Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Monday, 23 October 2023 00:20 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary bond market saw yields coming off during the trading week ending 20 October, on the back of spurts of aggressive buying interest.

The secondary bond market saw yields coming off during the trading week ending 20 October, on the back of spurts of aggressive buying interest.

Activity continuing to be robust all throughout the week, with some considerable foreign participation as well.

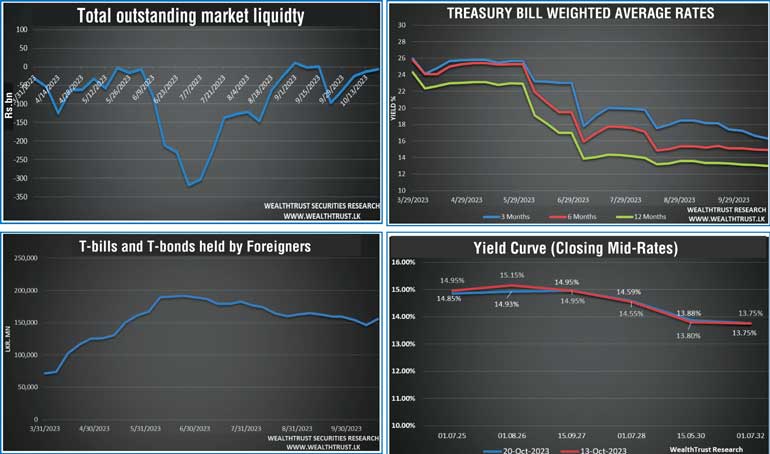

Trading continued to centre largely on the liquid maturities of the two 2026’s (i.e., 01.06.26 and 01.08.26) which saw its yields drop from weekly highs of 15.16% down to intraweek lows of 14.85%. Similarly, the liquid 01.05.24 and 2025 tenors (i.e., 01.06.25 and 01.07.25) also saw yields drop from 15.60% to 15.25% and 15.00% to 14.80% respectively. As such yields on the very shorter tenors were seen dropping while the medium to longer tenors remained broadly steady, resulting in a further flattening of the yield curve. Accordingly, the 01.07.28 maturity was seen trading in the range of 14.65% to 14.50% levels, very close to the levels seen the week prior.

The response for last week’s Treasury bill auction continued to be bullish. The weighted average rates dropped across the board for a fourth consecutive week. The 91-day bill in particular, continued to see the most demand, which led to its weighted average yield declining by 34 basis points to 16.30%. Similarly, the 182-day and 364-day bills also declined by 02 and 08 basis points respectively, to record weighted averages of 14.94% and 13.02%. A total of Rs. 56.65 billion was raised at the 1st phase of the auction against a total offered amount of Rs. 65 billion, while an additional Rs. 24.60 billion was raised at the 2nd phase across all three maturities at the respective weighted averages determined at the 1st phase.

This was against the backdrop of the anticipation and the announcement of the staff level agreement between the government of Sri Lanka and the International Monetary Fund with regards to the second disbursement of the Extended Funding Facility Program.

The foreign holding in Rupee bonds and bills recorded a large net inflow of Rs. 9.70 billion for the week ending 19 October, reversing a five-week streak of consecutive net outflows that totalled Rs. 10.46 billion prior.

The daily secondary market Treasury bond/bill transacted volumes for the first four days of the week averaged at Rs. 22.59 billion.

In money markets, the total outstanding liquidity deficit improved to Rs. 6.72 billion by the end of the week against its previous week’s of Rs. 12.23 billion. The Domestic Operations Department (DOD) of Central Bank continued to inject liquidity during the week by way of overnight to 30-day Reverse repo auctions at weighted average yields ranging from 10.08% to 13.29%.

The Central Bank of Sri Lanka’s (CBSL) holding of Government Securities was registered at Rs. 2,839.35 billion, unchanged against its previous week’s level.

In the forex market, the USD/LKR rate on spot contracts was seen depreciating considerably during the week to close the week at Rs. 325.50/326.00 against its previous week’s closing level of Rs. 323.80/323.90, subsequent to trading at a low of Rs. 325.95 and a high of Rs. 323.85.

The daily USD/LKR average traded volume for the first four trading days of the week stood at $ 62.91 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)