Thursday Feb 19, 2026

Thursday Feb 19, 2026

Monday, 15 July 2019 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

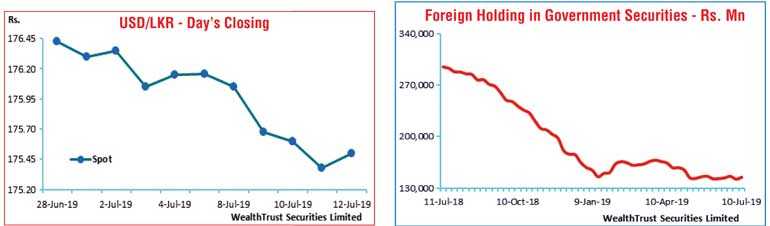

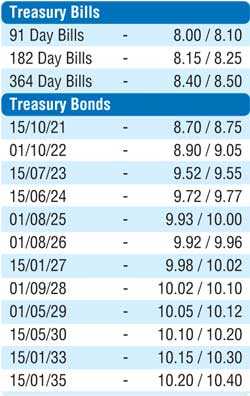

The secondary bond market remained positive during the week ending 12 July with yields continuing to decrease, reflecting a downward shift of the overall yield curve, fuelled by the outcome of the weekly Treasury bill auction where the 364 day bill average yield decreased for a fourth connective week to 8.54%.

The market also witnessed the return of foreign buying with an inflow of Rs. 2.67 billion, reversing an outflow witnessed during the previous week.

The yields of the predominantly traded maturities consisting of the 2021’s (i.e. 01.05.21, 01.08.21, 15.10.21 and 15.12.21), 2023’s (i.e. 15.03.23, 15.07.23 and 15.12.23) and 2024’s (i.e. 15.03.24 and 15.06.24) dipped to weekly lows of 8.65%, 8.70%, 8.70%, 8.65%, 9.45%, 9.48%, 9.59%, 9.70% and 9.70% respectively, against the previous weeks closing levels of 8.95/05, 9.00/07, 9.05/10, 9.05/12, 9.60/65, 9.65/75, 9.75/80, 9.78/83 and 9.83/85. Furthermore, the 01.08.26, 15.01.27, 01.09.28, 01.05.29 and 15.05.30 maturities too were seen changing hands at lows of 9.91%, 9.97%, 10.05%, 10.05% and 10.20%. However, profit taking at these levels curtailed any further downward movement with the market closing marginally higher.

The daily secondary market Treasury bond/bills transacted volume for the first four days of the week averaged Rs. 10.49 billion.

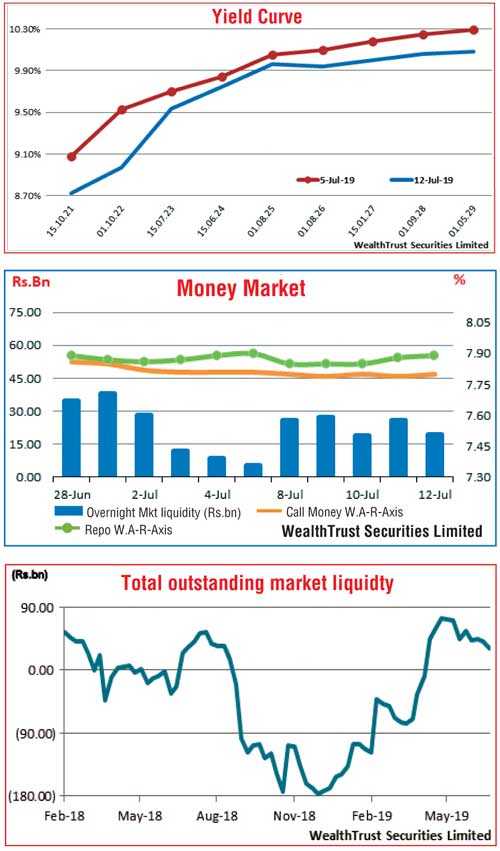

In money markets, the average net overnight liquidity surplus in the system stood at Rs. 23.59 billion, with the OMO (Open Market Operation) Department of the Central Bank of Sri Lanka draining out liquidity throughout the week on an overnight basis at weighted average yields ranging from 7.71% to 7.77%. In the meantime, the total money market liquidity during the week stood at Rs. 30.8 billion with the overnight call money and repo rates averaging at 7.80% and 7.86% respectively.

Rupee appreciates above Rs. 176

In the Forex market, the USD/LKR rate on spot contracts appreciated further to close the week at a high of Rs. 175.45/55 against its previous weeks closing level of Rs. 176.12/20 on the back of continued selling by banks.

The daily USD/LKR average traded volume for the first four days of the week stood at $ 84.76 million.

Some of the forward dollar rates that prevailed in the market were one month – 176.10/25; three months – 177.30/50 and six months – 179.20/50.