Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Monday, 12 November 2018 00:40 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The sentiment in the secondary bond market turned bearish towards the latter part of the week ending on 9 November 2018 following a bullish start to the week.

The prevailing political uncertainty, coupled with a spike in the weekly Treasury bill weighted averages, led to most market participants adopting a wait-and-see policy which resulted in activity coming to a complete standstill towards the latter part of the week.

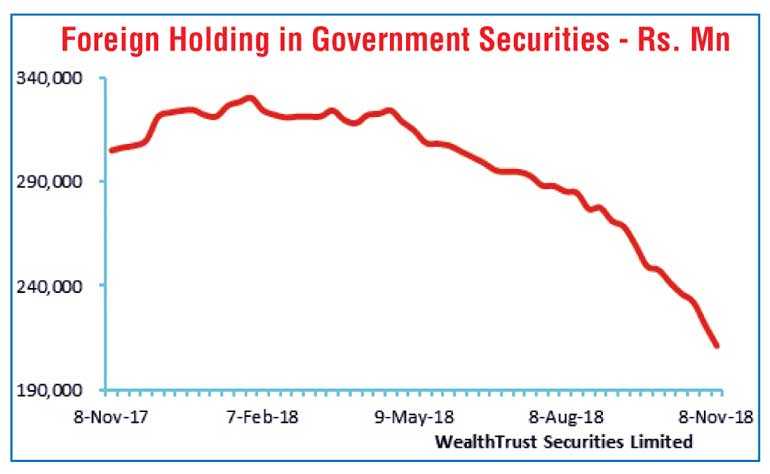

Foreign exits from the rupee bond market for a 10th consecutive week to the tune of Rs. 9.99 billion for the week ending 7 November 2018 contributed to the bearish sentiment as well.

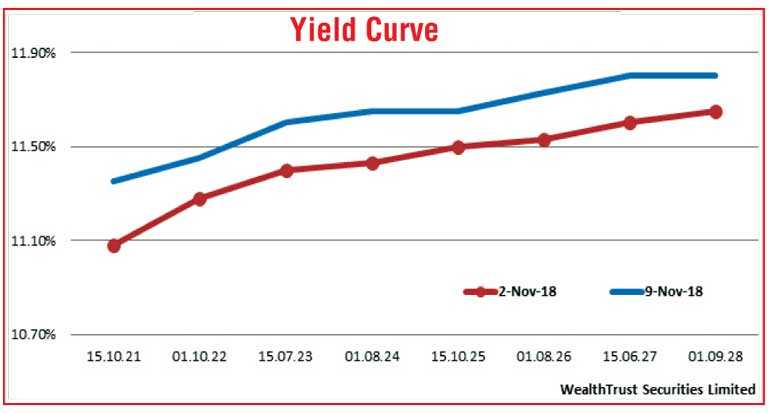

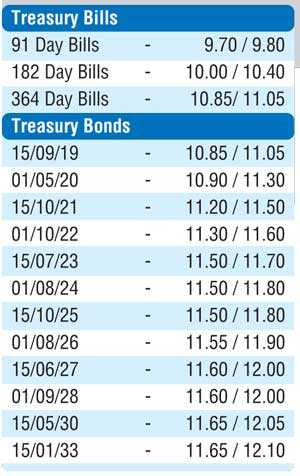

Yields on the liquid maturities of 15.09.19, 01.03.21 and 15.07.23 were seen increasing to weekly highs of 10.90%, 11.23% and 11.50% against its weeks opening lows of 10.75%, 11.00% and 11.30% to register a parallel shift upwards.

The daily secondary market Treasury bond/bill transacted volume for the first three days of the week averaged Rs. 4.58 billion.

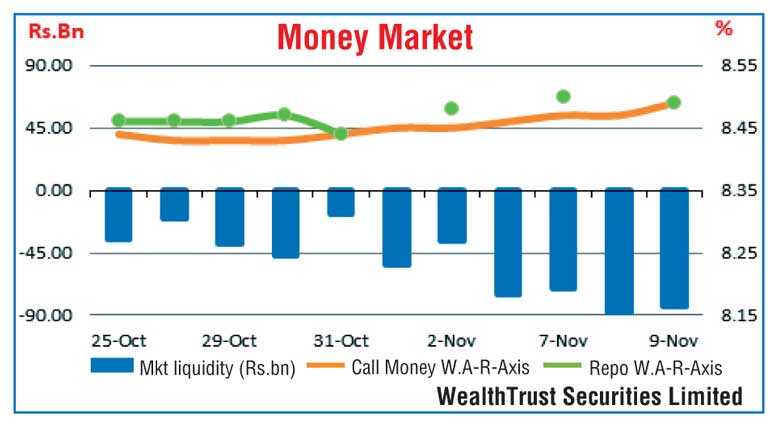

In money markets, the Open Market Operation (OMO) Department of the Central Bank of Sri Lanka injected liquidity throughout the week on an overnight and term basis for periods of seven to 14 days at weighted averages ranging from 8.46% to 8.47% and 8.48% to 8.50% respectively.

The daily average net liquidity shortfall in the system increased to Rs. 79.20 billion during the week against the previous week’s Rs.38.70 billion. The overnight call money and repo rates averaged 8.47% and 8.50% respectively for the week.

Dollar strengthens further

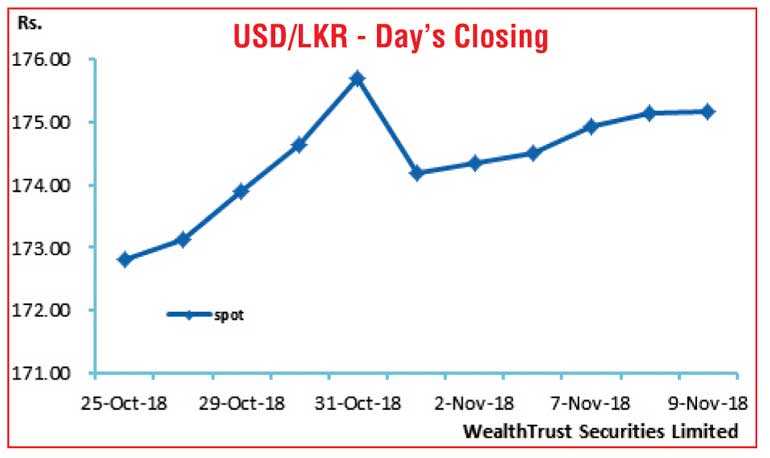

The prevailing political uncertainty, along with foreign outflows from capital markets, saw the rupee on spot contracts depreciating further during the week to close at Rs.175.10/25 against its previous week’s closing levels of 174.20/50.

The daily USD/LKR average traded volume for the first three days of the week stood at $ 58.17 million.

Some of the forward dollar rates that prevailed in the market were one month - 176.00/40; three months - 178.00/40 and six months - 180.90/40.