Thursday Feb 19, 2026

Thursday Feb 19, 2026

Monday, 1 July 2019 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

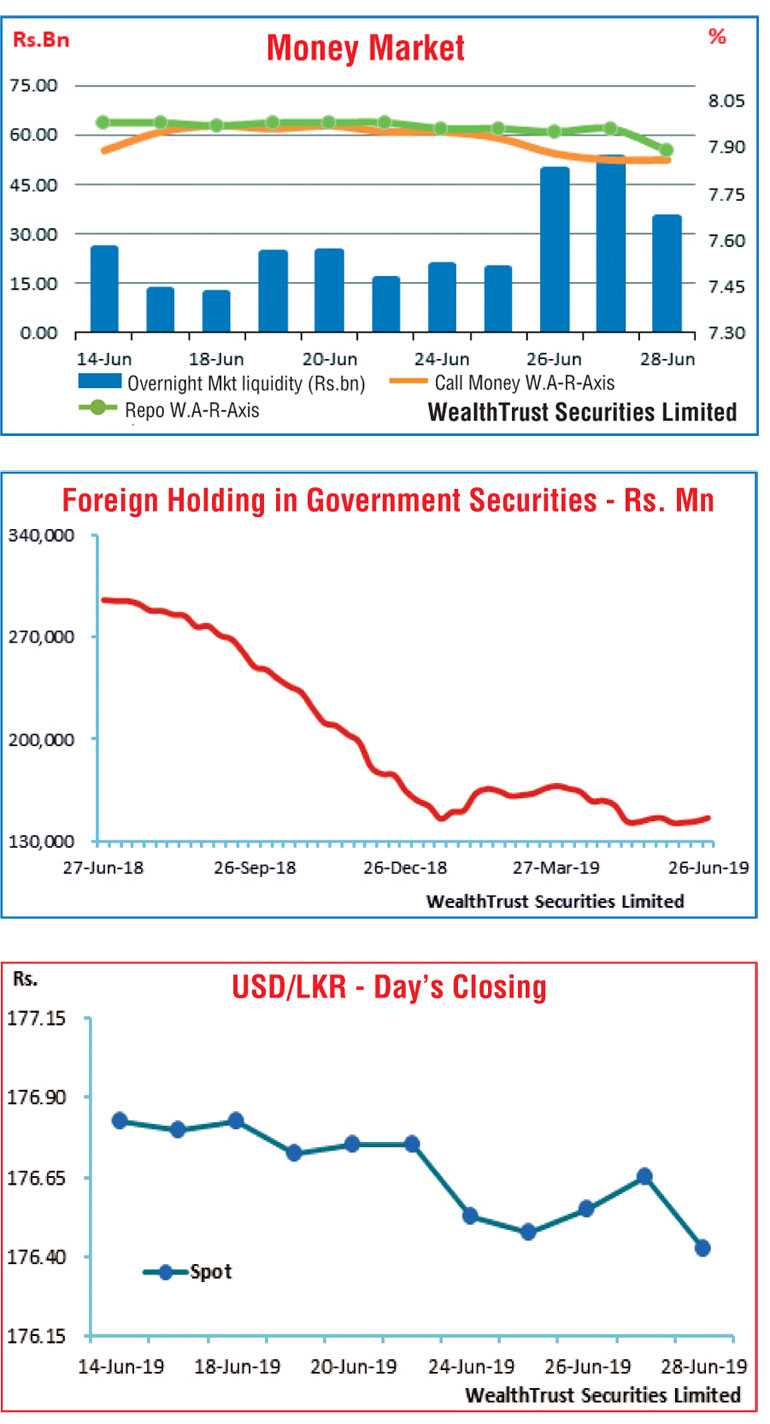

The bullish sentiment witnessed in the secondary bond market towards the later part of the week ending 21 June was seen continuing during the week ending 28 June as well, boosted by the $ 2 billion sovereign bond issue by the Government of Sri Lanka and the reduction of the applicable reference rate on rupee deposits for licensed banks to 8.83% from 10.54% for the quarter commencing July. The bullish outcome of the primary auctions conducted during the week contributed to the positive sentiment as well.

A majority of activity was witnessed on the short to mid-term maturities of 2021’s (i.e. 01.03.21, 01.08.21, 15.10.21 and 15.12.21), 2023’s (i.e. 15.03.23, 15.05.23, 15.07.23 & 15.12.23) and 15.03.24 closely followed by the 15.01.27 and 01.05.29 maturities as it yields were seen dipping to weekly lows of 9.00%, 9.20% each, 9.70% each, 9.75%, 9.85%, 10.16% and 10.35% respectively against its previous weeks closing levels of 9.30/50, 9.35/50, 9.46/50, 9.55/65, 9.87/93, 9.90/00, 9.95/05, 10.00/05, 10.05/09, 10.35/43 and 10.50/60, reflecting a parallel shift downward of the overall yield curve for a second consecutive week.

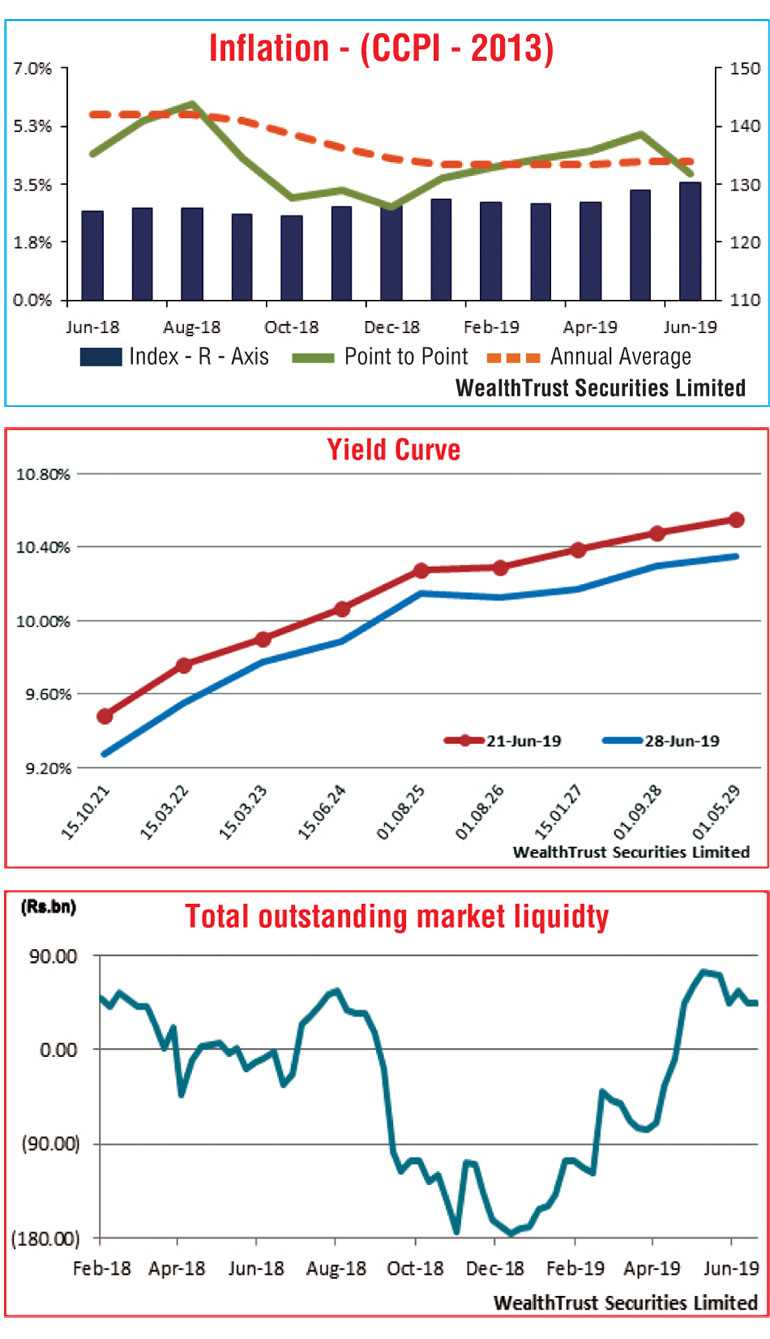

The foreign holding in rupee bonds was seen increasing for a third consecutive week to record an inflow of Rs. 2.26 billion while the Colombo Consumer Price Index (CCPI) was seen decreasing for the first time in six month to register 3.8% on its point to point for the month of June against 5.0% recorded in May. The annualised average remained steady at 4.2%.

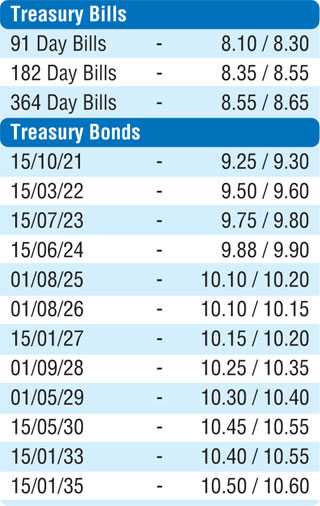

The daily secondary market Treasury bond/bills transacted volume for the first four days of the week averaged Rs. 27.01 billion. In money markets, the total money market liquidity increased to Rs. 44.73 billion as the overnight call money and repo rates averaged at 7.90% and 7.94% respectively for the week. The OMO Department of the Central Bank of Sri Lanka mopped up liquidity by way of overnight, five-day to seven-day term repo auctions at weighted averages ranging from 7.71% to 7.78%.

Rupee appreciates during the week

The USD/LKR rate on spot contracts appreciated during the week to close the week at Rs. 176.40/45 against its previous weeks closing of Rs. 176.70/80 on the back of selling interest by banks and export conversions. The daily USD/LKR average traded volume for the first four days of the week stood at $ 90.31 million. Some of the forward dollar rates that prevailed in the market were 1 month – 177.00/20; 3 months – 178.50/90 and 6 months – 180.50/00.