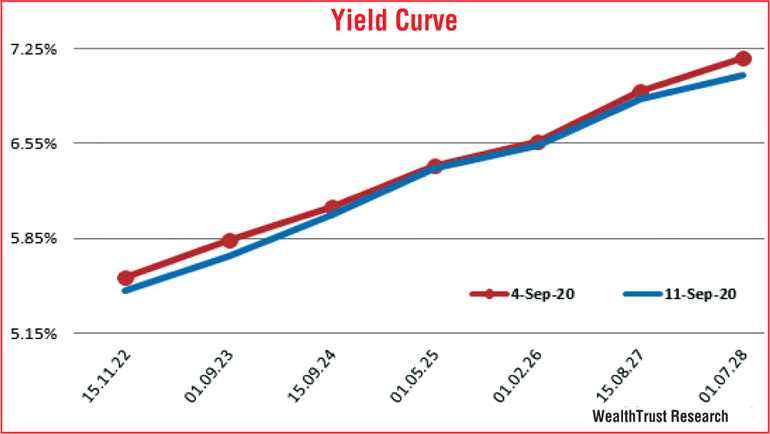

The bond market opened the week ending 11 September 2020 on a bearish note but gathered momentum during the week to reverse to a bullish sentiment on the back of renewed buying interest leading to the bond auctions on Friday as yields dipped across the yield curve.

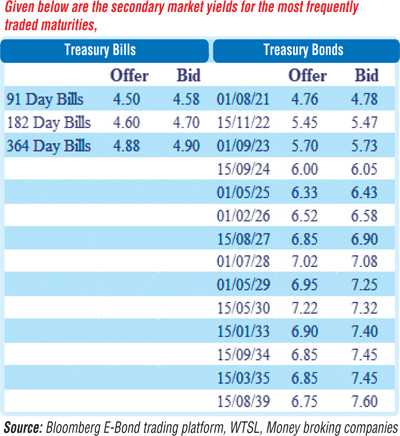

The downward trend was well supported by the weekly Treasury bill auction where the total offered amount of Rs. 40 billion was fully subscribed as the weighted average on the 364 day bill dipped by 01 basis point to 4.88%.

The primary Treasury bond auctions conducted on Friday recorded steady outcomes as the 01.10.2023, 01.02.2026 and 01.07.2028 maturities recorded weighted average rates of 5.72%, 6.57% and 7.07% respectively, marginally below its stipulated cut off rates of 5.75%, 6.60% and 7.08%.

However, the 2nd Phase of the auction was opened on the maturity of 01.07.2028 at its weighted average rate due to its offered amount of Rs. 30 billion not been fully subscribed to at its 1st Phase of the auction. The total offered amounts of Rs. 30 billion and Rs. 40 billion on the 01.10.2023 and 01.02.2026 maturities were fully accepted at its 1st phase of the auctions while the 01.07.2028 fell short by Rs. 3.435 billion. In the secondary bond market, buying interest mid-week onwards across the yield curve saw yields on the maturities of 2022’s (i.e. 15.11.22 and 15.12.22), 2023’s (i.e. 15.01.23, 15.07.23 and 01.09.23), 2024’s (i.e.15.06.24 and 15.09.24), 01.05.25, 01.02.26, 15.08.27 and 15.05.30 hit weekly lows of 5.45%, 5.47%, 5.49%, 5.68%, 5.70%, 6.02%, 6.01%, 6.34%, 6.50%, 6.79% and 7.25% respectively against its previous weeks closing levels of 5.53/58, 5.55/58, 5.57.60, 5.75/85, 5.80/88, 6.05/10 each, 6.33/40, 6.50/58, 6.93/95 and 7.25/35. This intern led to a marginal downward shift of the overall yield curve.

Meanwhile, foreign holdings in rupee bonds recorded an increase for the first time in three weeks by Rs. 870 million for the week ending 9 September 2020.

The daily secondary market Treasury bond/bill transacted volumes for the first four traded days of the week averaged Rs. 10.99 billion.

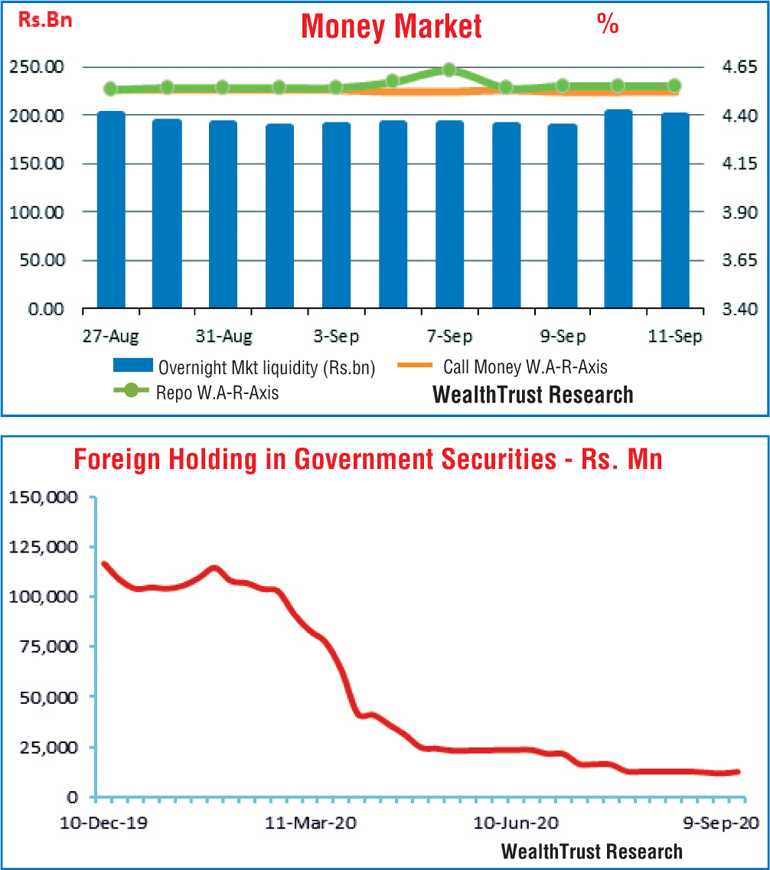

Money market liquidity remains high

In the money market, the overnight surplus liquidity in the system increased to average Rs. 194.12 billion for the week as the weighted average rates on overnight call money and repo’s remained mostly unchanged to average at 4.52% and 4.56% respectively for the week.

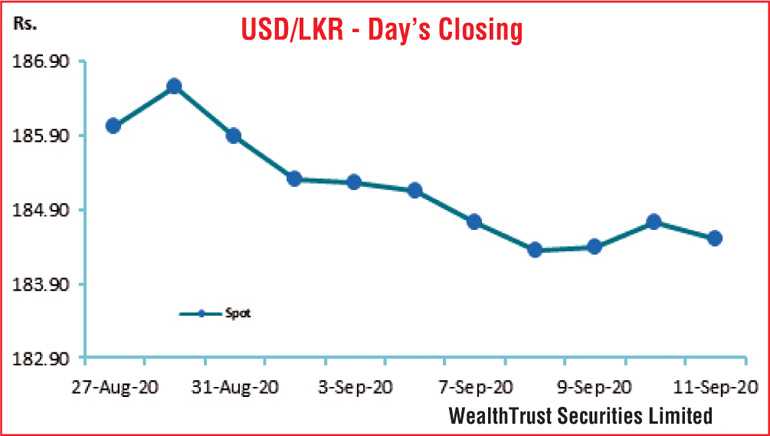

Rupee fluctuates during the week

In the Forex market, the Rupee on its spot contacts was seen trading within a high of Rs. 184.23 to a low of Rs. 185.95 during the week before closing the week at Rs. 184.45/55 against its previous weeks closing levels of Rs. 185.10/20.

The daily USD/LKR average traded volume for the first four days of the week stood at $ 86.84 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)