Thursday Feb 19, 2026

Thursday Feb 19, 2026

Tuesday, 24 October 2023 00:05 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

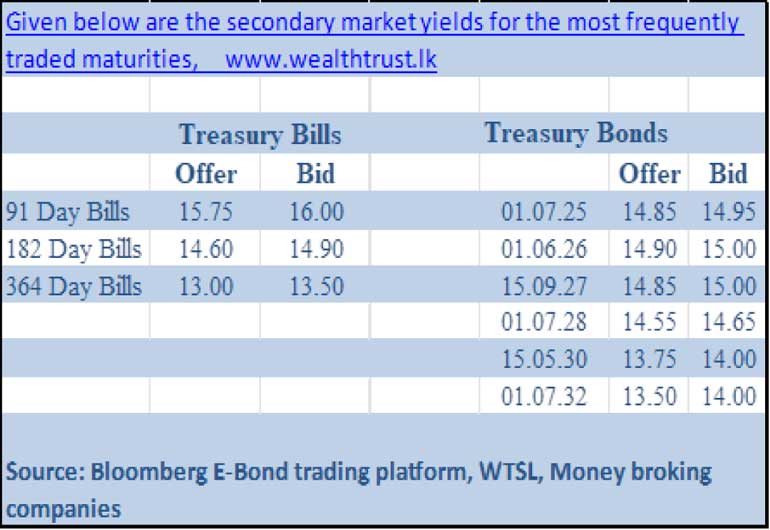

The secondary bond market started off the week with activity moderating compared to the previous week. Limited trading was seen centered on the liquid maturities of the two 2026s (i.e., 01.06.26 and 15.05.26) at 14.95% and 01.07.28 at 14.68%.

Whereas, in secondary market bills, significant volumes moved on the November and December 2023 maturities, which were seen trading within the range of 15.50% and 15.75% to 16.25% respectively. While January, February, March and April/May 2024 maturities changed hands at 15.85% to 16.00%, 15.50% and 14.70% to 14.90% respectively.

Meanwhile, the National Consumer Price Index -NCPI (Base: 2021=100) or National inflation for the month of September decreased sharply to 0.8% on its point to point as against 2.10% recorded in August and a peak of 53.6% in February 2023.

This is so far the lowest level witnessed in the NCPI since the index was rebased, at the start of the year 2023, as such inflation metrics continue to show fast easing inflation on a steady disinflation path. The total secondary market Treasury bond/bill transacted volume for 20 October 2023 was Rs.12.60 billion.

In money markets, the weighted average rates on overnight call money and Repo stood at 10.29% and 10.57% respectively while the net liquidity deficit stood at Rs.67.29 billion yesterday.

The DOD (Domestic Operations Department) of Central Bank injected liquidity by way of an overnight auction for LKR 44.12 billion at a weighted average rate of 10.14%. An amount of Rs.26.52 billion was withdrawn from Central Bank’s SLFR (Standard Lending Facility Rate) of 11.00% while an amount of Rs. 3.35 billion was deposited at Central Bank’s SDFR (Standard Deposit Facility Rate) of 10.00%.

Forex Market

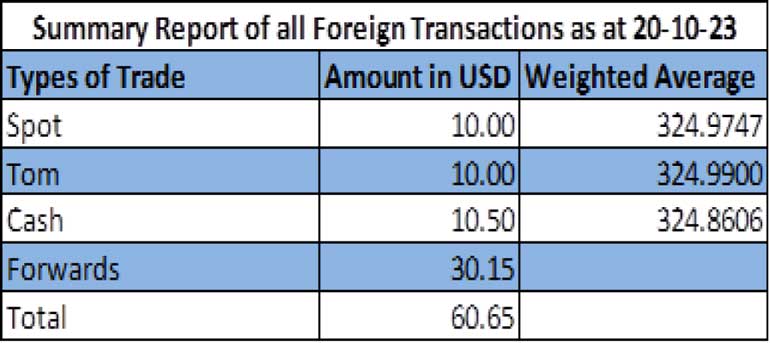

In the Forex market, the USD/LKR rate on spot next contracts closed the day at Rs.326.50/ 327.00, down further against its previous week’s closing level of Rs.325.75/326.25.

The total USD/LKR traded volume for 20 October was US$ 60.65 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)