Saturday Feb 21, 2026

Saturday Feb 21, 2026

Tuesday, 27 December 2022 00:00 - - {{hitsCtrl.values.hits}}

By WealthTrust Securities

The dull sentiment witnessed in the secondary bond market during the previous week continued during the week ending 23 December as well, with yields increasing on the back of moderate volumes on the backdrop of a holiday mood.

The dull sentiment witnessed in the secondary bond market during the previous week continued during the week ending 23 December as well, with yields increasing on the back of moderate volumes on the backdrop of a holiday mood.

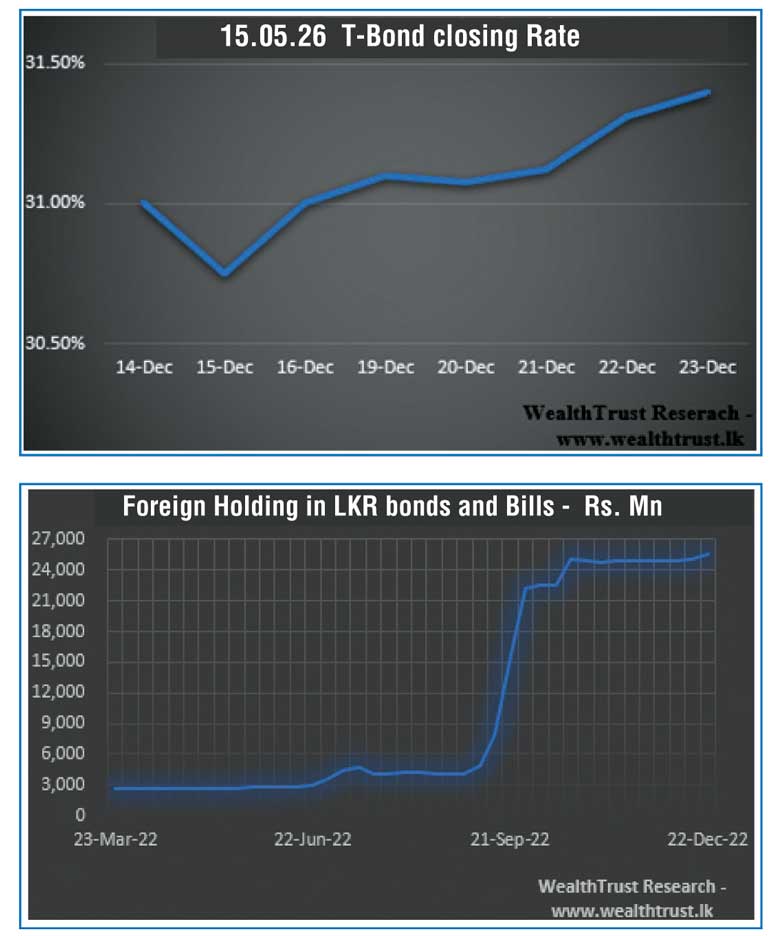

The limited activity was witnessed on the market favourite 15.05.26 maturity as its yield increased to an intraweek high of 31.45% against its previous week’s closing level of 30.90/10. In addition, maturities of 01.05.24, 15.01.28, 15.07.29, 15.05.31 and 01.07.32 changed hands at levels of 32.00% to 32.15%, 28.50% to 28.60%, 28.00% to 28.25%, 26.40% to 26.90% and 26.00% to 26.40% respectively as well.

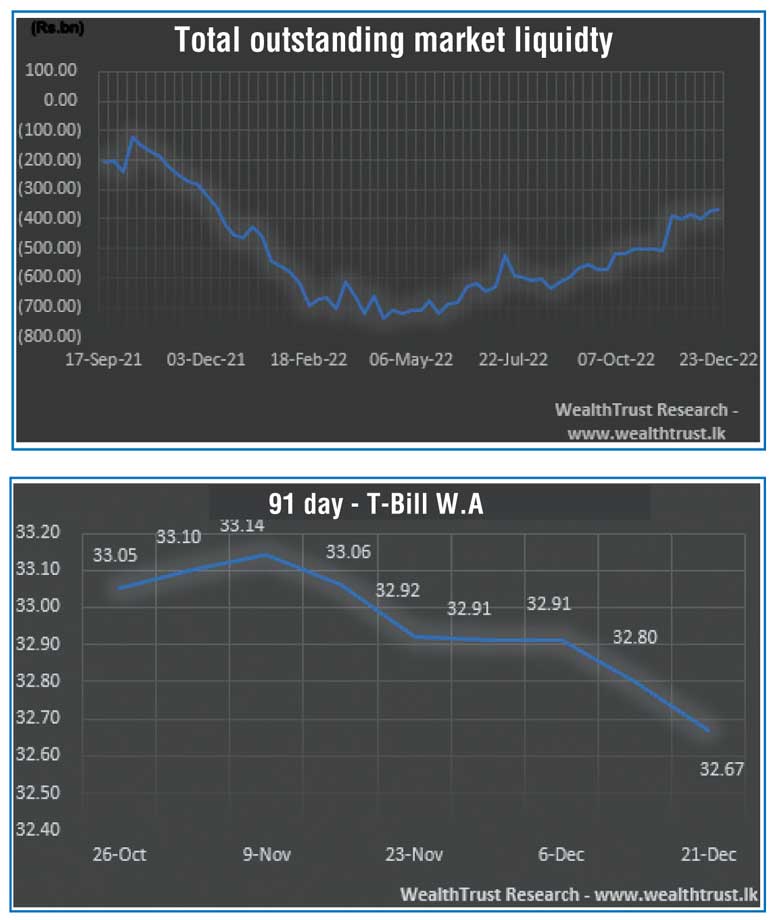

Nevertheless, the weekly Treasury bill auction was fully subscribed for a second consecutive week while weighted average rates on all three maturities were decreasing for a second consecutive week as well. Furthermore, the National Consumer Price Index (CCPI; Base 2013=100) for the month of November was seen decreasing for a second consecutive month to 65.0% against its previous month of 70.6% while its annualised average stood at 46.7% against 42.2%.

The foreign holding in rupee bonds increased further with an inflow of Rs. 456.02 million for the week ending 21 December while the daily secondary market Treasury bond/bill transacted volumes for the first four trading days of the week averaged Rs. 17.07 billion.

In money markets, the weighted average rates on overnight call money and repo stood at 15.50% each for the week while the total outstanding liquidity deficit was registered at Rs. 369 billion by the end of the week against its previous week’s of Rs. 370.84 billion. The CBSL’s holding of Government Securities stood at Rs. 2,589.44 billion against its previous week’s of Rs. 2,602.86 billion.

USD/LKR

In the forex market, the middle rate for USD/LKR spot contracts was registered at Rs. 363.1733 by end of week against its previous week’s closing of Rs. 363.18.

The daily USD/LKR average traded volume for the first four trading days of the week stood at $ 50.39 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)