Sunday Apr 20, 2025

Sunday Apr 20, 2025

Friday, 28 October 2022 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

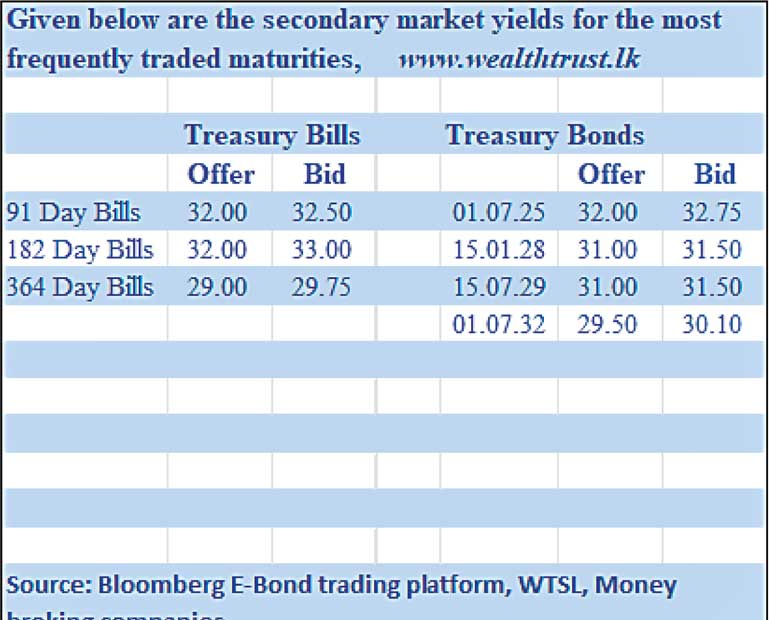

The secondary bond market remained dull ahead of today’s bond auction, with only marginal trades of the 15.01.28 and 15.07.29 maturities at around 31.10%. Today’s auction will have on offer a total volume of Rs. 30 billion, consisting of Rs. 12.5 billion of the 01.07.2025 maturity and Rs. 17.5 billion of the 15.01.2028 maturity.

The secondary bond market remained dull ahead of today’s bond auction, with only marginal trades of the 15.01.28 and 15.07.29 maturities at around 31.10%. Today’s auction will have on offer a total volume of Rs. 30 billion, consisting of Rs. 12.5 billion of the 01.07.2025 maturity and Rs. 17.5 billion of the 15.01.2028 maturity.

In the meantime, bills maturing in December 2022 and January-April 2023, changed hands within the range of 32.00% to 32.60%.

At the last bond auction conducted on 13 October 2022, the 15.07.29 maturity was issued at a weighted average rate of 30.85% with the total offered amount of Rs. 17.5 billion being accepted. Furthermore, an additional amount of Rs. 0.61 billion was also issued under the direct issuance window. However, only an amount of Rs. 6.79 billion of the other maturity 01.07.25 was accepted at a weighted average rate of 31.93%.

The total secondary market Treasury bond/bill transacted volume for 26 October 2022 was Rs. 48.23 billion.

In money markets, the Domestic Operations Department (DOD) of the Central Bank of Sri Lanka injected an amount of Rs. 80 billion by way of a 31-day Reverse Repo auction at a weighted average rate of 31.06%, valued today.

Furthermore, an amount of Rs. 681.81 billion was withdrawn from the Central Banks SLFR (Standard Lending Facility Rate) at 15.50% with the net liquidity deficit standing at Rs. 358.97 billion. The amount deposited with the Central Bank through its SDFR (Standard Deposit Facility Rate) amounted to Rs. 322.84 billion at a rate of 14.50%.

Forex Market

In the Forex market, the middle rate for USD/LKR spot contracts remained steady at Rs. 363.30 yesterday.

The total USD/LKR traded volume for 26 October was $ 56.00 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)