Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Monday, 12 December 2022 00:11 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

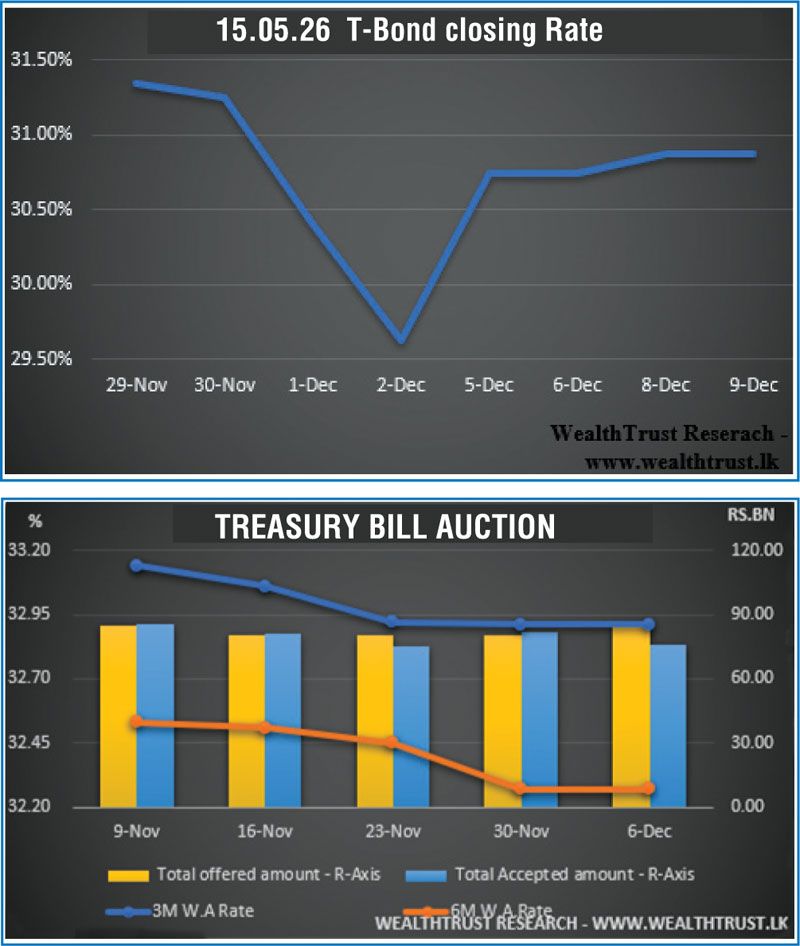

The activity levels in the secondary bond market moderated considerably while yields increased during the shortened trading week ending 9 December, reversing the bullish rally witnessed over the previous week. The outcome of the weekly Treasury bill auction along with news surrounding the impending IMF program were seen as the reasons behind the change in momentum.

The activity levels in the secondary bond market moderated considerably while yields increased during the shortened trading week ending 9 December, reversing the bullish rally witnessed over the previous week. The outcome of the weekly Treasury bill auction along with news surrounding the impending IMF program were seen as the reasons behind the change in momentum.

At the weekly Treasury bill auction, the total accepted amount fell short of the total offered amount, as only Rs. 76.04 billion was accepted in total against a total offered amount of Rs. 85 billion. The weighted average rates on the 91-day and 182-day maturities remained steady at 32.91% and 32.97% respectively, subsequent to three consecutive weeks of decreases while the weighted average rate on the 364-day bill decreased to 29.33%.

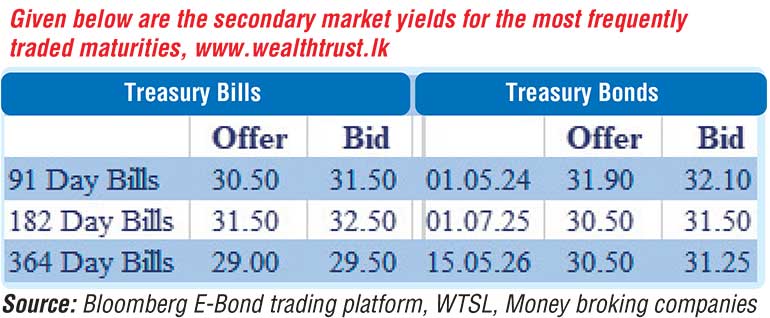

In the secondary bond market, yields on the liquid maturities of 01.05.24 and 15.06.25 increased to weekly highs of 32.10% and 30.50% respectively against its previous week’s closing levels of 31.00/31.25 and 29.50/75 while two-way quotes on the rest of the yield curve increased and widened as well.

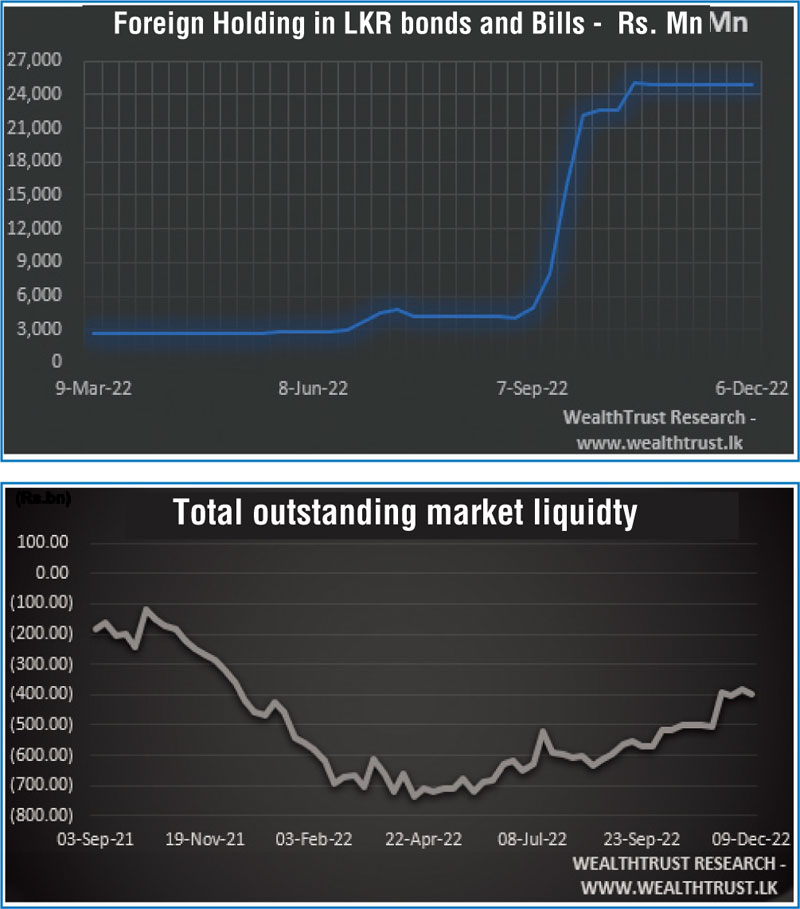

The foreign holding in Rupee bonds decreased to Rs. 24.89 billion, recording an outflow of Rs. 13.55 million for the week ending 6 December while the daily secondary market Treasury bond/bill transacted volumes for the first three trading days of the week averaged Rs. 22.78 billion.

In money markets, the total outstanding liquidity deficit was registered at Rs. 397.50 billion by the end of the week against its previous week’s of Rs. 384.81 billion while CBSL’s holding of Government Securities stood at Rs. 2,538.78 billion against its previous week’s of Rs. 2,543.05 billion.

USD/LKR

In the forex market, the middle rate for USD/LKR spot contracts was registered at Rs. 363.18 by end of week against its previous week’s closing of Rs. 363.19.

The daily USD/LKR average traded volume for the first three trading days of the week stood at $ 55.85 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)