Friday Feb 20, 2026

Friday Feb 20, 2026

Tuesday, 8 November 2022 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The sentiment in the secondary bond market remained bearish to negative during the trading week ending 4 November 2022 as uncertainties over domestic debt restructuring kept investors at bay. This led to activity levels in the secondary bond market being at a standstill.

The sentiment in the secondary bond market remained bearish to negative during the trading week ending 4 November 2022 as uncertainties over domestic debt restructuring kept investors at bay. This led to activity levels in the secondary bond market being at a standstill.

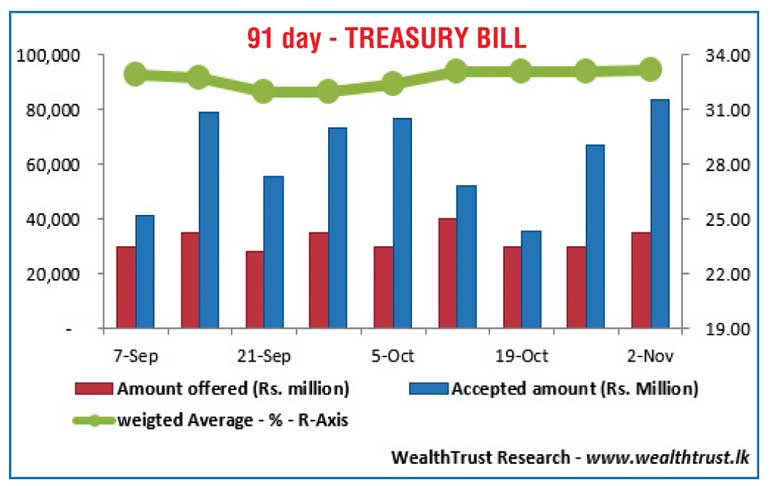

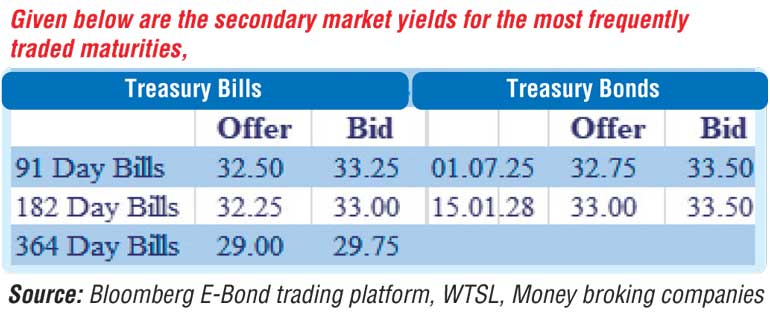

The said sentiment saw demand for the 91-day bill at the weekly Treasury bill auction increasing further to 91.39% of the total offered volume or to Rs. 83.48 billion against its previous week’s 90.84% or Rs. 67.06 billion. In the secondary bill market, December 2022 to March 2023 maturities traded at levels of 30.00% to 33.00%.

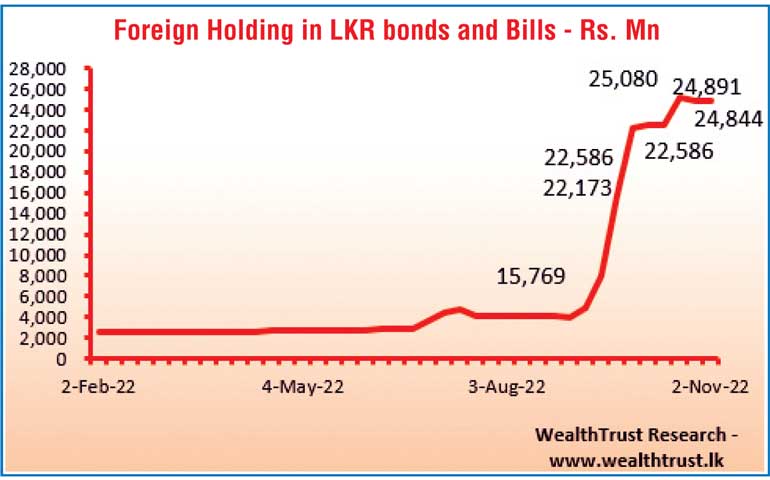

Furthermore, the foreign holding in rupee bonds decreased further, recording an outflow of Rs. 47.50 million for the week ending 2 November 2022.

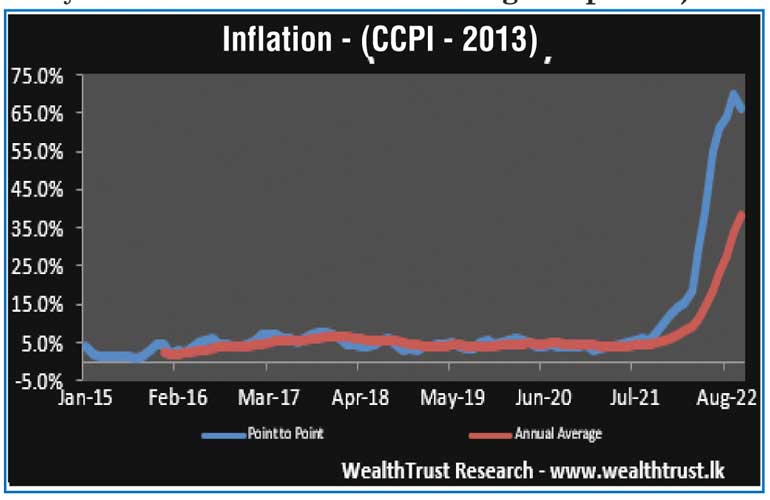

However, on a positive note, the Colombo Consumer Price Index (CCPI; Base 2013=100) for the month of October was seen decreasing for the first time in 13 months to 66.0% against its previous month of 69.8% while its annualised average stood at 38.3% against 33.4%.

The daily secondary market Treasury bond/bill transacted volumes for the first four trading days of the week averaged Rs. 15.06 billion.

In money markets, the total outstanding liquidity deficit was registered at Rs. 499.53 billion by the end of the week against its previous week’s of Rs. 499.22 billion while the CBSL’s holding of Government Securities stood at Rs. 2,422.73 billion against its previous week’s of Rs. 2,420.59 billion. The weighted average rates on overnight call money and repo were at 15.50% each for the week.

The Domestic Operations Department (DOD) of Central Bank was seen injecting Rs. 90 billion in total during the week by way of 30 and 90-day Reverse repo auctions at weighted average yields of 29.61% and 33.07% respectively.

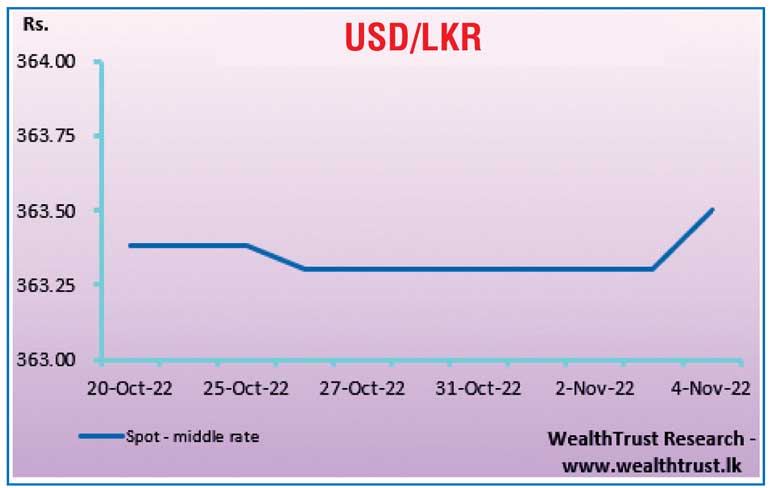

USD/LKR

In the forex market, the middle rate for USD/LKR spot contracts depreciated marginally during the week to close the week at Rs. 363.50 against its previous week’s closing of Rs. 363.30.

The daily USD/LKR average traded volume for the first four trading days of the week stood at $ 31.61 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)