Saturday Feb 21, 2026

Saturday Feb 21, 2026

Tuesday, 5 March 2024 00:56 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

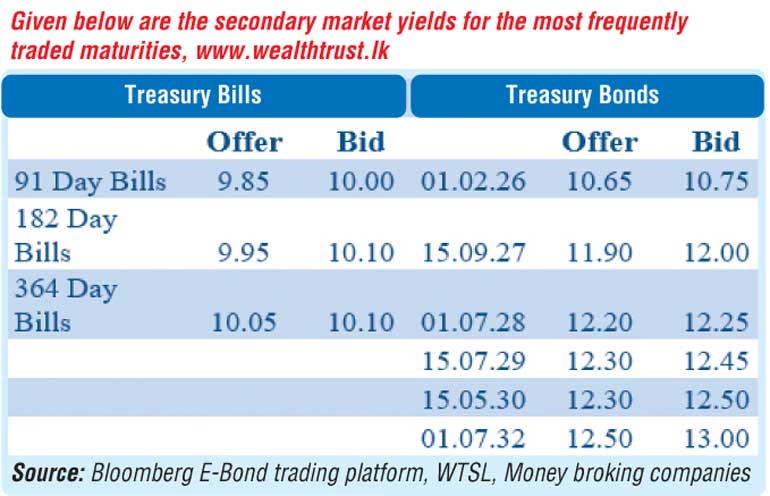

The secondary bond market commenced the week on a somewhat subdued note with sporadic activity and yields holding broadly steady. Trading was predominantly on the short end of the yield curve. Accordingly, trades were seen on the maturities of 01.08.26, 2028 tenors (15.03.28, 01.07.28, 01.09.28 and 15.12.28) and 15.07.29 within the narrow ranges of 10.95% to 10.90%, 12.24% to 12.20% and 12.40% to 12.35% respectively on the back of moderate volumes.

Meanwhile in secondary market bill transactions, May/June 2024 maturities (close to 3 months) and July/August 2024 (approximately 6 months) maturities were seen changing hands at 9.80% to 9.75% and 10.00% respectively with moderate volumes transacted once again.

The total secondary market Treasury bond/bill transacted volume for 1 March was Rs. 20.28 billion.

In money markets, the weighted average rates on overnight call money and Repo stood at 9.20% and 9.28% respectively. The DOD (Domestic Operations Department) of Central Bank injected liquidity by way of an overnight and 7-day term reverse repo auction for Rs. 33.50 billion and Rs. 60.00 billion at the weighted average rates of 9.11% and 9.51% respectively.

The net liquidity deficit stood at Rs. 71.66 billion yesterday as an amount of Rs. 21.84 billion was deposited at Central Banks SDFR (Standard Deposit Facility Rate) of 9.00%.

Forex Market

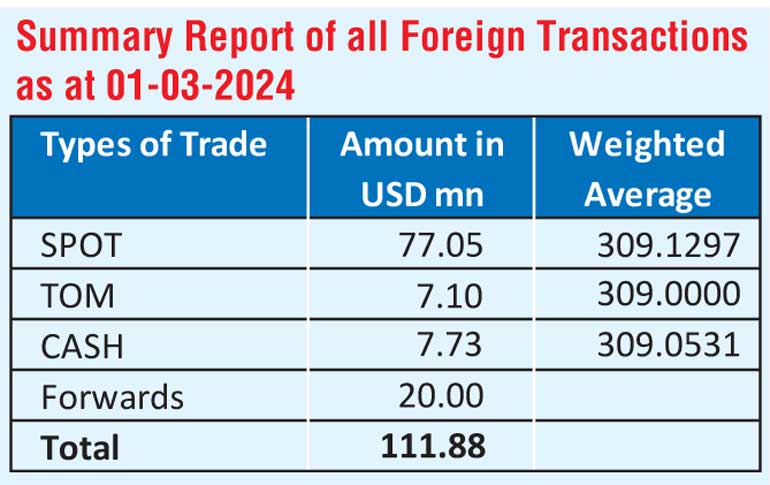

In the Forex market, the USD/LKR rate on spot contracts closed the day gaining marginally to Rs. 308.05/308.15 against its previous day’s closing level of Rs. 308.80/308.90.

The total USD/LKR traded volume for 1 March 2024 was $ 111.88 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)