Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Monday, 21 November 2022 00:44 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary bond market witnessed renewed buying interest, mainly during the latter part of the week ending 18 November, leading to a change in sentiment from a negative/bearish to positive.

The secondary bond market witnessed renewed buying interest, mainly during the latter part of the week ending 18 November, leading to a change in sentiment from a negative/bearish to positive.

The considerable reduction in money market liquidity coupled with the comments made by the CBSL Governor was seen as the main reasons behind the change in sentiment.

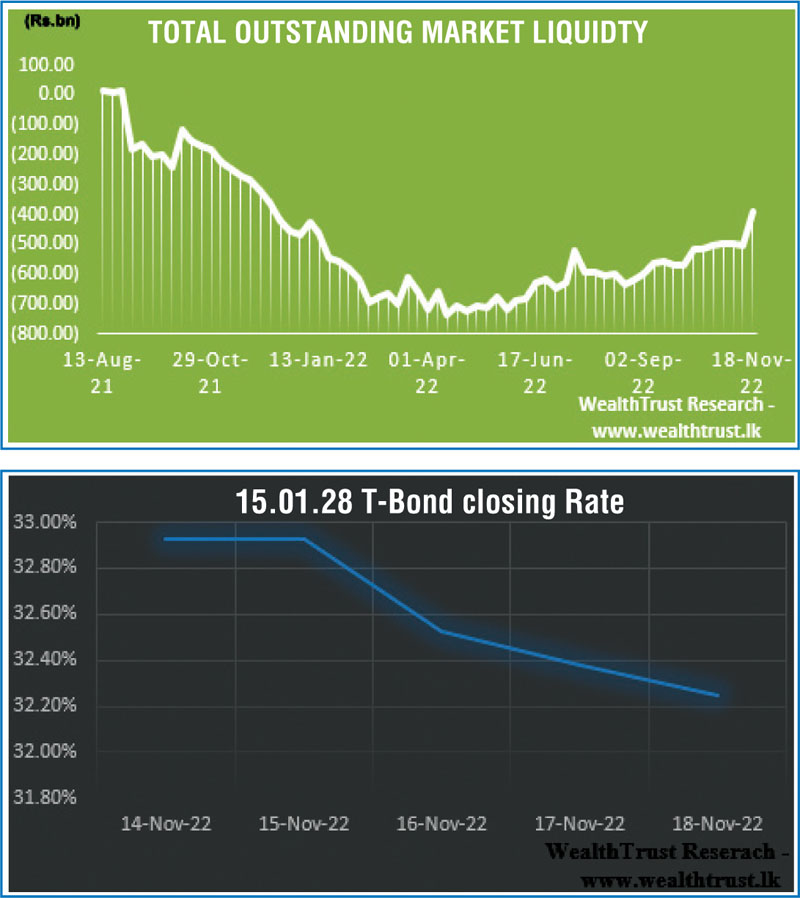

The total outstanding liquidity deficit in money markets decreased considerably to Rs. 390.97 billion by 18 November against its previous weeks of Rs. 504.75 billion while CBSL’s holding of Government Securities increased to Rs. 2,559.61 billion against its previous week’s of Rs. 2,440.75 billion.

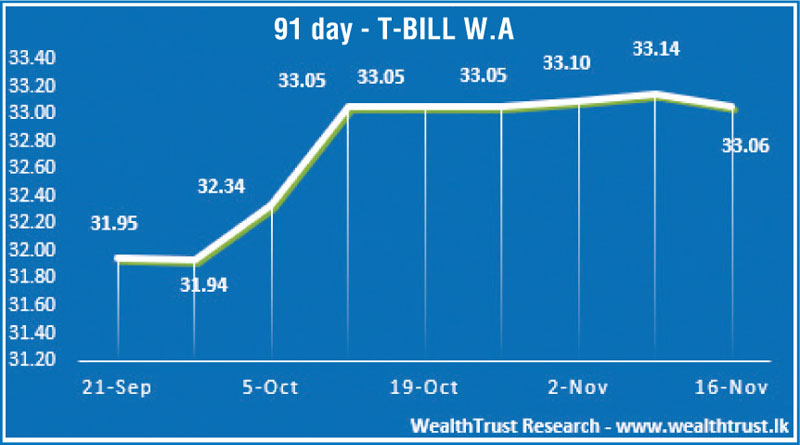

Furthermore, the improvement in liquidity had a positive outcome on the weekly Treasury bill auction, as the weighted average rate on the 91-day bill was seen decreasing for the first time in seven weeks while the total offered amount was accepted at the 1st phase of the auction.

In the secondary bond market, buying interest on the liquid 15.01.28 maturity saw its yield dip to a weekly low of 32.23% against its weekly high of 33.10%. In addition, maturities of 01.07.25 and 01.07.32 traded at levels of 33.00% and 30.47% to 30.85% respectively while in secondary bills, December 2022 changed hands at level of 30.00% to 31.00% as well.

The foreign holding in Rupee bonds increased marginally once again, recording an inflow of Rs. 25 million for the week ending 16 November 2022 while its total holding stood at Rs. 24.90 billion.

The daily secondary market Treasury bond/bill transacted volumes for the first four trading days of the week averaged Rs. 13.87 billion.

USD/LKR

In the forex market, the middle rate for USD/LKR spot contracts remained steady for a second consecutive week to close the week at Rs. 363.50.

The daily USD/LKR average traded volume for the first four trading days of the week stood at $ 38.75 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)