Friday Feb 20, 2026

Friday Feb 20, 2026

Friday, 5 July 2024 02:45 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary bond market yesterday continued on a positive trajectory, supported by the news that Sri Lanka has reached a debt restructuring agreement with International Sovereign Bondholders. The group holds a significant component of the nation’s external debt commitment. The terms help pave the way to achieving debt sustainability and restoring confidence in the international community such as continued IMF support, credit ratings and foreign capital market access.

The secondary bond market yesterday continued on a positive trajectory, supported by the news that Sri Lanka has reached a debt restructuring agreement with International Sovereign Bondholders. The group holds a significant component of the nation’s external debt commitment. The terms help pave the way to achieving debt sustainability and restoring confidence in the international community such as continued IMF support, credit ratings and foreign capital market access.

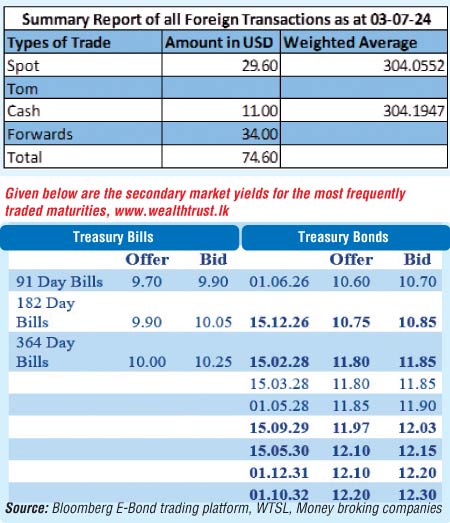

Accordingly, the secondary bond market yesterday saw yields edge down, propelled by renewed buying interest on active trade and sizeable volumes transacted. The popular liquid 2028 tenor 15.02.28 maturity dropped to a low of 11.82% as against opening highs of 11.85% while 15.03.28 and 01.05.28 maturities dropped to a low 11.85% each. Similarly, the 15.09.29 and two 2030’s (i.e. 15.05.30 and 15.10.30) maturities were seen trading at 12.00% and 12.15% respectively. Additionally, the 01.10.32 was seen changing hands at the rate of 12.25%.

The total secondary market Treasury bond/bill transacted volume for 7 July was Rs. 65.39 billion.

In money markets, the weighted average rates on overnight call money and Repo stood at 8.76% and 9.17% respectively as the DOD (Domestic Operations Department) of Central Bank injected liquidity by way of an overnight reverse repo auction for Rs. 13.69 billion at a weighted average rate of 8.62%.

The net liquidity surplus stood at Rs. 120.76 billion yesterday as an amount of Rs. 4.16 billion was withdrawn from Central Banks SLFR (Standard Lending Facility Rate) of 9.50% against an amount of Rs. 138.61 billion being deposited at Central Banks SDFR (Standard Deposit Facility Rate) of 8.50%.

Forex Market

In the Forex market, the USD/LKR rate on spot contracts closed the day depreciating further slightly to Rs. 304.60/304.80 as against its previous day’s closing level of Rs. 304.20/304.50.

The total USD/LKR traded volume for 3 July was $ 74.60 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)