Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Monday, 27 March 2023 00:26 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary bond market was stagnant towards the latter part of the trading week ending 24 March due to supply side pressures, despite Treasury bill averages continuing to nosedive at its weekly auctions.

The secondary bond market was stagnant towards the latter part of the trading week ending 24 March due to supply side pressures, despite Treasury bill averages continuing to nosedive at its weekly auctions.

The secondary market bond yields were seen dipping initially during the early part of the week on the back of the expectations and subsequent realisation of the IMF’s board level approval for the Extended Fund Facility (EFF) to Sri Lanka.

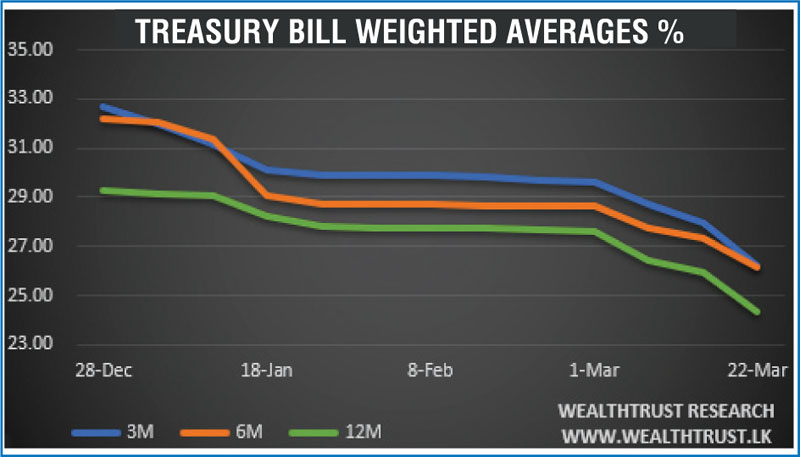

The downward movement in yield was supported by weekly Treasury bills auction where weighted average rates on all three maturities decreased for a fourth consecutive week. The averages were seen hitting 38-week lows or levels not seen since 6 July 2022.

However, renewed selling interest on the back of additional supply side pressure resulting from the Government allocation of bonds to institutes, led to yields increasing once again.

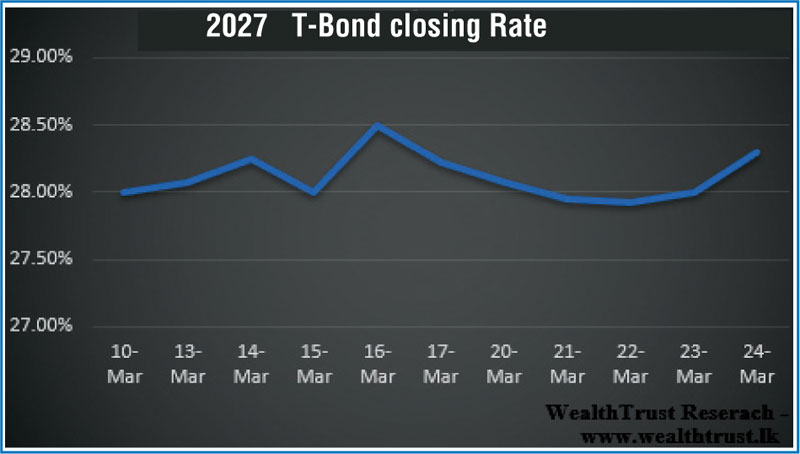

Yields of the 01.07.25 and two 2027’s (i.e., 01.05.27 & 15.09.27) bond maturities were seen decreasing to weekly lows of 30.00%, 27.50% and 27.40% respectively against its previous weeks closing levels of 31.00/40 and 28.15/30 while the 01.07.25 and 15.09.27 maturities hit highs of 30.75% and 28.30% respectively once again.

The National Consumer Price Index (NCPI; Base 2021=100) for the month of February increased marginally to 53.6% on its point-to-point against its previous month’s figure of 53.2%.

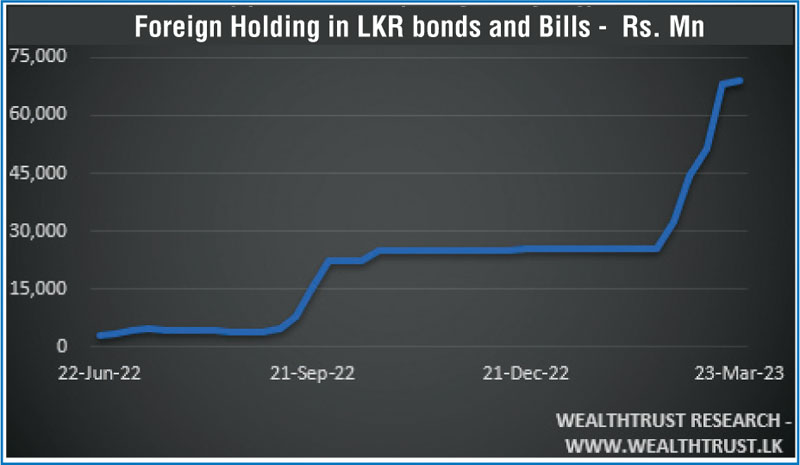

The foreign holding in rupee bonds increased to Rs. 68.82 billion for the week ending 23 March while the daily secondary market Treasury bond/bill transacted volumes for the first four trading days of the week averaged Rs. 23.83 billion.

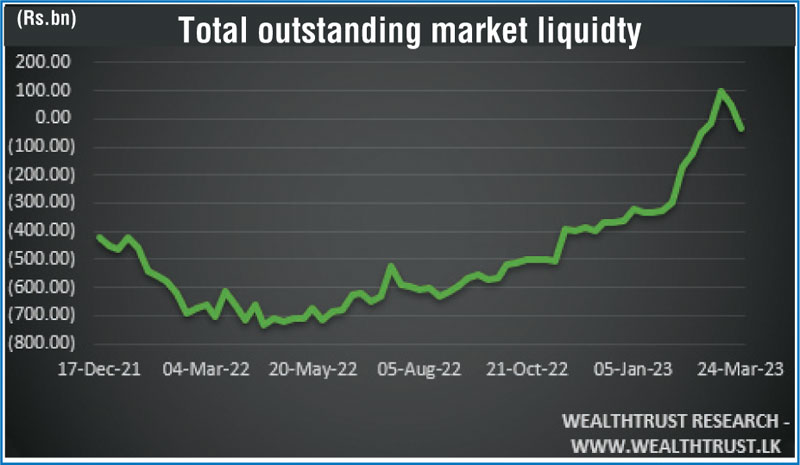

In money markets, the total outstanding liquidity registered at a deficit of Rs. 34.53 billion by the end of the week against its previous week’s surplus of Rs. 50.43 billion while CBSL’s holding of Govt. Security’s stood at Rs. 2,658.21 billion against its previous weeks of Rs. 2,701.99 billion.

Forex market

In the Forex market, the USD/LKR rate on spot contacts was seen appreciating during the week to close the week at Rs. 320.00/325.00 against its previous weeks closing levels of Rs. 337.00/345.00 subsequent to fluctuating within a high of Rs. 315 and a low of Rs. 339.75 during the week.

The daily USD/LKR average traded volume for the first four days of the week stood at $ 106.60 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)